Bank of america Stories

BofA CEO says foreclosure deal will take time

A settlement between a coalition of federal and state agencies and banks over foreclosure practices will take longer to hammer out than many expect, Bank of America Corp Chief Executive Brian Moynihan said on Wednesday.

Pre-market movers on May 31(ADI, EXK, HIG, FOE, DOW, GME, WFR, NVDA, APC, CCL, MOS)

The companies whose shares are moving in pre-market trade on Tuesday are: Analog Devices, Endeavour Silver, Hartford Financial, Ferro Corp, Dow Chemical, Gamestop Corp, MEMC Electronic Materials, Nvidia Corp, Anadarko Petroleum Corp, Carnival Corp and Mosaic Co.

Mobile Payment Systems Draw Interest from Banks, Retailers

Google took the wraps off of Google Wallet, its new mobile payment system, making the announcement on Thursday from the company's New York office. Mobile payment systems have drawn the interest of banks and retailers, and the industry is hoping consumers will adopt the systems as well.

BofA selling all its BlackRock shares to BlackRock

Bank of America Corp is selling its remaining BlackRock Inc stake back to BlackRock for $2.5 billion, its latest step to prepare for new industry capital requirements.

BlackRock buying back all its shares held by BofA

BlackRock Inc said it was buying back all of its shares owned by Bank of America Corp , closing out an ownership relationship that helped BlackRock grow into the world's biggest asset manager.

New York AG probes banks over mortgage securities: report

New York Attorney General Eric Schneiderman is investigating big banks like Bank of America Corp , Morgan Stanley and Goldman Sachs related to packaging of toxic mortgage loans into securities, the Wall Street Journal reported, citing sources.

Wall Street stock index futures point to gains

Stock index futures pointed to a higher open for Wall Street on Tuesday, in a modest rebound from falls in the previous session.

Post-Market NASDAQ Movers (GFRE, SCEI, PLAB, CAST, OTIV, NVLS, MBLX, CALD, TICC, IDTI, AVEO)

The top after-market NASDAQ Stock Market gainers are: Gulf Resources, Sino Clean Energy, Photronics, ChinaCast Education, On Track Innovations, and Novellus Systems. The top after-market NASDAQ Stock Market losers are: Metabolix, Callidus Software, TICC Capital, Integrated Device Technology, and AVEO Pharmaceuticals.

Gold Rallies As Analysts Predict Euro Strugglers Will Go Bust

The Dollar price of Gold on wholesale markets continued to rally Friday morning, rising as high as $1516 per ounce - less than 4% off this month's all-time high - before slipping back, while stock and commodity markets recovered some of Thursday's losses.

Gold Diversification Doubted As Commodity Slump Continues

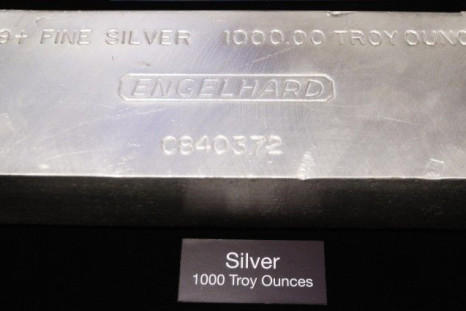

Thursday's London Silver Fix set the white metal's price at $32.50 per ounce, nearly $7 lower than a day earlier and 33% below the 31-year high of $48.70 set on April 28. [Silver] is still in an uptrend, despite the sharp sell-off reckons Mary Ann Bartels, head of US technical and market analysis at Bank of America Merrill Lynch, who said yesterday silver could hit $50 per ounce by the end of the year.

BofA to slash $850 billion bad loan portfolio by half: report

Bank of America Corp plans to reduce its $850 billion portfolio of troubled home loans by about half over the next three years, the bank's new mortgage unit head told the Financial Times.

BofA posts trading gains every day in Q1

Bank of America Corp made money in trading every day of the first quarter, and posted more than $25 million in trading-related revenue for practically all of those days, the company said on Thursday.

Pre-Market NASDAQ Movers (KNDL, ZSTN, HNSN, JDSU, CBEY, ONNN, SMSI, SWIR, ATML, AIXG, MELI, ARMH)

The top pre-market NASDAQ Stock Market gainers are: Kendle International, ZST Digital Networks, Hansen Medical, JDS Uniphase, Cbeyond, and ON Semiconductor. The top pre-market NASDAQ Stock Market losers are: Smith Micro Software, Sierra Wireless, Atmel, Aixtron, Mercadolibre, and ARM Holdings.

