There is perhaps no other time in modern history when recognizing the role of startups in driving transformational growth and creating inclusive and positive change is so important. The pandemic has accelerated the trends toward online services and cashless economies, reshaping the banking and financial services industry in the process. Much of this change is being driven by fintech startups as traditional companies in the space fight to adapt and survive.

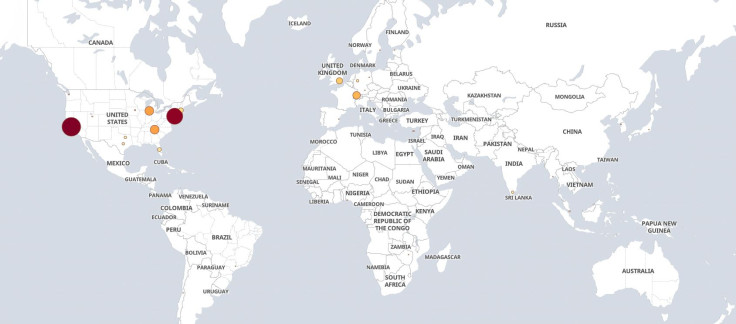

The International Business Times Hottest Fintech Startups 2021 is an exclusive club of fintech disruptors and innovators who are helping to create a smarter, inclusive world. This list, created in partnership with specialist startup research organization StartUs Insights, showcases the fintech leaders driving the changes sweeping the sector.

The global fintech market is valued at $5.5 trillion, and thousands of fintech startups are born every year. But these startups survived our rigorous technology-driven vetting process to make it to the International Business Times Hottest Fintech Startups 2021. These are the fintech startups to watch — the chosen few that we expect to be the movers and shakers in the coming months and years.

Those who made the IBT list are the titans in the crowd -- the disruptors who are leveraging ideas and cutting-edge technology in digital payments, cryptocurrency adoption, wealth management and digital business models. They also come in all sizes: from those in the seed funding stage to those that have gone public, and from across the globe. And they do different things within the fintech space.

This sheer diversity — of ideas, the technological niches they operate in, the size — threw up an unique problem before us: there is no apples to apples comparison between them. Ranking these leaders against one another would be doing injustice to their work.

That is why the IBT Top Fintech Startups 2021 is not a ranked list: these are the top dog startups in fintech, and they are all top dogs!

They showcase the ingenuity of the human mind in leveraging technology to address what just a few years ago were seen as vexing, even intractable, problems that plagued the globe.

As Daniel Polotsky, the CEO at bitcoin the Skokie, Ill., based ATM operator Coinflip put it, "being at the forefront of fintech means we have to be most inclusive as possible in order to ensure that the change we make is positive."

Here is a snapshot of some of the startups that have made it to this exclusive club:

Nashville, Tenn., based Leaf Global Fintech, founded in 2017, offers virtual banking services to vulnerable populations crossing borders -- in other words, a group of people who had no real access to any such services and who were largely ignored by traditional governmental and financial infrastructure.

There is Walnut, Calif., based Hummingbird is a finance company intended to enhance anti-money laundering and counter-terrorist financing investigations — a problem that has sucked in considerable governmental resources across the world and yet has not been really controlled.

Atlanta-based Bitcoin Depot's multi-cryptocurrency ATM network offers users the ability to buy and sell Bitcoin, Litecoin, Ethereum, and Bitcoin Cash at hundreds of locations across the United States — which is nothing but an effort to lower the access barriers to cryptocurrency transactions.

Nymbus, founded in 2015, is the top funded company on the IBT Top Fintech Startups List. It has raised $98.4 million so far. Its core banking software is an all-in-one core processing system with a single sign-on combined with a modern user-friendly interface.

The Miami Beach, Fla., headquartered startup has revenue of $16 million, and 129 employees.

The pandemic has boosted fintech adoption. Polotsky calls it "the natural procession of money and banking; people are tired of the legacy system with its fees and control over their own money."

The fintech industry seems to be trending toward consolidation, with fewer companies and fewer funding rounds, but offering higher rewards for companies that have managed to prove themselves.

The last couple of years have seen a funding shift toward late-stage startups from early-stage ones. In 2019, funding for early-stage startups reached a five-year low, while funding for later-stage startups hit a five-year high, CB Insights reported. Early-stage companies received $5.3 billion last year, down from $6.5 billion in 2018.

Notes on the list- This is a list of the top fintech startups, but NOT a ranked list.

- All attempts have been made to collect funding information from available public sources. (If you want to update the funding information on your startup, please contact us.)

- This list was created in partnership with global startup research organization StartUs Insights.