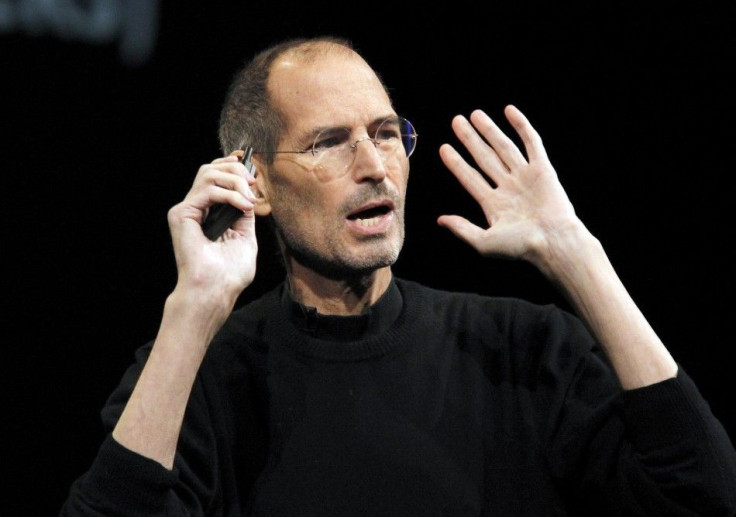

Could Steve Jobs and Apple Rescue the U.S. Federal Government?

On the surface, Apple Inc. boss Steve Jobs would seem to have scarcely little in common with 19th century banking mogul John Pierpoint Morgan.

Amidst reports that Apple has more cash on hand than the beleaguered U.S. government, one might speculate if Steve Jobs could singlehandedly bail out the Feds by using the mountain of cash that Apple has in its reserves (in excess of $76 billion).

As unlikely as such a scenario might seem, it has actually happened in the past.

J. P. Morgan, the U.S. financier who founded the J.P. Morgan & Co. bank in 1871, bailed out the government and financial markets not once, but twice.

Following the financial panic of 1893, the U.S. Treasury found itself at risk of going bankrupt as frightened investors sought to get their hands on the gold reserves held by the government. Morgan stepped in and pledged $60 million to $65 million in gold at the behest of President Grover Cleveland – thereby saving the Treasury and likely preventing a financial collapse, as well as rescuing the U.S. dollar.

In the following decade, J.P. Morgan again came to the rescue.

During a run on banks amidst the financial panic and recession of 1907, Morgan convinced his fellow banking titans to come together to help the weaker bank and trust companies which had been hurt by bad investments.

Seeing that the potential collapse of smaller financial institutions might spell doom for the banking industry as a whole, Morgan and his cronies bailed out the whole system, again preventing a devastating financial catastrophe.

© Copyright IBTimes 2025. All rights reserved.