2012 U.S. Holiday Shopping: Department Store Sales Suggest Americans Will Spend More This Year

Black Friday -- America’s busiest shopping day of the year, when merchants typically roll-out enticing deals -- is just two weeks away, and economists are scrambling to predict holiday sales. The consensus is that 2012 will be the best year since the start of the Great Recession.

A day after digital market research firm comScore Inc. of Reston, Va., predicted a “very healthy” online holiday shopping season, Forrester Research of Cambridge, Mass., chimed in Thursday with its own rosy outlook for holiday online shopping of $68.4 billion, a 15 percent rise from 2011.

These ecommerce forecasts are in line with the National Retail Federation’s prediction of “solid” overall holiday shopping of over a half trillion dollars, higher than the average growth for the past 10 years, despite concerns about the so-called fiscal cliff that economists fear will tip the U.S. economy back into recession, if Congress doesn’t act on impending tax hikes and spending cuts.

This week five major department stores will report quarterly earnings, including Plano, Tex.-based J.C. Penney Company, Inc. (NYSE: JCP) Friday fiscal second-quarter filing, which is expected to disappoint for its third quarter with a loss of 4 cents earnings per share (EPS) on revenue down 18 percent from last year.

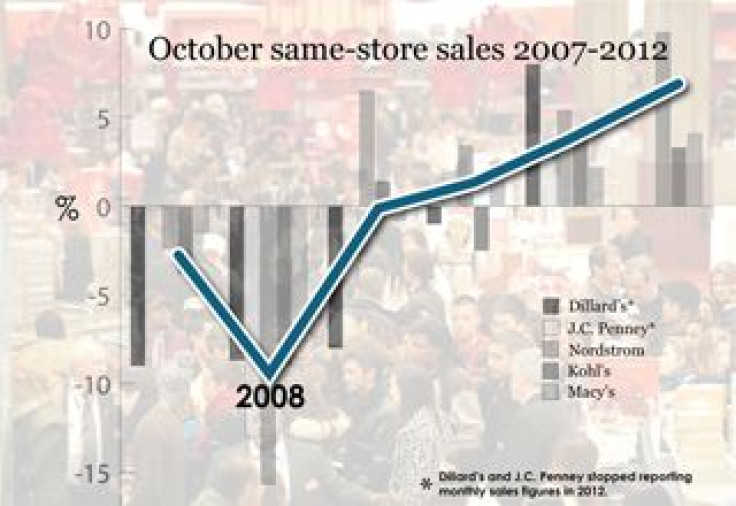

Moreover, the performance of these companies combined in the quarter prior to the holiday season can offer insight into general consumer sentiment. And while sales in October don’t necessarily offer a definitive look into how holiday shopping will perform, the October salea trend over time can give an indication of what direction the pre-holiday-season economy is taking.

And since 2008 these five department store retailers have seee their average same store sales frist dig out of negative territory in 2010, and sales are up nearly 6 percent from 2011.

Family oriented mid-range department store Kohl's Corporation (NYSE: KSS) of Menomonee Falls, Wis., announced Thursday a 1.9 percent increase in third quarter earning, but disappointed Wall Street on its annual ESP guidance of $2 to $2.08, lower than the $2.16 that analysts polled by Thomason Reuters had expected.

Seattle’s high-end fashion specialty retailer Nordstrom, Inc. (NYSE:JWN) was expected Thursday after markets closed to announce an EPS of 72 cents for its third quarter, up from 59 cents last year.

Cincinnati-based Macy's, Inc. (NYSE:M) topped estimates on Wednesday with a 4.3 percent rise in net income to $145 million, or 36 cents per share and raised its full-year outlook by a nickel to between $3.35 and $3.40 a share. It expects same-store sales to increase 4.2 percent this holiday season.

And finally, mid-range department stores Dillard's, Inc. (NYSE:DDS) of Little Rock, Ark., posted robust third quarter results on Wednesday, with an EPS of $1.01 on net income of $48.5 million and a 5 percent rise in same store sales.

Retail Metrics, which tracks the industry, said as of Thursday 34 percent of the 120 major merchandisers it tracks have reported earnings tht on average have beat consensus estimates by 2.5 percent - yet another piece of evidence that despite the flavor of the year being “economic uncertainty,” U.S. consumers are confident enough to spend more than in recent years past.

© Copyright IBTimes 2024. All rights reserved.