Former Labor Chief Reich Slams S&P for Downgrade

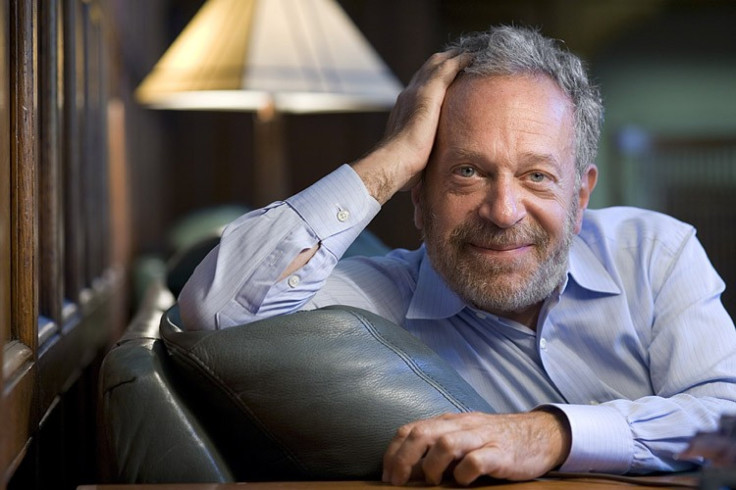

Robert Reich, U.S. secretary of labor under President Bill Clinton, is outraged by Standard & Poor’s decision to downgrade the U.S. government credit rating and has taken several potshots at the credit agency.

In a commentary posted on his Robertreich.org, the former secretary, now a professor of public policy at the University of California at Berkeley, said the timing of S&P’s action was particularly egregious.

“The result is likely to be higher borrowing costs for the government at all levels, and higher interest on your variable-rate mortgage, your auto loan, your credit card loans, and every other penny you borrow,” he wrote.

Reich fumed that the reason S&P reduced the credit rating is because “it doesn’t think we’re on track to reduce the nation’s debt enough to satisfy S&P — and we’re not doing it in a way S&P prefers.”

Reich pointedly asked: “Pardon me for asking, but who gave Standard & Poor’s the authority to tell America how much debt it has to shed, and how? If we pay our bills, we’re a good credit risk. If we don’t, or aren’t likely to, we’re a bad credit risk. When, how, and by how much we bring down the long-term debt — or, more accurately, the ratio of debt to GDP — is none of S&P’s business.”

The ex-secretary described S&P’s downgrade maneuver as an “ironic” intrusion into American politics.

“Much of our current debt is directly or indirectly due to S&P’s failures (along with the failures of the two other major credit-rating agencies — Fitch and Moody’s) to do their jobs before the financial meltdown,” Reich asserted.

“Until the eve of the collapse, S&P gave triple-A ratings to some of the Street’s riskiest packages of mortgage-backed securities and collateralized debt obligations. Had S&P done its job and warned investors how much risk Wall Street was taking on, the housing and debt bubbles wouldn’t have become so large – and their bursts wouldn’t have brought down much of the economy.”

Reich went on: “You and I and other taxpayers wouldn’t have had to bail out Wall Street; millions of Americans would now be working now instead of collecting unemployment insurance; the government wouldn’t have had to inject the economy with a massive stimulus to save millions of other jobs; and far more tax revenue would now be pouring into the Treasury from individuals and businesses doing better than they are now.”

© Copyright IBTimes 2025. All rights reserved.