Here's How A Fed Rate Hike Will Affect Your Bank Account

This article was originally published on the Motley Fool.

The Federal Reserve has implemented three interest-rate increases in the past seven months, which has allowed banks to charge consumers higher rates on loans. However, this hasn't yet translated to higher interest rates on savings accounts and CDs at most financial institutions. Here's a look at the effects of this rate-increase cycle so far, and what to do if you want a slightly higher yield on your savings.

Federal Reserve rate increases usually mean better savings interest rates for consumers

Historically speaking, the federal funds rate has been a good predictor of rates on banking deposit products. While consumer deposit rates, such as savings account interest rates, aren't officially tied to the federal funds rate, an increase or decrease by the Fed has typically led to an increase or decrease in deposit interest rates.

The Fed has raised rates by 1% so far. What has it meant for consumers?

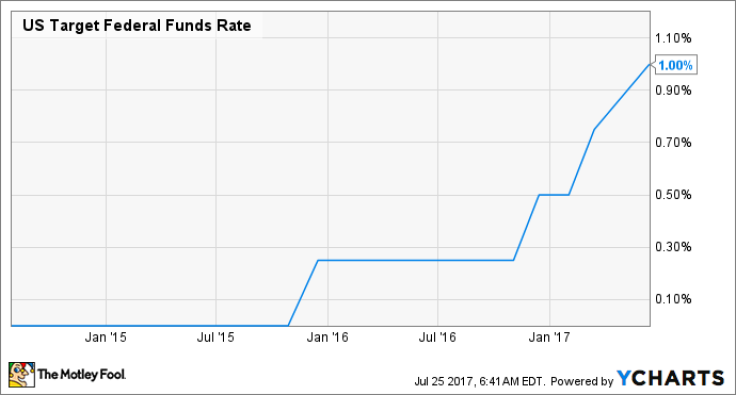

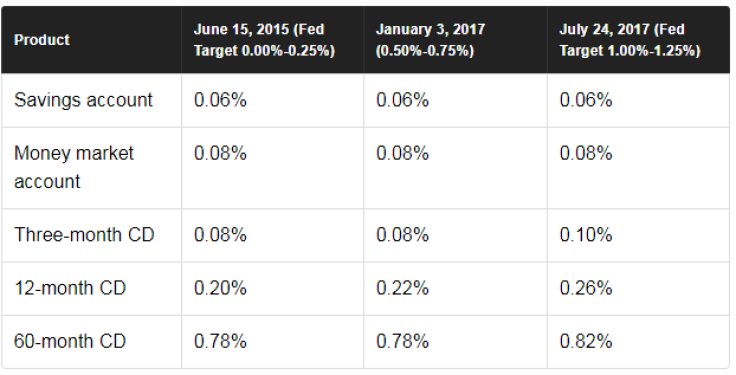

Since the middle of 2015, the Federal Reserve has increased interest rates four times, including, as mentioned, three rate increases in the past seven months alone. In all, the federal funds target has increased from a range of 0.00%-0.25% to a range of 1.00%-1.25%.

So you might expect that rates on deposit products would have risen by 1%, or close to it, since the Fed started raising rates in mid-2015, but that hasn't happened. In fact, the rates you can expect on savings accounts, money market accounts, and CDs have barely moved.

Why haven't banks passed the rate incresaes along to customers?

There are a couple of potential reasons banks haven't increased the rates they pay on deposit products in line with the Fed's rate increases.

First, many banks have excessive deposits, relative to the demand for loans. Since banks finance their lending activity mainly through consumer deposits, if they have enough deposits to meet their needs at low interest rates, what incentive do they have to pay more?

Second, it's important to note that the low-interest environment of the past several years has been unprecedented. Interest rates on loan products such as mortgages have been remarkably low, and since banks can't realistically lower their deposit interest rates below zero, the result has been historically low interest-rate spreads. So banks might be allowing their margins to reinflate to historically normal levels before raising the interest rates on their deposit products.

Exceptions to the rule

The data in the table is based on national averages and is not a universal rule. There are some banks, especially those that operate primarily online, that have been increasing their interest rates.

In fact, according to Greg McBride, CFA, Bankrate.com's chief financial analyst, there is an "arms race" among the top-paying banks, and consumers can take advantage of it. "Everybody needs an emergency savings account, and the top-yielding, nationally available accounts with little or no minimum deposit are the place to look," says McBride.

Because of the intense competition, these rates could change at any time, but as of this writing, there are savings accounts listed on Bankrate offering interest rates as high as 1.40%, many of which don't have any minimum deposit requirement. Twelve-month CDs are available with rates as high as 1.60%, and three-year CDs can be found that pay as much as 2%, all of which are federally insured.

The bottom line is that if you're going to keep cash in an emergency fund, or set aside for a rainy day, there's no reason to earn virtually no interest on that money while there are better options on the table.

The Motley Fool has a disclosure policy.