Atacama Minerals Corp. said it will buy privately-held Sirocco Gold Inc. in an all-stock deal and bring in a new team headed by Chief Executive Richard Clark, sending its shares soaring 64 percent to a six-month high.

Great Basin Gold Ltd. sold 27 percent less gold sequentially in the third quarter from its operations in Nevada and South Africa.

Russian miner Polymetal's placement book for its London listing is more than 50 percent subscribed after the company opened it a day before, two sources close to the deal told Reuters on Tuesday.

Italy's divided government kept Europe waiting on Tuesday for long delayed reforms on the eve of a summit to devise a strategy to confront the euro zone's worsening debt crisis.

World no.3 gold producer AngloGold Ashanti Chief Executive Mark Cutifani sees no bubble in gold prices and said prices could easily go higher amid global economic uncertainty.

Maersk Drilling, a unit of Danish shipping and oil group A.P. Moller-Maersk , has struck a four-year $780 million deal with BP for a deepwater rig, and aims to increase its fleet by 6-8 rigs within five years.

Stock index futures pointed to a mixed open on Wall Street on Tuesday, with futures for the S&P 500 up 0.2 percent, Dow Jones futures down 0.03 percent and Nasdaq 100 futures down 0.1 percent at 0925 GMT (5:25 a.m. EDT).

Deutsche Bank's third-quarter pretax profit beat forecasts as retail banking and asset management offset a drop in investment banking which it warned was facing the toughest conditions since 2008 that could lead to more job cuts.

Swiss bank UBS AG posted a better-than-expected third-quarter net profit Tuesday, with its core wealth management business performing well despite last month's trading scandal, although it warned of tough times ahead.

Uncertainty about just how close European Union leaders will come to solving the euro zone debt crisis kept many markets trading in a tight range on Tuesday.

Many investors suffered a bout of pre-summit uncertainty on Tuesday a day before a crucial meeting of European Union leaders to solve the euro zone debt crisis.

India's central bank raised interest rates on Tuesday for the 13th time since early 2010 but gave a strong signal it may be finished with its current tightening cycle as growth slows and it expects high inflation to ease starting in December.

European stock index futures fell Tuesday on uncertainty before a key summit, failing to sustain gains made in Asia where investors grew more optimistic about Europe's leaders coming to a broad agreement on containing the region's debt crisis.

Swiss bank UBS AG reported a better-than-expected third-quarter net profit on Tuesday as an accounting gain helped cancel out a loss of 1.849 billion Swiss francs ($2 billion) on unauthorized trades it uncovered last month.

When Michael Woodford began his short tenure as Olympus president, he described the man who hired him, Chairman Tsuyoshi Kikukawa, as an umbrella, a protective cover to deflect anyone out to stop the Briton's western-style tough cost-cutting.

A semi-tethered jailbreak is not as big a deal, given that it has its own problems.

Asian shares rose and the euro steadied on Tuesday, keeping gains from the previous day as investors grew more confident about European leaders coming to a broad agreement to contain the region's debt crisis.

Groupon Inc sued two former sales managers who held confidential information before they quit the daily deal company to join Google Inc's competing daily deals site, a court filing showed.

Debt-laden independent power producer Dynegy Inc has been discussing with bondholders a plan to put a subsidiary into bankruptcy after bondholders shunned a $1.25 billion refinancing, sources told Reuters.

Netflix Inc reported an increase in third-quarter revenue that beat analyst expectations but said DVD subscriptions would sharply decline in the fourth quarter, sending its shares down sharply.

The weak housing sector continues to pose a strong headwind to the economic recovery, and the Federal Reserve could potentially do more to drive down mortgage rates to support the sector, an influential Federal Reserve official said on Monday.

Another round of quantitative easing is a possible option for the central bank as it attempts to boost the slow U.S. economic recovery, one of the most influential Fed officials said on Monday.

The U.S. government is making it easier for small businesses to beef up defenses against cyber criminals through a free, online tool, the top U.S. communications regulator said on Monday.

German lawmakers flexed their muscles to secure a full parliamentary vote Wednesday on euro zone crisis measures negotiated by Chancellor Angela Merkel and her euro zone peers, a move senior politicians said would give Merkel a stronger mandate.

Stocks rose on Monday, as a flurry of merger activity and strong earnings from Caterpillar boosted investor sentiment and kept the three-week rally intact.

WikiLeaks will have to stop publishing secret cables and devote itself to fund-raising if it is unable to end a financial blockade by U.S. firms such as Visa and MasterCard by the end of the year, founder Julian Assange said on Monday.

Stuart Walker, a young gay hotel manager and barman, was found tied, beaten and burned alive in Cumnock, Scotland this weekend. Though police will not confirm that Walker was the victim of a hate crime, his death, evoking as it does the legacy of Matthew Shepard and the rash of gay teen suicides in North America, is a testament to how far the LGBT movement still has to go, and how stark a reality dying for who you love can still be for gay teens and adults.

Caterpillar Inc muscled through murky economic conditions with a surprising 44 percent jump in quarterly profit, and forecast strong demand through next year in a sign of optimism for the global economy.

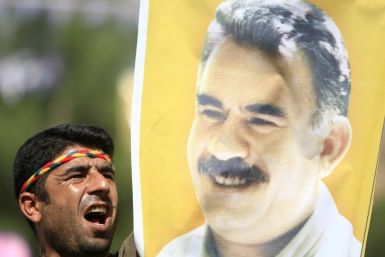

While the humanitarian tragedy arising from the quake will not occupy the hearts, minds and bodies of the local population – the longer-term struggle between Kurds and Turks will likely not abate.

The Suck for Luck sweepstakes to win the first pick in this year's upcoming NFL Draft became incredibly apparent this weekend. While no team would ever admit to purposely tanking a game, it's hard to justify the pitiful performances by the winless Miami Dolphins and Indianapolis Colts on Sunday.