US Stock Futures Point To Lower Open Ahead Of Existing Home Sales Data, FOMC Minutes

U.S. stock futures were weak on Wednesday morning suggesting a slow start to the markets, as the wait for the Federal Open Market Committee's, or FOMC, July meeting minutes, is set to end and clues to the future of the Fed's stimulus program are expected to be revealed.

The minutes will be released at 2:00 p.m. EDT, and their content could significantly influence markets depending on what was said during the July 30-31 meeting. Futures on the Dow Jones Industrial Average were down 0.28 percent, while futures on the Standard & Poor's 500 Index were down 0.35 percent and those on the Nasdaq 100 Index were down 0.39 percent.

According to the Wall Street Journal’s latest poll, 53 percent of economists expect the Fed to begin winding down its $85-billion-a-month bond-buying program in September and 36 percent expect it to start doing so in the fourth quarter, while the rest predict the Fed to start reducing stimulus by the first quarter of 2014.

“We will also be looking for any suggestions of whether officials favor tapering the Treasury and MBS purchases evenly or whether there is any support for maintaining the MBS purchases as a means of countering the impact of the recent rise in mortgage rates on the housing recovery,” Paul Ashworth, an economist with Capital Economics, wrote in a research note.

The FOMC meeting minutes and employment data for August, which is due on Sept. 6, are the only major indicators that could give investors further clues about the future of the bond-buying program, before the Fed’s mid-September monetary policy meeting.

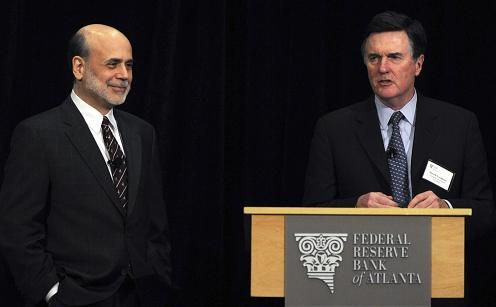

And although, central bank governors and economists will gather over the weekend for the Fed’s annual symposium in Jackson Hole, Wyo., several high-profile officials including Fed Chairman Ben Bernanke are not expected to attend the meet.

Investors are likely to look to the National Association of Realtors' existing home sales report, which measures the change in the annualized number of existing homes sold during the previous month, for a sense of the extent of the economy's recovery. Analysts estimate sales of previously-owned U.S. homes will rise to 5.15 million in July, up from June’s 5.08 million.

In Europe, most markets traded in the red on Wednesday as investors remained cautious ahead of the release of the Fed minutes. The Stoxx Europe 600 index was down 0.38 percent, London’s FTSE 100 was down 0.72 percent, Germany's DAX-30 was down 0.26 percent and France's CAC-40 was trading down 0.1 percent.

In Asia too, markets traded mixed ahead of the release of the Fed's minutes on Wednesday, after posting sharp losses in the previous session on concerns about a capital flight out of emerging markets if the U.S. bond-buying program ended earlier than expected.

Japan’s Nikkei ended up 0.21 percent while Australia’s S&P/ASX 200 rose 0.43 percent. The Shanghai Composite index ended flat, Hong Kong’s Hang Seng Index lost 0.69 percent and South Korea’s KOSPI Composite index plunged 1.08 percent.

India’s BSE Sensex, which opened higher on Wednesday, after losing more than 4 percent in the last two trading sessions, lost ground during intraday trade to close down 1.46 percent.

© Copyright IBTimes 2024. All rights reserved.