Oil Price Predictions Are Both Science And Art For Energy Analysts

In January last year, federal energy experts projected that global oil supply would jump by 1.60 million barrels a day in 2014 over 2013 levels, with demand rising by 1.21 million barrels a day. But those figures were off -- supply was higher, demand was lower -- and, as a result, the forecasters were way off about global crude oil prices for the year.

The miscalculation highlights what Tancred Lidderdale calls the “imprecise science” of estimating oil prices, which is done by federal agencies, major investment banks and private consulting firms, all of which arrive at their own conclusions. “We’re making assumptions [about supply and demand], and those assumptions are imprecise. There’s a wide range of possible outcomes,” says Lidderdale, a senior economist at the Energy Information Administration, the statistics arm of the U.S. Energy Department.

On the supply side, the agency assumed that, among other factors, conflicts in the Middle East and North Africa would disrupt exports, U.S. oil production would grow, and Saudi Arabia and other OPEC nations would curb their oil production by about 0.5 million barrels a day in 2014. In reality, Libya and Iraq exported more oil despite armed insurgencies. American production outpaced expectations, while OPEC members refused to slash their output, exacerbating the global supply glut.

The EIA team also assumed that emerging economies like China, Brazil, India and Russia would grow much faster than they did, but the result was a weaker appetite for oil than forecast. Oil demand growth rose by only 0.9 million barrels a day over 2013, and supplies grew by 2 million barrels a day, according to the EIA's latest data.

As supply outstripped demand last fall, global oil prices plummeted to nearly $60 a barrel for the first time in five years. Brent crude, a global benchmark, averaged $76.40 a barrel in the last three months of 2014, compared to EIA’s quarterly projections of $103 a barrel. The agency now forecasts Brent crude will average $58 a barrel in 2015, which is still $11 less than it predicted in December.

The assumptions that the EIA, banks and analysts make are particularly important to energy-intensive businesses like manufacturers. If forecasters say fuel prices will climb throughout the year, a cash-strapped company could buy diesel contracts on the futures market, locking in current prices for later purchases. But if the forecasts are wrong, and diesel prices drop, the company will end up paying more for fuel than it could get on the market. The same might happen for state governments and federal agencies that use forecasts to plan their budget for energy costs.

Lidderdale likens the process to paying for health insurance; there's a chance you'll stay healthy and accident-free, and won't actually need your plan. "It's a hedge. You're really protecting yourself from a bad outcome," he says.

Michael Loewen, a Toronto-based commodity strategist at TD Securities, the Canadian investment bank, describes projecting oil prices as “both a science and an art.” On the science side, analysts cull data from myriad sources to build models for supply and demand. “But you have to assign a probability to certain factors actually happening, and so that’s the art side,” he says. “You have to have a very good handle on both sides to be worth your salt.”

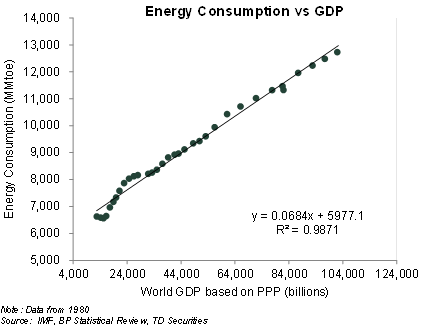

Analysts rely heavily on the International Monetary Fund’s GDP growth forecasts to determine the global thirst for crude oil. The purchasing power parity of each country "is a great predictor" of that nation's oil demand, Loewen says.

For supply forecasts, experts look at the EIA’s weekly report on U.S. petroleum inventories, as well as weekly U.S. rig counts from Baker Hughes Inc., which help indicate the pace of American production. They also fetch figures directly from government websites, including Iraq’s Oil Ministry and the provincial ministry of Alberta, home to Canada’s vast oil sands resources. OPEC meetings and subsequent reports shed light into how decisions by the oil-exporting cartel could affect oil markets.

“I might even look at a specific company that’s known for drilling in a specific region, like Bakken Shale [in North Dakota], and see what they’re drilling, how many rigs they have contracted,” Loewen says. “You have to get data from everywhere and build your model based on what fundamentally makes sense to you. You take a lot of different variables into the equation.”

But for all the painstaking planning, natural and manmade events can still throw a wrench into commodity forecasts, he says. In late 2013, for instance, few energy analysts would have predicted that Russia would invade Ukraine, as it did last August, prompting Western sanctions. The swift escalation of attacks by the Islamic State group in Syria and Iraq last year also took many energy analysts by surprise. Even as late as November, experts were still split on whether OPEC would vote to cut production or stay the course, as its members opted to do, Loewen says.

Still, he bristles at the idea that analysts could be wrong in forecasting the price of oil. “To say analysts got it wrong is like saying, ‘Well, you didn’t win the lottery last year, so what’s up with that?’” he says. “Analysts will always be wrong; they’ll be wrong 49 percent of the time.”

© Copyright IBTimes 2025. All rights reserved.