Consumer Loan Delinquency Rates Drop Across the Board

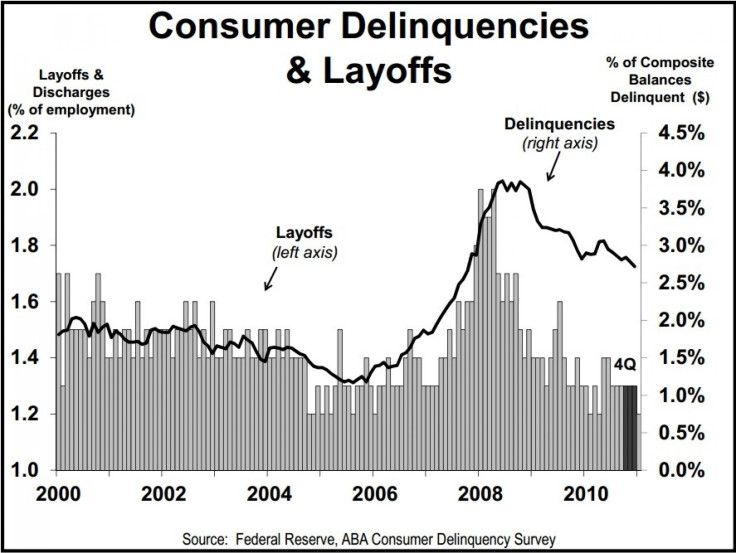

Consumer loan delinquency rates dropped in all 11 categories tracked by the American Bankers Association (ABA) in fourth quarter 2011, a sign that private debt reduction is helping stabilize Americans' personal finances.

It's very rare that delinquencies improve in every single loan category. The last time that happened was in the fourth quarter of 2004, ABA Chief Economist James Chessen said Thursday.

Chessen noted that despite the broad decline in delinquencies, loans in certain housing categories remain high compared to historic levels.

The composite delinquency ratio, which consists of close-end installment loan categories (the first 10 categories listed above), was 2.49 for fourth quarter 2011. Before the global financial crisis, it hovered around 1.5 percent.

The health of the jobs market, which is highly correlated with consumer loan delinquency rates, also remains poor compared to pre-recession levels, although conditions have steadily improved since mid-2009.

One metric that is well below pre-recession levels is the Federal Reserve's financial obligation ratio (FOR), which compares obligations in debt, automobile, rental, homeowners' insurance and property tax payments to disposable personal income. The FOR has fallen to the lowest level since 1984. The ratio, published by the Federal Reserve,

The deleveraging of consumer credit is paying dividends now. Consumers are being careful about taking on new debt; they're managing the debt they do have much better and the amount of debt as a portion of income is going down, said Chessen.

© Copyright IBTimes 2024. All rights reserved.