Deutsche Bank faces U.S. mortgage fraud lawsuit

The United States sued Deutsche Bank AG, accusing the German bank and its MortgageIT Inc unit of repeatedly lying to be included in a federal program to select mortgages to be insured by the government.

Thornburg trustee sues big banks for $2.2 billion

The trustee for bankrupt Thornburg Mortgage Inc has sued Goldman Sachs, Barclays and other big banks for a combined $2.2 billion, blaming them for the former home loan company's bankruptcy.

Prospect of silver hitting $80 shakes up stock, ETF markets

The Bank of America Merrill Lynch said in a report that there was strong possibility of silver hitting $80 an ounce, causing ripples in the silver stock and ETF markets.

Pre-Market NASDAQ Movers (USAT, REDF, MSPD, SIFY, CLMS, VECO, WIBC, LWSN, ZSTN, TLAB, NFLX, ESRX)

The top pre-market NASDAQ Stock Market gainers are: USA Technologies, Rediff.com India, Mindspeed Technologies, Sify Technologies, Calamos Asset Management, and Veeco Instruments. The top pre-market NASDAQ Stock Market losers are: Wilshire Bancorp, Lawson Software, ZST Digital Networks, Tellabs, Netflix, and Express Scripts.

Wells Fargo profit up as credit quality improves

Wells Fargo & Co , the fourth-largest U.S. bank, posted higher quarterly profit, but its results were shaped by the same trends as most of its rivals, which is unusual for a bank known for outsmarting competitors.

Wells Fargo posts falling revenue, shares drop

Wells Fargo & Co , the fourth-largest U.S. bank, posted a decline in revenue, and shares fell 4.9 percent as a bank known for outsmarting rivals turned in an average performance.

World Market Update 04/19/2011

US stocks ended sharply lower on Monday after Standard & Poor’s (S&P) revised its rating outlook on the United States to negative.

Stocks slump as S&P cuts US rating to ‘negative’

US stocks ended sharply lower on Monday after Standard & Poor’s (S&P) revised its rating outlook on the United States to negative.

Global Markets Overview 04/19/2011

U.S. stocks suffered a rout after Standard & Poor's cut its outlook on the U.S. government debt, warning that the U.S. fiscal profile may become meaningfully weaker than that of other triple-A-rated countries if policy makers can't tame the budget deficit. The Dow Jones Industrial Average fell 140.24 points, or 1.14%, to 12201.59, led lower by Bank of America and Caterpillar, which each fell 3.1%.

Citi profit falls as revenue shrinks, expenses surge

Citigroup Inc's first-quarter profit fell 32 percent as shrinking loans and poor trading results pressured revenue while expenses surged.

Instant View: Citi first-quarter profit falls 32 percent

Citigroup Inc's first-quarter profit fell 32 percent, slightly beating expectations, as the bank lost less money on bad loans. The third-largest U.S. bank said it earned $3.0 billion, or 10 cents per share, down from $4.4 billion, or 15 cents per share, a year earlier. Analysts on average had expected 9 cents per share, according to Thomson Reuters I/B/E/S.

Citi profit falls 32 percent as bond trading weakens

Citigroup Inc's first-quarter profit fell 32 percent as bond trading revenue plunged and operating expenses jumped.

Citigroup profit falls 32 percent on weak revenue

Citigroup Inc's first-quarter profit fell 32 percent, slightly beating expectations, as the bank lost less money on bad loans but struggled to grow its business.

Citi faces weak trading, shrinking loans on recovery path

Citigroup Inc is expected to report a drop in quarterly profit and revenue on Monday, as an uncertain trading environment and weak consumer loan demand hinder its efforts to move past the financial crisis.

Bank of America hires ex-SEC official Gary Lynch

Bank of America said it has hired Gary Lynch, a former director of enforcement at the U.S. Securities and Exchange Commission, to head its legal, compliance, and regulatory relations efforts.

Merrill Lynch boosts assets, adds advisers

Bank of America Corp's Merrill Lynch brokerage business provided a bright spot in an otherwise dismal first quarter for the bank, reporting sharply higher revenue and client assets as well as a net increase of nearly 200 financial advisers.

Merrill dangles rich signing bonuses to top brokers

Merrill Lynch is giving some regional managers permission to offer unusually high upfront signing bonuses to attract top-tier brokers from rivals, according to several recruiters.