President Hugo Chavez's government formalized the nationalization of Venezuela's gold industry on Monday with a decree that prohibits exports of the metal and gives the state 55 percent of joint ventures.

The BRICS emerging market powerhouses have already bought debt through the European Financial Stability Facility and could buy more, a potential help to struggling euro zone economies, a Brazilian newspaper reported on Monday.

Finally, there's some good news for U.S. motorists. Gas prices, down about 10 cents per gallon in the past month to an average of $3.60 per gallon for regular unleaded, are likely to continue to decline, assuming no oil disruptions from major oil producers or a large storm in the Gulf of Mexico.

The auction of online video site Hulu has been slowed by recent developments which could derail it completely, according to sources familiar with the process.

A proposed capital surcharge for big banks is not anti-American and will help reduce the risk of big bank failures, a top European regulator said on Monday.

U.S. stocks tumbled on Monday as growing fears of a Greek debt default prompted investors to sell risky assets and put an end to a week-long rally on Wall Street.

The BRICS emerging market powerhouses have already bought debt through the European Financial Stability Facility and could buy more, a potential help to struggling euro zone economies, a Brazilian newspaper reported on Monday.

A group of short-sellers, who earlier this month accused miner Silvercorp Metals of fraud, outlined new allegations against the company on Monday.

Newmont Mining Corp., which initially announced a link between its dividend and the price of gold, said Monday its annual dividend could rise to $4.70 if gold hits $2,500.

With gold and silver prices down Monday and the bulk of safe-haven investors opting for U.S. Treasuries instead of precious metals, shares of companies that mine for gold and silver were nearly all down along with the broader stock market.

The rogue trade disaster at UBS will put pressure on the Swiss bank to accelerate plans to install a successor to Chief Executive Oswald Gruebel with a mission to dramatically slash the investment bank and renew the focus on wealth management.

As the U.S. economy slouches toward another recession and confidence in policymakers erodes, investors are coming to grips with the notion that the country may already be several years into a Japan-style lost decade.

Connecticut and Rutgers have both expressed interest in joining the ACC, according to reports, but don't bank on the schools joining the conference in the very near future.

U.S. stocks fell sharply on Monday as renewed fears of a Greek debt default prompted investors to book some of last week's gains and turn to toward the safety of U.S. government debt.

Gold fell Monday in midday trading as investors decided to diversify their safe-haven opportunities by increasing their holdings of U.S. Treasuries, the dollar and the Japanese yen, said George Cocalis, senior market strategist for PFGBEST.

The Toyota Plug-in Hyrbrid Prius just announced by the company will be the first alternative to pure gasoline combustion automotive engines that provides the best of plug-in and hybrid combined in one.

Workers at Peru's Cerro Verde mine, which yields 2 percent of the world's copper, agreed to end an indefinite strike they began last week, but may down tools again on Sept. 27, a union leader said Monday.

UBS has kicked off an internal investigation into the catastrophic failure of its risk systems after rogue equity trades cost the Swiss bank $2.3 billion, raising the pressure on top management.

Homebuilder sentiment dipped in September with an industry index mired in a low range as the housing market continues to struggle, the National Association of Home Builders said on Monday.

For the first time since 1985, European central banks have become net buyers of gold, according to data from the World Gold Council.

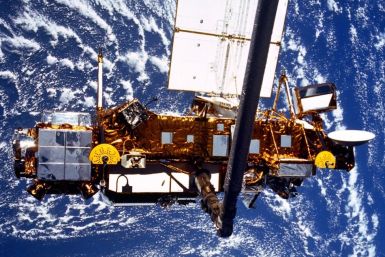

Temperatures will be seasonal this week with some areas having a chance of rain and slight odds of falling NASA satellite debris.

Although President Obama’s new deficit reduction plan will be portrayed as a tax hike, in reality, it by and large returns the tax code, with a few exceptions, to levels that existed prior to the 2001 Bush income tax cut -- a cut that fundamentally altered the U.S.'s fiscal and economic trajectory. The nation has been trying to recover ever since.

Polyus Gold, Russia's top gold producer, reported a first half net profit of $206.8 million in the first half of 2011, nearly double year-on-year, due to a rise in the price and demand for the precious metal.

Newmont Mining Corp. plans to boost its dividend payments to shareholders, should gold prices remain above $1,700 an ounce, the company said on Monday.

Canada's Aurizon Mines said it has found two new high-grade gold zones at its Marban Block property in the Abitibi region of Quebec.

Rui Feng, the chief executive of embattled miner Silvercorp , has boosted his stake in the company further, according to regulatory filings that indicate his vote of confidence in his own firm.

Wall Street stock indexes were set to drop more than 1 percent at the open on Monday as renewed fears of a Greek debt default prompted investors to book some of last week's gains and turn to safer assets such as gold.

Here is the list of the top 5 Windows 8 features that are expected to arrive with the OS.

Gold prices held steady Monday, as concerns about Europe's sovereign debt crisis, its weak financial sector and divisions among leaders about how to solve the crises drove investors into safe-haven securities like the U.S. dollar.

Venture capital-backed telecom gear startup SpiderCloud Wireless aims to tap into the emerging market of small wireless networks which can be used inside offices, shopping centers and stadiums.