Which Tax Mistakes Avoid IRS Penalties?

According to the IRS, the most significant factor in determining whether you have reasonable cause and whether you acted in good faith is your effort to report the proper tax liability

IRS Says 21 State Rebates Paid In 2022 Are Not Taxable

As taxpayers and tax return preparers started turning to 2022 tax preparation this time of year, those rebate checks became controversial.

Receiving An Employment Settlement? How IRS Taxes Apply

Most plaintiffs use contingent fee lawyers, and many assume they are tax issues only for the net money they collect after legal fees.

Forget This Tax Form, IRS Gets 24%

The Form W-9 certifies that the recipient is a U.S. citizen or tax resident and therefore is not subject to the onerous reporting and withholding obligations often required for payments to non-U.S. persons.

When IRS Form 1099 And Tax Returns Don't Match

With the IRS getting nearly $80 billion in new funding — about $45 billion of which is specifically designated for "enforcement" — you can expect more audits.

Two Easy Ways To Avoid IRS Problems

Keeping business and personal affairs separate is smart if you want to steer clear of the

IRS.

IRS Penalties Can Be Very Big Even For Innocent Mistakes

The size of penalties varies, but they are often around 25% of the tax.

Make Lemonade, Crypto Losses Mean IRS Tax Losses

IRS audits of crypto are increasing, and the IRS is inquisitive, learning and probing.

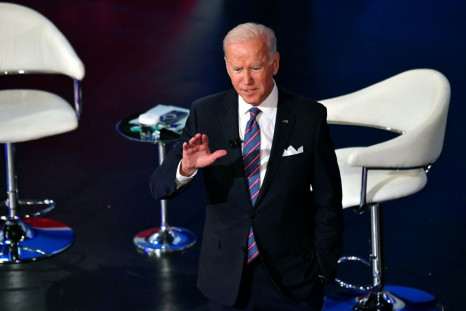

Joe Biden Plans To Raise Your Taxes, Here’s How

These proposals have not yet become law, but here’s what is in store for you if the Biden administration’s raft of ambitious tax hikes becomes law the way the administration hopes.

US Taxes 2022: IRS Forms 1099 Are Coming And Are Key To Your Taxes

If you don't receive a Form 1099 you expect, consider not asking for it.

Joe Biden’s Big Tax Hikes Are Still Looming?

Under one Biden proposal, the 23.8% rate may go to 43.4% in some cases, an 82% increase in the old rate.

Tax Season 2021: How To Avoid IRS Penalties

The best way to avoid penalties is to file on time, pay on time, and don’t make mistakes.

Careful, IRS Didn’t Extend All Tax Deadlines To May 17

Filing Form 4868 gives taxpayers until Oct. 15 to file their 2020 tax return but does not grant an extension of time to pay taxes due.

Taxes Are Going Up, But Payments On January 2nd Can Still Be Smart

The IRS can tax you under the doctrine of constructive receipt.

Did You 'Disclose' On Your Taxes? Here’s Why IRS Cares

Disclosure is more than the usual listing of income or expenses. It is simply a type of extra explanation.

Tax News: Be Careful, IRS Can Even Dispute FedEx Filings

The IRS lists some FedEx services as qualifying, but the dispensaries used a FedEx service not on the IRS’s list at the time.

Tax Season 2020: Taxes Are Due July 15, But Extending Might Lower Audit Risk

Tax forms like K-1s from partnerships and LLCs have an annoying habit of showing up late, and they are often amended.

Got Losses? IRS Makes It Easier To Claim Losses On Your Taxes

Losses that are carried back are carried to the earliest of the tax years to which the loss may be carried first.

Stimulus Check: Important Facts Taxpayers Need To Know About Payment, Eligibility

Not everyone is eligible and in some cases filing a tax return is required.

Tax Season 2020: IRS Eases Up On Tax Collections During Coronavirus Crisis

The IRS says that if the statutory period is not set to expire during 2020, the IRS is unlikely to pursue the foregoing actions until at least July 15, 2020.

New Tax Deadline: What To Know About Filing Before July 15, 2020

All taxpayers and businesses have this additional time to file and make payments without interest or penalties.

Incorrect IRS Form 1099? How to Push Back

Any Form 1099 sent to you goes to the IRS too.

Tax Season 2020: Why The IRS Starts Surprise Knock-Knock Visits About Your Taxes

The IRS says part of the reason it is making these visits and publicizing them is to make all the rest of the American taxpayers who are playing by the rules and paying their taxes feel better about the process.

New IRS Tax Question: Can Yes Or No Trip You Up?

Tax savvy people may recognize it as similar to the foreign account question included on the Schedule B. The question could set you up for big penalties or even committing perjury for checking the wrong box as the IRS intensifies its hunt for crypto tax cheats.

Penalties Of Perjury And IRS: Change Words On Form 1040, Get Audits Forever

With over half our returns being prepared by someone else, it is no wonder that many taxpayers may feel tempted not even to look at their tax returns. That would be a big mistake.

Beware IRS Forms 1099 At Tax Time, Here’s Why

As all the forms descend this time of year, there are key things to know.

Tax Laws: Can You Take The Fifth With The IRS?

Merely invoking the Fifth in a tax case can invite penalties or get the IRS looking more harshly at you.

Can 'Pay Me Next Year' Backfire With The IRS?

If you have a legal right to payment but decide not to receive it, the IRS can still tax you now, even if you are actually paid next year.

IRS Tax Election Is Worth $10 Million Tax Free

If you have a corporation—one that you formed or inherited—should it be an S or a C corporation?

IRS Taxes Wildfire Victims, Here’s How

How fire victims are taxed can be pretty surprising.