The top after-market NYSE gainers Thursday were Netsuite Inc, Rentech Nitrogen Partners, Foot Locker, Cash America International and ENSCO plc. The top after-market NYSE losers were Green Dot Corp, Fortune Brands Home & Security, Superior Energy Services, Newmont Mining Corp and Renren Inc.

Starwood Hotels & Resorts Worldwide Inc. (NYSE: HOT), which operates the Sheraton, Westin and W hotel brands, is moving ahead with its expansion in China, even as the world's second-largest economy suffers a recent slowdown in growth.

Ford Motor Company (NYSE: F) is recalling 485,000 model-year 2001 to 2004 Escape crossover SUVs, owing to a risk of unintended acceleration from stuck throttle pedals, according to the Detroit Free Press.

Facebook Inc (NYSE: FB), the world's largest social networking platform, on Thursday issued its first quarterly report, disclosing results that slightly beat analyst expectations.

Soybeans are used to make tofu, but did you know they can also be used for tires?

Exxon Mobil Corporation (NYSE: XOM), the world's largest publicly traded oil company, said Thursday its second-quarter profit rose 49 percent, helped by a gain related to divestments and tax items.

The top after-market NYSE gainers Wednesday were Terex Corp, Trinity Industries, Skechers U.S.A, Thompson Creek Metals Company and Inphi Corp. The top after-market NYSE losers were Ferro Corp, Ruby Tuesday, Las Vegas Sands, Renren Inc and Newcastle Investment Corp.

Global economic uncertainty and the dreaded fiscal cliff have taken a toll on American consumer demand, affecting second-quarter revenues and urging companies to dim their forecasts. DuPont and Co, Texas Instruments, Inc. and United Parcel Service, Inc. are the latest to do so.

IAC/InterActiveCorp. (Nasdaq: IACI) and AOL Inc. (NYSE: AOL) both reported profitable second quarters on Wednesday, and both New York-based companies discussed the futures of their respective troubled media properties.

Based on analyst estimates, Merck & Co. will report earnings of $1.01 a share on sales of about $12.16 billion -- an increase of 0.1 percent from the year-earlier quarter. The company posts its second-quarter earnings on Friday, before the opening bell.

Shares of The Boeing Company (NYSE:BA) soared Wednesday after it said Mexico's Aeroméxico will buy as many as 100 single- and twin-aisle airplanes in a deal with a nominal value of $10.8 billion.

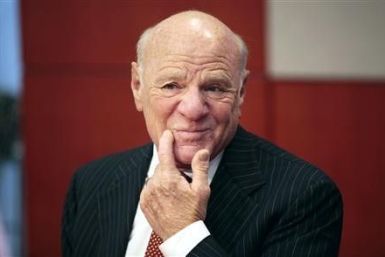

Former Citigroup chief executive Sanford I. Weill, one of the most important players in the deregulatory push of the 1990s that repealed the Glass-Steagall Act and allowed the formation of too big to fail banks, said on CNBC Wednesday morning that the nation's financial supermarkets should be split up by government mandate.

This time, China's bid is unlikely to be blocked by the government, as its attempted takeover of Unocal was seven years ago

Caterpillar Inc. (NYSE: CAT), the largest maker of construction and mining equipment, reported a 67 percent jump in its second-quarter profit that topped analysts' estimates and boosted its full-year outlook as demand increased from North American builders and overseas miners.

The top after-market NYSE gainers Tuesday were Unisys Corp, Tempur-pedic International, McEwen Mining, InvenSense and Sanchez Energy Corp. The top after-market NYSE losers were DigitalGlobe, Genco Shipping & Trading, International Game Technology, Crestwood Midstream Partners and Owens & Minor.

The New York Times Co. (NYSE: NYT), publisher of the third-largest U.S. newspaper by circulation, is expected to have higher earnings in the second quarter on lower revenue as print advertising is flat but online subscribers increase.

Based on a median estimate among analysts polled by Thomson Reuters, ExxonMobil will report earnings of $1.96 a share on revenues of about $115.08 billion -- a decline of 8.3 percent from the year before. The company will post its second-quarter earnings on Thursday at 10 a.m. EDT.

The New York Yankees' trade for 10-time All-Star Ichiro Suzuki should help baseball's most popular team both on and off the field.

Wal-Mart, in a bid to protect consumers, said it was not happy with the proposed $7.25 billion retailers' settlement with Visa Inc., and MasterCard Inc., over interchange and processing fees to cover credit and debit card payments.

Facebook Inc. (Nasdaq: FB), the world's largest social networking platform, is expected to post a profit in its first quarter as a publicly traded company following revenue growth in the April-through-June period.

U.S. companies have been finding it much easier to deliver earnings beats, or profits that are higher than expected, as analysts on Wall Street continue to trim their forecasts for earnings growth. However, they might have also come to realize that beating earnings expectations alone is not enough to help their stock prices.

Peruvian President Ollanta Humala appointed a new prime minister among several anticipated cabinet changes Monday, reflecting pressure from low approval ratings amid mass environmental protests.