Dow Jones Industrial Average Dips After US Economic Growth Comes Up Shy Of Forecasts

U.S. stocks mostly declined in midday trading Thursday after new data revealed that the economy grew at a slightly slower pace than expected in the second-quarter. The report comes a day after the U.S. Federal Reserve left interest rates at historic lows as it prepares lift rates for the first time in nearly a decade. The Fed's rate adjustment could come as soon as its scheduled meeting September 16 and 17.

The Dow Jones Industrial Average (INDEXDJX:.DJI) edged down 5.98 points, or 0.03 percent, to 17,745.41. The S&P 500 index (INDEXSP:.INX) dipped 1.54 points, or 0.07 percent, to 2,106.99. However, the Nasdaq composite (INDEXNASDAQ:.IXIC) edged up 7.77 points, or 0.15 percent, to 5,119.43.

Seven out of the 10 Standard & Poor's 500 sectors traded lower, led by declines in healthcare and energy. Dow component Procter & Gamble Co. (NYSE:PG) led the index lower, falling 3.5 percent, while United Technologies Corporation (NYSE:UTX) experienced the largest gains, up more than 1 percent.

Although the U.S. economy grew somewhat slower than expected last quarter, there was a bright spot: the Commerce Department said first quarter GDP was revised upward to growth rate of 0.6 percent, reversing previous estimates that showed the economy shrinking in the January-March period.

Most market experts view the report as positive and consistent with an economy that is showing modest growth. “The figure was modestly below expectations, but it still reflects growth and provides evidence for the Federal Reserve to raise interest rates come September, should they choose, or in December,” said Terry Sandven, chief equity strategist at U.S. Bank Wealth Management.

However, some experts view the report as a mixed bag. Although this year looks stronger than it did before the revision, the past three years from 2012-2014, the economy was weaker than previously thought. With more slack in the economy than previously thought, that could prevent the Fed from raising rates in September, says John Canally, Investment Strategist and Economist for LPL Financial.

“I’d be surprised if they raises rates in September because they just haven’t prepared us very well, and there’s nothing to prepare us between now and then,” Canally said, referring to the central bank’s monetary policy statement on Wednesday, which was the last statement scheduled before the Fed’s next meeting in September.

The Federal Open Market Committee (FOMC), a board of governors at the Federal Reserve that determines the direction of monetary policy, did not specifically indicate when an increase in the federal funds rate is coming this year in its statement Wednesday.

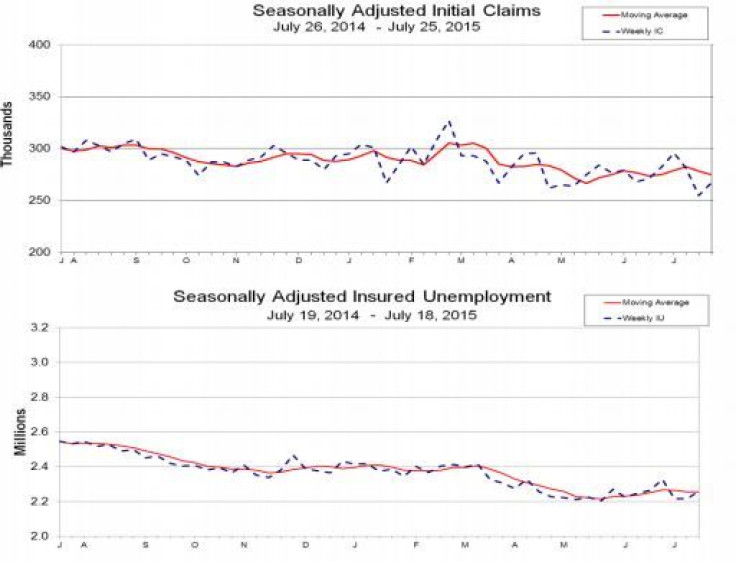

Separately, the number of Americans filing new claims for unemployment increased 12,000 to a seasonally adjusted 267,000 for the week ended July 25, the Labor Department said Thursday. The report comes a week after claims tumbled to a nearly 42-year low last week as fewer Americans filed new applications for unemployment benefits for the week ended July 18.

Economists had forecast that jobless claims last week rose by 15,000 to 270,000, according to analysts polled by Thomson Reuters.

Halfway through second quarter earnings season, with 264 S&P 500 companies reporting, earnings per share growth currently stands at declining 0.3 percent, still negative but an improvement from the prior estimate for a decline of 3.7 percent forecast before Alcoa reported on July 8, according to Estimize.

Notable companies reporting after the closing bell Thursday include professional networking company LinkedIn Corp. (NYSE:LNKD).

Shares of Whole Foods Market Inc. (NASDAQ:WFM) plunged 12 percent Thursday, a day after the organic foods retailer announced sales cooled last quarter after the company fell “victim” to overcharging allegations.

Meanwhile, shares of Facebook Inc. (NASDAQ:FB) dipped 4 percent Thursday, despite the social media giant beating Wall Street forecasts on earnings and revenue this week. Investors were disappointed by a sharp 82 percent jump in expenses as the company invested in growth, which cut into its earnings.

Shares of Facebook have soared 30 percent in the last 12 months.

© Copyright IBTimes 2024. All rights reserved.