A controversial weapon could be deployed soon in the U.S. fight against the housing crisis as states and top banks near a deal in their dispute over mortgage abuses -- cutting the mortgage debt owed by homeowners.

Swiss Re has regained a prized credit rating lost during the financial crisis, a key step toward the reinsurer's goal of expanding its business.

Exchanges in London and Singapore said it was business as usual on their bourses for futures broker MF Global Holdings Ltd on Friday, after two rating agencies downgraded its debt to junk status.

Vancouver-based Argentex Mining Corp. said Friday that Argentina's new decree tax repatriation law will not affect the company in the near term.

Canadian stocks edged higher in early action on Friday, led by a rise in shares of gold and base metal miners, even as fading optimism over a European debt deal weighed on the broader market.

Peru's government will broker talks on Friday between townspeople and U.S.-based miner Newmont in a bid to solve a conflict over the planned $4.8 billion Minas Conga gold mine, officials said.

U.S. consumer sentiment improved in October for the second month in a row as consumers felt more upbeat about the economy's prospects, a survey released on Friday showed.

Metro AG could become the latest European retailer to warn on profits next week, piling pressure on the German group to sort out a successor to Chief Executive Eckhard Cordes.

If one buys into reactions of global markets, including the New York Stock Exchange and Dow Jones Industrials Average, they could go to sleep at night with little concern that the Eurozone financial crisis is a ticking time bomb, just waiting to explode with global implications that ripple back to the U.S.

U.S. consumer spending rose in September as Americans saved less to fund purchases amid weak income growth, which could cast doubts over the durability of the third-quarter's economic growth spurt.

Coventry Health Care Inc , a health insurer, posted a lower quarterly profit that just beat analysts' estimates, but raised its full-year outlook for a third time -- although this is still below market consensus.

Euro zone interest rates will very likely remain on hold next week as the European Central Bank navigates the transition to new leadership, with an anti-crisis plan forged by EU leaders taking some heat off monetary policymakers.

An agreement by a private equity firm to buy Mosaid Technologies for C$590 million ($594 million) includes core wireless patents controlled by the Ottawa-based target company as part of a recent deal with Nokia and Microsoft.

India gold futures eased a tad from its highest level in more than a month on global cues and a firm rupee at home, though physical buyers held back from placing

new orders after the sudden spike in prices in the previous session, dealers said.

Andean American Gold Corp., a Toronto-based gold and copper miner, said it was looking to sell or enter into partnerships for some of its properties.

Europe has staved off an imminent financial crisis and fears of a U.S. double-dip recession may have been overblown. With the Federal Reserve already lowering long-term interest rates through Operation Twist, it seems QE3 is not likely to come.

Pay talks between Freeport-McMoRan Copper & Gold and a union representing striking workers at its Indonesia mine are deadlocked after a week of negotiations, the union said on Friday.

Stocks edged lower on Friday as investors took a breather from a powerful rally that propelled the S&P to close above its 200-day moving average for the first time since August.

Shares of Newmont Mining Corp., the world's second-largest gold miner, fell Friday after its third-quarter profit slipped eight percent on markdowns of two recently acquired companies.

Sluggish growth in U.S. consumer income in September led households to cut back on saving to increase their spending, casting doubts over the durability of the economy's third-quarter growth spurt.

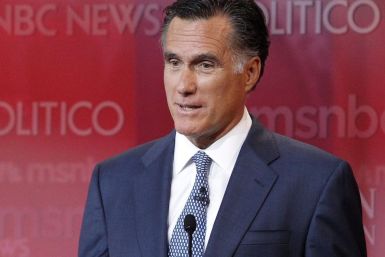

Mitt Romney seems to be cruising to a New Hampshire victory. Who could pull off an upset in the first-in-the-nation primary?

Stocks opened lower on Friday as investors booked profits a day after a powerful rally that propelled the S&P to close above its 200-day moving average for the first time since August.

The head of Europe's bailout fund sought financial support from China on Friday to help resolve the bloc's debt crisis, saying that while no quick deal was in sight he was still confident Beijing would keep buying bonds issued by his fund.

Stocks were set for a lower open on Friday as investors looked to book profits a day after a powerful rally that propelled the S&P to close above its 200-day moving average for the first time since August.

Chevron Corp said its quarterly earnings more than doubled, beating Wall Street forecasts, as the second-largest U.S. oil company benefited from high oil prices and strong refinery margins.

The head of Europe's 440 billion euro bailout fund played down hopes of a quick deal with China to throw its support behind efforts to resolve the bloc's debt crisis but said he expects Beijing to continue to buy bonds issued by the fund.

Stock index futures fell on Friday as investors took profits a day after a powerful rally that propelled the S&P to close above its 200-day moving average for the first time since August.

WPP Plc , the world's largest advertising company, sought to reassure the market with a pledge of improving margins on Friday, after it cut as expected its 2011 outlook due to slowing growth in the U.S. and the euro zone debt crisis.

U.S. stock index futures fell on Friday as investors took profits a day after a rally that pushed the S&P to close above its 200-day moving average for the first time since August.

Agricultural Bank of China Ltd <1288.HK><601288.SS>, the country's third-largest bank by market value, said on Friday that its chairman, Xiang Junbo, has resigned.