After-Hours News: Yelp Inc (YELP), Twitter Inc (TWTR)

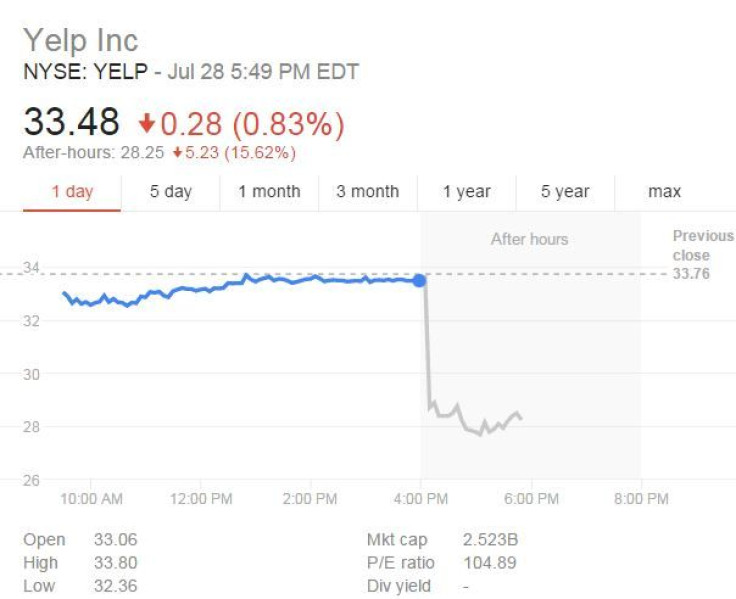

Shares of Yelp Inc. (NYSE:YELP) plunged more than 15 percent Tuesday in extended-hours trading after the company posted a surprise quarterly loss. The stock tumbled further after the company announced Chairman Max Levchin would step down from the board to pursue other interests, effective immediately.

The report comes as the company faces slowing subscriber growth since its initial public offering in 2012. The San Francisco company, which has a market value of nearly $2.5 billion, has seen its stock tumble more than 50 percent in the last 12 months. Since its IPO, users have written more than 83 million reviews on the site, according to the company, covering everything from dining to hotels and travel.

The site averages more than 162 million unique visitors monthly, including mobile and desktop users, up 17 percent from a year ago, but still down from a growth rate of 27 percent a year ago.

Following the announcement, Yelp’s stock fell more than 15 percent to as low as $27.70 in after-hours trading.

Shares were also under pressure earlier this month following a report that the consumer review website is no longer exploring a sale, Bloomberg reported.

The company announced plans in February to buy Eat24, an online and app-based food-ordering service in San Bruno, California, for $134 million. Yelp’s transactions revenue totaled $11.3 million, compared to $1.2 million a year ago, primarily due to the acquisition of Eat24.

"Our core local advertising business remains strong, and we are investing in Yelp's future," Rob Krolik, Yelp's chief financial officer, said in a statement Tuesday. "We expect local advertising will continue to be our primary driver of growth as we work toward our goal of generating $1 billion of revenue in 2017."

Yelp reported a fiscal second-quarter loss of $1.31 million, or earnings per share of 2 cents, on revenue of $133.91 million, compared with a profit of $2.74 million, or earnings per share of 4 cents, on revenue of $88.79 million a year ago.

The company’s revenue slightly beat Wall Street forecasts of $133 million. However, Yelp's revenue outlook for the current quarter and the year also missed estimates, disappointing investors.

Shares of Yelp have lost nearly 40 percent of their value since January.

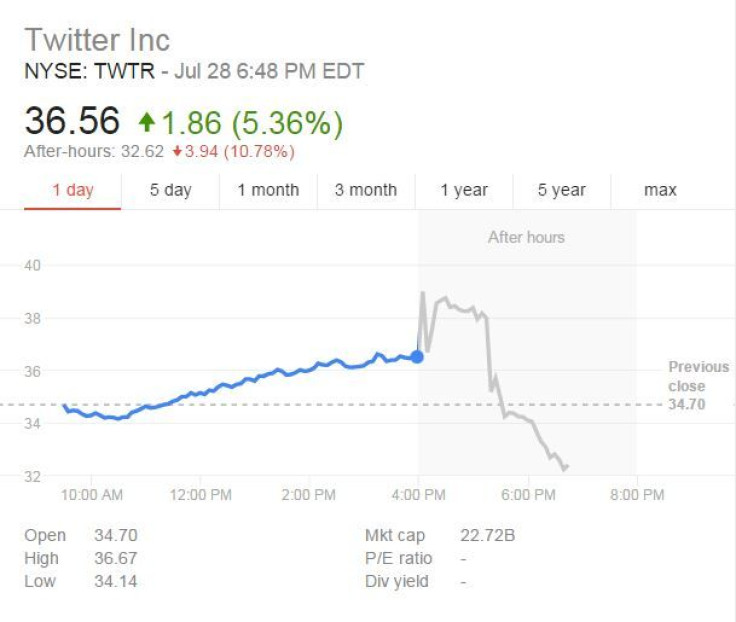

Meanwhile, another social media company -- Twitter Inc. (NYSE:TWTR) -- saw its shares drop more than 10 percent in extended-hours trading Tuesday after executives warned of slow user growth. The move erased a 5 percent gain following the closing bell after the social media company's revenue soared 61 percent from a year ago, topping Wall Street forecasts, driven by growth in advertising revenue.

Twitter continues to face tough shareholder questions about slowing user growth since its initial public offering in November 2013.

"We don’t expect to see sustained, meaningful growth (in monthly active users) until we reach the mass market,” Chief Financial Officer Anthony Noto said during its conference call with shareholders Tuesday. "We expect it to take a considerable period of time."

Shares of Twitter dropped more than 10 percent to as low as $32.25 in after-hours trading.

Twitter’s key measure of growth -- average monthly active users -- came in at 304 million for the April-June quarter, 12 percent higher than a year ago. However, that’s only up from 302 million in the prior quarter.

But the gains pale in comparison to Facebook, which has more active monthly users than Twitter and LinkedIn Corp. combined. Facebook announced in April it officially has more monthly active users (1.44 billion) than China has people (1.4 billion).

Twitter reported a fiscal second-quarter loss of $136.7 million, or earnings per share of 21 cents, as revenue rose 61 percent to $502.38 million, compared to a loss of $144.6 million, or earnings per share of 24 cents, on revenue of $312.2 million a year ago.

Wall Street had projected Twitter to report a fiscal second-quarter loss of $177.3 million, or earnings per share of 27 cents, on revenue of $481.3 million, according to analysts polled by Thomson Reuters. Excluding items, Twitter earned 7 cents per share, beating Wall Street forecasts.

Shares of Twitter have dipped 4 percent in the last 12 months.

© Copyright IBTimes 2024. All rights reserved.