World Stocks Skid As Rate Hike Bets Keep Investors Cautious

Global equity markets and oil slipped and the safe-haven dollar rose after the latest red-hot U.S. inflation reading heightened investor fears about Federal Reserve interest rate hikes and a possible recession.

Wednesday's data showed U.S. consumer prices jumped 9.1% year-on-year in June, up from May's 8.6% rise.

The data was seen as firming the case for the Federal Reserve to raise rates aggressively. Policymakers might consider a 100 basis point increase at the July meeting, Atlanta Federal Reserve Bank President Raphael Bostic said.

The pan-European STOXX 600 index lost 1.58% and MSCI's gauge of stocks across the globe shed 1.61%.

On Wall Street, stock indexes tumbled on Thursday after weaker-than-expected earnings from big U.S. banks JPMorgan Chase & Co and Morgan Stanley underscored growing fears of a sharp economic downturn.

Meanwhile, the dollar soared to a 20-year high, emerging as a preferred save haven amid growing economic risks of late, as gold slumped more than 2% to a near one-year low on Thursday. The dollar index rose 0.49%, with the euro down 0.54% to $1.0006.

"The Fed probably needs to temper people's expectations in terms of what they can do," said Eddie Cheng, head of international multi-asset investment at Allspring Global Investments.

"In the past hiking cycle, we have observed that inflation kept rising during the hiking cycle. ... It takes time for the monetary policy to affect inflation."

Cheng said that riskier assets will be the "collateral damage" in the Fed's attempts to reign in inflation.

JPMorgan Chase, the United States' biggest bank, reported a fall in second-quarter profit. Chief Executive Jamie Dimon warned that geopolitical tension, high inflation, waning consumer confidence, the never-before-seen quantitative tightening and the war in Ukraine "are very likely to have negative consequences on the global economy sometime down the road."

The British pound was down 0.5% at $1.1832. In the first vote to choose who will succeed Boris Johnson as Conservative party leader, former finance minister Rishi Sunak won the biggest backing from Conservative lawmakers.

The euro was down 0.5% at $1.001, having slipped below parity on Wednesday for the first time since 2002.

The euro has been under pressure because of the European Central Bank lagging the Fed in ending its ultra-easy monetary policy of the past decade, as well as the economic risks from the euro zone's dependence on Russian gas.

The European Commission cut its forecasts for euro zone economic growth for this year and revised upward its estimates for inflation.

Germany's benchmark 10-year government bond yield was up 7 basis points at 1.219%.

Italian yields rose sharply ahead of a parliamentary confidence vote which risks bringing down the country's government.

The yield on 10-year Treasury notes was up 6.3 basis points to 2.969%. The 2-year, 10-year part of the Treasury yield curve is the most inverted it has been at any point in this cycle, according to Deutsche Bank.

Yield curve inversion - which is when short-dated interest rates are higher than longer-dated ones - is commonly seen as an indicator that markets are anticipating a recession.

The two-year U.S. Treasury yield, which typically moves in step with interest rate expectations, was up 3.2 basis points at 3.176%.

Oil prices fell as traders saw a large U.S. rate hike possibly reducing crude demand.

U.S. crude recently fell 2.52% to $93.87 per barrel and Brent was at $97.54, down 2.04% on the day.

Overnight, the Monetary Authority of Singapore and the Philippines central bank surprised markets by tightening monetary policy in off cycle moves.

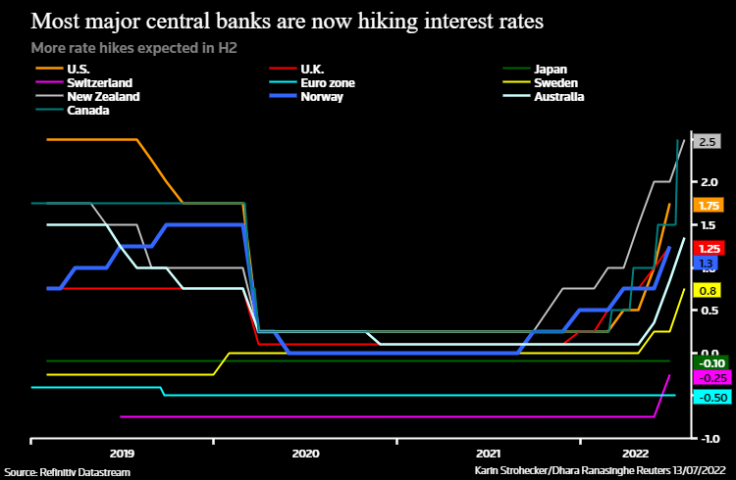

Graphic: Most major central banks are now hiking interest rates-

© Copyright Thomson Reuters {{Year}}. All rights reserved.