401k Savings Up Slightly in 2011: Fidelity

U.S. workers contributed more to their 401(k) plans in 2011, while average balances at year's end also rose slightly, according to a quarterly survey by Fidelity Investments.

"It's very encouraging that savings levels actually held up during the intense market volatility of last year and a sluggish economic environment," said James M. MacDonald, president, president of Fidelity's workplace-investing unit. "Increases in savings levels, however small, can make a significant impact over time."

The report is based on Fidelity's 11.6 million 401(k) participant accounts.

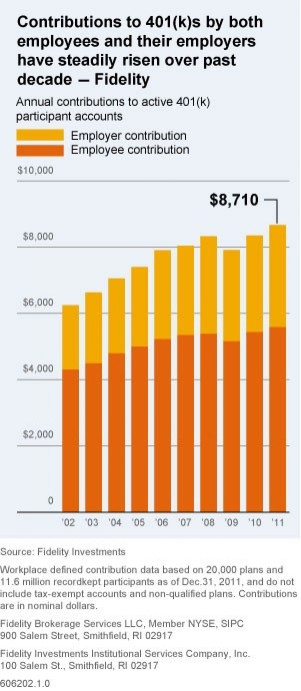

In 2011, the average employee contribution rose slightly to $5,750, up from $5,680 a year ago, as participants on average continued to save more than eight percent of their annual salaries. As of the end of last year, the average 401(k) balance was $69,100, up nearly eight percent from the end of the third quarter.

Meanwhile, more participants benefited from employer contributions -- 82 percent of active participants received employer contributions during 2011, up from 79 percent in the prior year. Such contribution typically matches the amount of employee contributions up to a cerain level or come in the form of profit-sharing.

About 75 percent of employers made contributions to eligible participants last year, averaging $3,270, up from $3,170 the year before.

© Copyright IBTimes 2024. All rights reserved.