China Crisis: 2 Risks That Could Push US Economy Into Recession

In the midst of this month's global stock market sell-off, the U.S. provided investors with some relief last week with a revised gross domestic product number that showed the world’s largest economy grew more than previously thought in the April-June period. For now, the country's second-quarter economic activity has eased fears that a China-led global economic slowdown could spread to the U.S.

China, the world’s second-largest economy, is expected to grow at a roughly 6 percent annual pace this year, according to Rockwell Global Capital. That's much slower than previously anticipated and considerably more plodding than the country's double-digit growth rate of just a few years ago. Global financial markets dipped sharply lower last week on a variety of fears, anticipating a global downturn in response to weakness in China’s economy and financial markets.

To be sure, there is nervousness in the U.S., too. The current recovery has been the weakest in the country's history, and some economists fear the U.S. isn't strong enough to withstand a global slowdown. Last week, when the S&P 500 was in the midst of its first correction since late 2011, it triggered talk of recession.

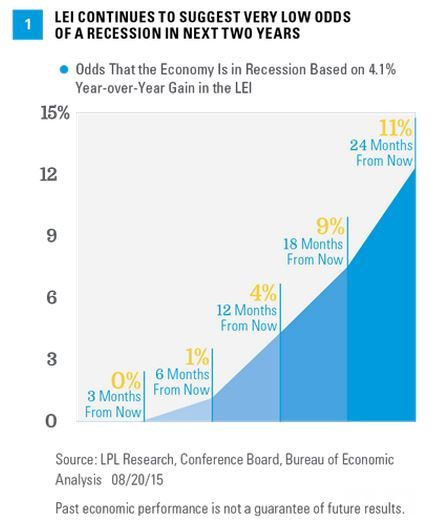

Even so, most economists say the U.S. economy is not at severe risk of recession -- not yet, anyway. The Conference Board’s most recent monthly Leading Economic Index (LEI), released last week, suggests the risk of recession in the next 12 months is low at just 4 percent. The LEI measures 10 economic factors, including employment, income and housing values, and has been largely effective at forecasting recessions in the last half century. The Conference Board's report did note, however, that the odds of a recession increase to 9 percent when looking out 18 months and 11 percent within a 2-year period.

A global slowdown hurts the U.S. in several ways. U.S. corporations -- from McDonald's to Apple -- face the prospect of sharply lower-than-expected revenue from their overseas operations, especially in countries that are heavily dependent on exporting to China. Those dampened prospects are unlikely to weigh heavily on the U.S. economy, economists say. The U.S. still relies largely on domestic consumption to fuel economic growth, with consumer spending accounting for around two-thirds of economic activity.

“The current sub-par global growth performance does not help the U.S. economy, but it would take a pretty severe global recession to actually push the U.S. into a recession,” says Sal Guatieri, senior economist at BMO Capital Markets.

The real threats to U.S. expansion lie elsewhere, experts say.

1. The ever-strengthening dollar

One of the main risks of a U.S. recession has to do with the Federal Reserve’s decision on interest rates, coming at its next meeting, set for Sept. 16 and 17. The concern is whether the U.S. central bank will raise interest rates this year, even in the wake of China’s slowing economy and the steep sell-off in global financial markets.

A rate hike, says Robert Godby, a professor of economics and finance at the University of Wyoming, “could really drive us into a recession because that would lead to currency appreciation and would hurt our entire trade sector.”

Economists also fear the U.S. dollar, which has gained more than 16 percent in the last 12 months, could appreciate even further if the U.S. central bank hikes interest rates. As the Fed aims to begin tightening its monetary policy, other major economies around the world, including China, Japan and Europe, are stimulating their economies to boost growth. Those moves have depreciated other world currencies against the greenback.

“Even a small move in interest rates from the Fed could have a disproportionate impact on the U.S. dollar, driving it higher,” Guatieri says.

The U.S. economy doesn't rely heavily on exports to China. Only 7 percent of U.S. exports go to China. However, an appreciating dollar makes it more difficult for U.S. companies to sell to Americans when they are competing against foreign companies. “If all the sudden we start substituting more foreign goods than domestic goods, then that hurts our manufacturing economy,” Godby says.

Sectors within the U.S. economy, including manufacturing that compete with foreign produced goods are at risk. “If people start buying Korean cars versus American cars, then that clearly hurts automakers like General Motors,” Godby says.

2. Plunging U.S. stocks

If U.S. stocks continue to fall sharply, the plummet would undercut household wealth and overall consumption. "Anything that drives equities lower would pose a risk of a recession in the U.S.," Guatieri says.

When consumers have smaller balances in their retirement accounts, they end up spending less. “If we did get a severe setback in the stock market, that could raise a downside risk to the U.S. economy,” Guatieri says.

But, stock market downturns don’t always imply recession, but what’s important now is how things change in the near term. Guatieri's own outlook is rather positive. He says global reactions to China's slowdown were overdone in light of the recent interest rate cut and raised bank reserve ratios from the People's Bank of China.

He also sees a low likelihood of global recession. Global interest rates are currently at historic lows, and economists expect consumer-driven economies like the U.S., Europe and Japan to benefit from the drop in oil prices because it will lead to cheaper fuel. “It would be unusual to see a global recession under the current conditions,” Guatieri.

© Copyright IBTimes 2024. All rights reserved.