Western Union Gets Into Nigeria's Mobile Money Game, Partnering With eTranzact

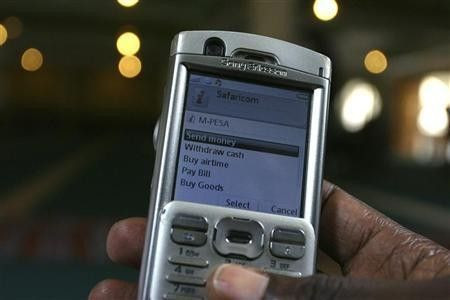

Banking systems are changing rapidly in the digital age, and nowhere is this clearer than in Africa, where the vast majority of people save, spend and exchange money without using any formal banking institution. For them, mobile phones can be a lifeline. Most Africans own one, and at least 55 million people -- and counting -- use a system called mobile money to manage their finances. Customers can pay bills, transfer money and withdraw or deposit funds using only their cell phone.

Now Western Union (NYSE:WU) is getting into the mobile money game in Nigeria, Africa's most populous country, where mobile money systems have been slower to take hold than in other fast-growing, tech-savvy states such as Kenya and Ghana. The Colorado-based financial services corporation has partnered with the Nigeria-based eTranzact to make Western Union money transfer services available to mobile phone users.

"Western Union continues to introduce new service offerings to complement our multiproduct, multichannel strategy," Khalid Fellahi, a senior vice president and general manager for Western Union Digital, said in a statement.

"We are very pleased to launch our new relationship with eTranzact to increase the number of access points for consumers to use our services worldwide, and provide convenient mobile solutions for those who want new methods for money transfer transactions."

Western Union can't gain a strong foothold in Nigeria the old-fashioned way. The country's central bank has banned exclusivity agreements between money transfer companies and local banks, forcing Western Union to contend with considerable competition when it comes to basic cash transfers. By building up links with the mobile banking sector in Africa, Western Union, which has faced criticism for sticking to old business models, is setting its sights on a potentially lucrative revenue stream.

Only 28.6 million people -- 32.5 percent of the adult population -- in Nigeria have bank accounts, according to a 2012 survey from EFInA, a Lagos-based financial development organization. About 63.9 percent of Nigeria's people have access to mobile phones, making the country fertile ground for the mobile money market, which was worth at least $61 billion across the continent last year.

The Nigerian government's approach to mobile money has been cautious, with the central bank insisting that physical banks, rather than telecommunications companies, drive progress in the market; however, eTranzact isn't a traditional telecom; it launched in 2003 as an online payment processor. The company first won permission from the central bank to launch mobile money services in the form of an application called PocketMoni in February 2011.

"[PocketMoni] is specifically designed to transform a user’s mobile phone into a highly interactive, feature-rich payment device," eTranzact CEO Valentine Obi said. "And our relationship with Western Union will allow for 24/7 access to money transfer transactions."

© Copyright IBTimes 2024. All rights reserved.