Why The Price Of Oil Is Falling

This article originally appeared on the Motley Fool.

What happened?

After two weeks of fairly steady gains, crude oil lost a step this week. After gaining 11% from May 9-May 23, Brent crude futures have fallen 4%, from over $54 to $52 at the close on May 26.

The big driver this week has been relatively mixed news. OPEC announced it would continue its plan to cut output by 1.8 million barrels per day, keeping production at recent levels in an effort to stabilize prices. Unfortunately, this good news wasn't particularly well received by the market. Some were hoping the cartel would even consider a bigger cut, as U.S. crude production has continued to climb in recent months.

• Motley Fool Issues Rare Triple-Buy Alert

According to Baker Hughes, the U.S. active rig count has increased every week for almost five months, steadily pushing domestic oil output higher and cancelling out a significant portion of OPEC's production cuts.

So what?

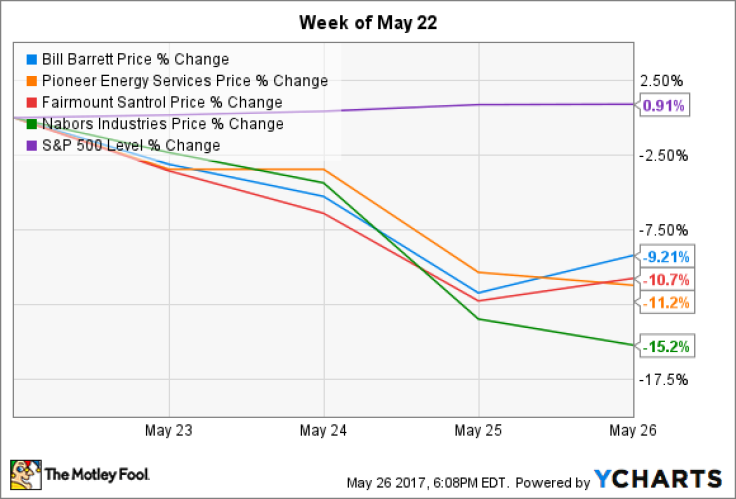

In short, this renewed uncertainty around global oil supplies has taken the wind out of the oil rally -- at least for now. According to S&P Global Market Intelligence, some of the biggest losers this week were independent oil and gas producer Bill Barrett Corporation (NYSE:BBG), and oilfield service companies Nabors Industries Ltd. (NYSE:NBR), Pioneer Energy Services Corp (NYSE:PES), and Fairmount Santrol Holdings Inc (NYSE:FMSA):

While Bill Barrett is a small, independent oil and gas producer, Pioneer Energy Services, Fairmount Santrol, and Nabors Industries are oilfield service providers. Pioneer Energy and Nabors Industries are drilling contractors, while Fairmount Santrol generates more than 70% of its business from making and selling proppants used in oil and gas production.

• This Stock Could Be Like Buying Amazon in 1997

In a weak oil-price environment, it's often these kinds of companies -- ones that work for the oil producers -- who are the first to feel the pinch of falling oil prices as producers look to cut costs.

Now what?

Oil prices are likely to remain volatile for the foreseeable future. And while OPEC's decision to extend production cuts is relatively positive for oil prices, the market put more value in the news that North American shale production would probably grow faster than anticipated this year, stopping the recent mini-rally and sending prices lower.

At the same time, beyond the connection between falling oil prices and the risk that producers cut back on drilling activity, there's no material news that Pioneer Energy, Fairmount Santrol, or Nabors Industries are facing any new challenges. Even with oil prices falling a little this week, many U.S. producers can still make money at current crude prices.

At the end of the day, it seems unlikely that U.S. shale production will bridge the gap between OPEC's continued cuts and global consumption. If that proves to be the case, this week's market reaction may have been a little premature. However it plays out, there's still a lot of oil in the market that needs to be worked through before there's any chance oil prices can push past $60 per barrel.

• 7 of 8 People Are Clueless About This Trillion-Dollar Market

Until that glut is worked through, crude prices will probably go through these weekly swings, dragging oil and gas stocks along for the ride.

Jason Hall has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.