New York's Bitcoin Center: Where The Cryptocurrency Elite And Newbies Gather

NEW YORK -- Edwin Cuevas III stands quietly in front of a folding table at the back of the room, people crowding around him, a buzz of excitement in the air. A projector shoots real time prices of bitcoin and other alternative digital currencies against the wall -- flickering green figures against a black background that are oddly reminiscent of the computers used by Gordon Gecko-like power traders at the dawn of the personal computer.

The screen flickers and the price of litecoin increases minutely. Someone next to Cuevas delights at the progression and taps furiously away on his iPhone. Cuevas listens intently to a large man cheerfully shouting over the crowd as he describes the next item up for auction. “It’s a Butterfly Labs machine,” Nick Spanos, co-founder of the Bitcoin Center NYC says, referring to the company that made the equipment. “You can be big time.”

Cuevas, 25, is a college student studying business management at Hostos Community College in the Bronx, near where he was born and raised. His expression is subtle and calculating as he listens to Spanos gush about the virtues of the item up for bid.

“Thirty gigahashes; you can make $10 a day,” Spanos calls to the crowd. Luke Wu, the owner of the Butterfly Labs ASIC bitcoin miner up at auction, stands by Spanos feeding him information about the device. The miner, a small black box the size of a standard loaf of bread, isn’t much to look at, but Cuevas sees potential; he sees dollar signs -- or bitcoin signs.

The device is what’s known as an application-specific integrated circuit, or ASIC bitcoin mining computer, which is precisely tuned with a singular purpose, to create bitcoins, the gold standard in digital currency. Cryptocurrencies, like bitcoin and litecoin, were first theorized in 1998 by Wei Dai as a decentralized form of money created through cryptography, the foundation for debit cards, ecommerce and computer banking systems. The ASIC rig being auctioned, the one that Spanos gingerly palms as he calls to the crowd, would change Cuevas’s future. He wouldn’t be just a casual bitcoin user, he could create his own bitcoins with it.

Cuevas starts the auction with a tiny bid. “Ten bucks,” he yells. Spanos affirms the bid, but changes the units to millibits, the smallest unit of bitcoin used today. This is the Bitcoin Center NYC after all.

“Ten millibits,” Spanos says as he looks over the crowd.

Austin Alexander, deputy director of the Bitcoin Center NYC, jumps in. “Fifty dollars,” he yells.

“Fifty millibits,” Spanos corrects, then invites someone to up the ante to 60. The auction continues, Spanos yelling, affirming and prompting higher bids. A two-man bidding war begins between Cuevas and Alexander, each successively raising each other’s bid until the price reaches 450 millibits.

“Four hundred fifty millibits, going once,” Spanos shouts, glancing around the room, then at Cuevas. “Going twice. Sold!” Cuevas grins as Spanos approaches him with the Butterfly Labs computer. Cuevas has successfully won his first ASIC bitcoin miner, which will pay for itself, Cuevas predicts, in “three months of nonstop mining.”

This particular machine is not the fastest or most powerful machine on the market. Butterfly Labs recently launched a 600-gigahash ASIC bitcoin miner, making the one Cuevas just won seem antiquated; Wu, the former owner, auctioned it off because he upgraded his own equipment. But there’s nothing pitiful about it in Cuevas’ eyes. He’ll be making his own money.

Cuevas first got into the bitcoin game during the 2013 government shutdown. “At the time, in October, a lot of people in my neighborhood were concerned about losing jobs as well as losing money or not having anything of value to use as payment,” Cuevas remembers. That’s when he made his first buy. The price of bitcoins was at what was then an all-time high of $872 per bitcoin. He bought two. Over the next two months the price would climb to a record breaking $1,245, only to fall after China essentially banned banking institutions from using cryptocurrencies on Dec. 5.

Though Cuevas lost money in the crash, he saw it as an opportunity. “I was finishing up a paper for my college term, and I couldn’t believe the price was just going down,” Cuevas recalls. “It was crazy. I was like, do I sleep? Do I buy? What do I do?”

He bought, and he bought big. “I ended up buying seven coins at $432, which was the best thing I could have done,” Cuevas says. During the last month, the price of bitcoin has fluctuated between $800 and $900.

“There’s really nobody on earth that can’t benefit from bitcoin technology,” Austin Alexander says as he quenches his parched mouth. In between bidding on the bitcoin miner, he’s been talking nonstop for two hours. The turnout today has been larger than expected and networking has kept him from visiting the water cooler.

