Fed's Powell vows to act to sustain US expansion, Trump lashes out

Federal Reserve Chair Jerome Powell vowed Friday to act to ensure the American economic expansion continues, but warned the central bank has no "rulebook" for dealing with the US-China trade war that deteriorated further almost as he spoke.

China announced Friday new tariffs on $75 billion in US products and President Donald Trump lashed out with threats of further retaliation, meaning the trade uncertainty that Powell said is exacerbating the global slowdown is unlikely to go away soon.

Trump lost no time in criticizing Powell -- and swiping at Beijing.

In a furious flurry of tweets, Trump attacked the Fed's stewardship of the world's biggest economy and vowed a quick response to China.

"As usual, the Fed did NOTHING! It is incredible that they can 'speak' without knowing or asking what I am doing, which will be announced shortly. We have a very strong dollar and a very weak Fed," Trump tweeted after Powell's comments.

"My only question is, who is our bigger enemy, Jay Powel or Chairman Xi?" Trump said, misspelling the Fed chief's name in an unprecedented attack on the independent central bank.

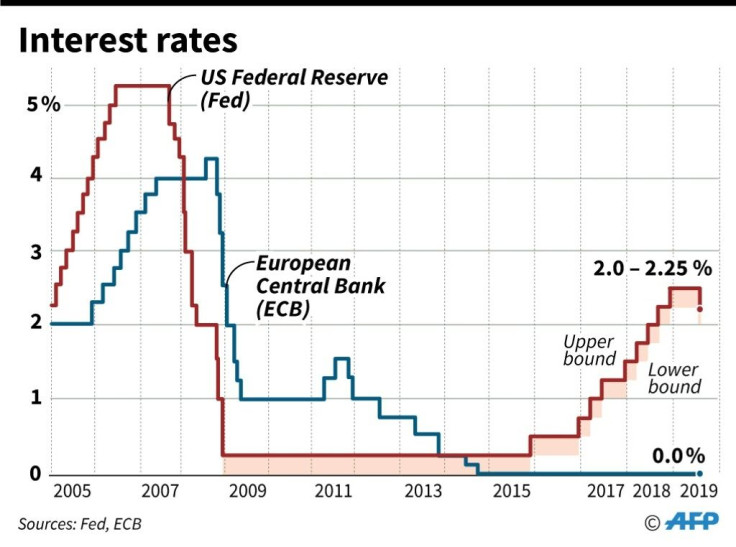

The Fed cut the benchmark interest rate last month for the first time in more than a decade, partly as insurance against the impact of trade uncertainties on the economy.

But in his hotly anticipated speech to an annual central banking conference in Jackson Hole, Wyoming, Powell cautioned that the Fed has no "rulebook" for dealing with the trade war fallout.

"The three weeks since our July FOMC meeting have been eventful, beginning with the announcement of new tariffs on imports from China," he said.

"The global growth outlook has been deteriorating since the middle of last year. Trade policy uncertainty seems to be playing a role in the global slowdown and in weak manufacturing and capital spending in the United States."

While Powell said the US economy "is now in a favorable place," it faces "significant risks" and he again pledged that the Fed "will act as appropriate to sustain the expansion."

However, he warned that there is no "settled rulebook for international trade ... no recent precedents to guide any policy response to the current situation."

Walking a tightrope

Stock markets seemed to like the speech, regaining some ground after sinking on news of Chinese tariff retaliation, but they fell after Trump's outburst and the Dow closed with a loss of more than 600 points, or 2.4 percent.

"Powell is rather more diplomatic in his language than the president -- a low bar, admittedly -- but it is clear from his speech that the single biggest factor driving both market volatility, the actual global slowdown, and fears of a US slowdown, is trade policy," said Ian Shepherdson of Pantheon Macroeconomics.

The Fed chief has had some communication misfires as he walks the tightrope between competing views on the correct policy and defending the institution's independence from political interference.

Powell seemed to be making an economic case for some further stimulus -- possibly to ward off concerns he is bowing to the relentless pressure from Trump to drastically cut rates -- but he also noted the generally healthy state of the US economy, a possible signal he does not foresee a series of cuts.

Those favoring a lower interest rate face opposition within the Fed, but Powell tried to lay those concerns to rest as well, saying he does not see any buildup of financial risks or price pressures.

"Low inflation seems to be the problem of this era, not high inflation," he said.

"In the unlikely event that signs of too-high inflation return, we have proven tools to address such a situation," he added.

Shepherdson said the inflation "hawks have been vocal recently, but they seem still to be outnumbered."

"We don't envy Mr Powell and his colleagues right now; all their analysis and forecasts can be upended by a single tweet, so the policymaking process has been wrecked, even without the overlay of the president railing at the Fed like Lear on the heath, but less coherently."

© Copyright AFP {{Year}}. All rights reserved.