OPEC Monthly Oil Market Report: US Crude Production To Slip Further On Lower Oil Prices

U.S. oil production will continue to slip in 2015 as lower crude prices punish shale drillers, OPEC projected. The oil cartel said Monday it lowered expectations for non-OPEC oil supply this year due to slowing production in America’s shale regions.

In its monthly oil market report, the Organization of the Petroluem Exporting Countries said it expected non-member supplies to grow by 880,000 barrels a day -- down by 72,000 barrels a day from last month’s report -- because of “lower-than-expected output” from the U.S. In 2016, non-OPEC supplies are expected to increase slightly by 160,000 barrels a day, a downward revision of 100,000 barrels from the previous report.

“U.S. oil production has shown signs of slowing,” OPEC said in its latest report. “This could contribute to a reduction in the imbalance of the oil market fundamentals, however, it remains to be seen to what extent this can be achieved in the months to come.”

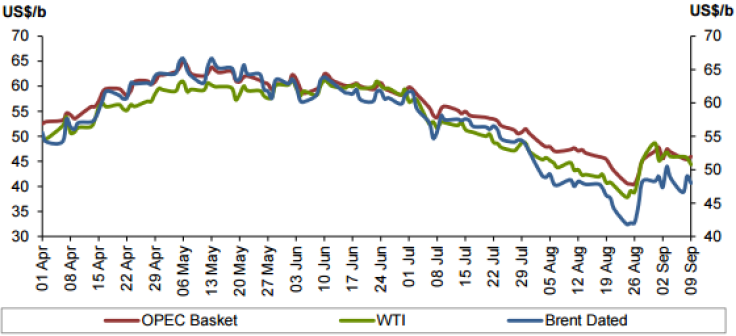

Oil prices have plunged by roughly half since June 2014, thanks to waning demand from major consumers in Europe and Asia and surging output in the U.S., Saudi Arabia and other oil-producing nations. Brent crude, the global benchmark, was down 1.5 percent to $47.42 a barrel on Monday at 9:10 a.m. EDT. U.S. crude dropped 0.72 percent to $44.31 a barrel.

The fall from triple-digit per-barrel prices has forced many U.S. producers to shelve or postpone costly and intensive projects in Texas, North Dakota and other shale-rich regions. The U.S. rig count, a measure of oil and gas activity, is down by 1,083 rights from last year, according to the latest report from Baker Hughes Inc.

U.S. oil activity will continue to slow even as oil demand is set to rise in the main consuming countries, OPEC said. The oil cartel revised up its forecast for 2015 oil demand growth to 1.46 million barrels a day, a gain of 84,000 barrels a day, to reflect better-than-expected economic data from the Organization for Economic Cooperation and Development, a group of the world’s richest nations.

Still, OPEC cut its 2016 demand growth projection to 1.29 million barrels a day, due to slowing economic momentum in China and Latin American countries.

Total production from OPEC’s 12 member countries rose slightly by around 13,200 barrels a day in August to more than 31.5 million barrels, compared with July. The uptick reflects higher output from Nigeria, Saudi Arabia and Kuwait.

OPEC, which supplies about one-third of the world’s crude, revised the demand for its own supplies upward this year by about 400,000 barrels a day to 29.3 million barrels -- or 2.2 million a day less than the member countries pumped in July.

© Copyright IBTimes 2024. All rights reserved.