This is not a typical Monday night at the Bitcoin Center NYC; although, because the center has only been open for three weeks, it’s hard to define what typical is. The Bitcoin Center NYC opened its doors on Dec. 31, hosting a bash to ring in the New Year. “2014 will be the year of the bitcoin,” the party invitation predicted. Financial traders and savvy bitcoin entrepreneurs packed the house. But that wasn’t considered the Bitcoin Center’s target audience.

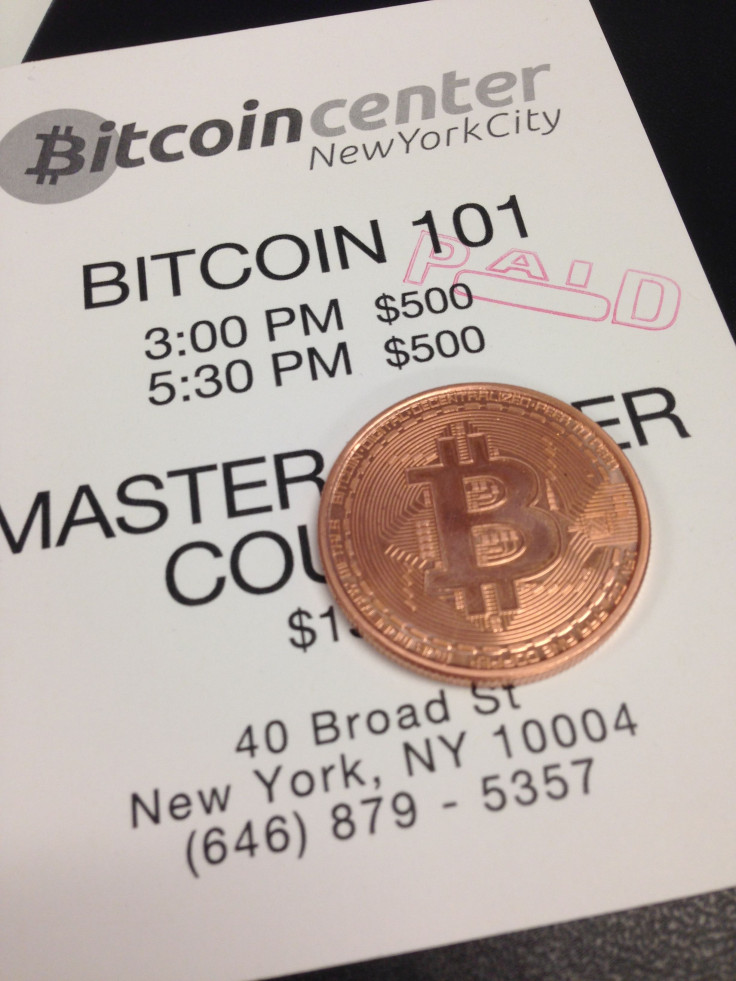

“We would hope to make it accessible to anyone, and because bitcoin is a game changer when it comes to finance, this is a good place to be,” Alexander says. The Bitcoin Center NYC is located 100 feet away from the New York Stock Exchange, historically the most financially influential building in the city. “People who are most involved in global financial networks can also come here to seek out a better understanding of what bitcoin is,” Alexander says.

Alexander, who was a political consultant before joining the ranks at the Bitcoin Center NYC, stands out in the crowd as one of the only people in a suit. The attendees are a motley group, ranging in age and experience, but all of like mind. To them, bitcoin is the future.

Alexander speaks with a slow methodical pace, choosing every word carefully. “The center right now is serving as an educational facility,” Alexander says, recounting the mission of the center. “We hope to educate the legacy financial sector and just anybody who walks in.”

Most of the people who have come tonight are part of a group called Satoshi Square. They are bitcoin traders and investors who gather together to discuss bitcoin, trade and make connections. The group is named after Satoshi Nakamoto, a shadowy figure considered to be the father of bitcoin, though no one knows who he really is. Some say he isn’t really a person at all, but an identity created for a group of developers who first started the currency in 2009. Real or not, the figure Satoshi (which means “wise man” or “clear thinker” in Japanese) stepped down and disappeared in mid-2010. As time has passed, interest in who actually started bitcoin has faded, replaced by speculation about where the currency is going.

“I don’t think Satoshi himself could have imagined that we’d be 100 feet away from the New York Stock Exchange talking about this,” Julian Rodriguez, a Satoshi Square member and contributor to Bitcoin Magazine, says. Rodriguez brings copies of the magazine to the Bitcoin Center NYC every Monday. It’s the only print periodical dedicated to cryptocurrencies. “We’re all computer scientists,” Rodriguez says. “We cover similar technologies in cryptography or math-based crypto-products. Bitcoin is one of them.”

Mining computers like the one Cuevas bought in the auction spend energy solving cryptographic puzzles called blocks. Every puzzle solved results in the award of bitcoins, and a doubling of the difficulty of the puzzle. In the early days of bitcoins, puzzles were easy to solve with regular desktop computers and laptops. Now, as the puzzles have gotten increasingly harder, ASIC miners and high-powered graphics processors are required to solve the blocks. “Cryptography has been used for thousands of years,” Rodriguez says. “And what we know as ‘cryptography mathematics’ computer science has been integrating it in the past 50 to 60 years.”

Rodriguez simplifies the idea of bitcoin. “So it’s kinda like email. Where we trusted the United States post office to keep all those records and send out all your mail in a timely fashion, now you have a Gmail. You login and you distribute your information how you want. Now we’re doing it with value, which is what bitcoin is.”

Not everyone at the center is a computer scientist. Eric Brakey is running for Maine’s state senate and is proud to be the first candidate in his state to accept campaign donations in bitcoins.

“We had supporters that are involved in the bitcoin community who wanted to be able to support our campaign in that way,” Brakey says. Tonight, in fact, Nick Spanos makes an announcement to the crowd, urging attendees to donate to Brakey’s campaign.

“If you want the politicians to start accepting these digital currencies and not create stupid laws that are going to make it more difficult, start giving them donations in bitcoin and they’ll get used to it really quick,” Brakey says, speaking to the engaged crowd.

But he is the first to tell you that he isn’t the most knowledgeable person on the subject. “It’s something that friends and supporters know a lot more about than I do,” Brakey says. “I was at an event over a year ago where someone gave me probably five cents’ worth of bitcoin. Then a year later it’s worth $10 and I thought, jeez, I should have bought some when I had the chance.”

Brakey isn’t concerned about the federal government’s ambiguity about bitcoin -- the Internal Revenue Service has yet to determine how or if bitcoins should be taxed. Right now, Brakey looks at bitcoin contributions as a commodity. “In Maine anything of value can be accepted as campaign contribution if you call it an in-kind contribution, so that’s how we are dealing with it,” he says.

But that’s not the case with the Bitcoin Center NYC, which strives to be fully compliant with any relevant law, and therefore is withholding any big moves until the state makes some declaration on how cryptocurrency-centric businesses can proceed. “We are seeking out guidance. Hopefully that is going to come, hopefully next month,” Alexander says. “Right now we don’t know what we can do. Obviously we want to comply with the state in every way; it’s all just a fog.”

The New York State Department of Financial Services is holding a hearing on virtual currencies Jan. 28 and 29.

Alexander reiterates that the Bitcoin Center NYC has one overriding goal: “Anything and everything that we can do to help lower the barrier of entry into the bitcoin economy, to help facilitate adoption, while remaining 101 percent compliant.”

While most of the people at the Bitcoin Center NYC are traders, investors or, as is the case with Edwin Cuevas, looking for a way to make money off of bitcoin, not everyone shares Alexander’s view. “I don’t really need anything,” says a woman who would give her name only as Katherine. A native New Yorker, she says she became involved in bitcoins last February while at the Liberty Forum in New Hampshire, where “they had a vending table and a little ATM machine. I figured it can’t hurt.” She bought in when the price of a bitcoin was around $30. The Liberty Forum primarily attracts people who oppose big government. According to its website, past speakers at the group’s forums have included Libertarian Ron Paul.

The decentralized nature of cryptocurrencies attracts people from many different backgrounds. Libertarians like it because it takes fiat power away from what they consider to be already-too-big governments. Others see bitcoin’s anonymity as a shield for clandestine activities. The criminal element is an unfortunate truth that bitcoin enthusiasts try to avoid talking about.

“There are a lot of people excited,” Julian Rodriguez says, “from a computer science view, a libertarian view, an anarchist view. Bitcoin means something different to everyone.”

As Katherine sees it, bitcoin offers a financial escape route. “The Federal Reserve and the way that they create money out of nothing, that’s unsustainable and it’s going to crash eventually. I mean it is crashing and they just keep trying to prop it up.” Her eyes widen. “You have to get on a lifeboat; the Titanic, to me, it’s already sunk.”

Both Austin Alexander and Nick Spanos see great potential in the Bitcoin Center NYC and in the currency itself. “There are no niches,” Alexander says of bitcoin. “If you look out the window at the landscape of the economy, there are no niches -- it’s canyons.”

Spanos sums the bitcoin phenomenon up in a single phrase. It is, he says, “the monetary 2.0 revolution -- right now, happening.”

© Copyright IBTimes 2025. All rights reserved.