Amazon Inc. (AMZN) Q4 2015 Earnings: Retail Giant Fails On Estimates, Sending Stock Down By 13 Percent

After four quarters of beating expectations, Amazon has slipped in its ability to blow away investors by missing both revenue and profit expectations. The e-commerce and, as of late, media giant reported $482 million in profits for its fourth quarter, far below the $725 million Thomson Reuters analysts estimated. Amazon’s stock fell by 13 percent in after-hours trading on the Nasdaq.

Amazon’s net sales reached $35.7 billion, again below estimates of $35.98 billion. Revenue was up by 22 percent compared with the fourth quarter of 2014. These were driven by holiday sales and a rise in revenue from Amazon Web Services and Prime subscribers. Amazon Web Services garnered $2.4 billion, up from $1.4 billion in 2014. Prime members increased by 51 percent in the last year, the company reported.

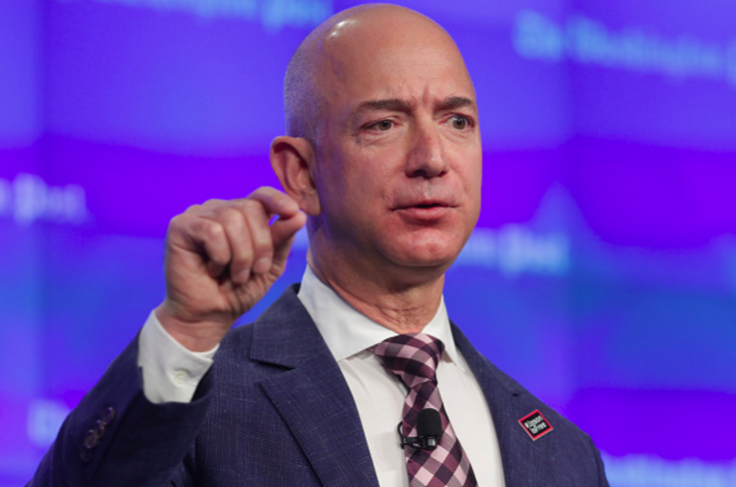

Amazon may be back to its regular game as one of the tech industry’s biggest spenders. CEO and founder Jeff Bezos said it feels like day one. “Twenty years ago, I was driving the packages to the post office myself and hoping we might one day afford a forklift. This year, we pass $100 billion in annual sales and serve 300 million customers,” Bezos said in a statement.

“And still, measured by the dynamism we see everywhere in the marketplace and by the ever-expanding opportunities we see to invent on behalf of customers, it feels every bit like Day 1," he continued.

"They’re quietly dominating hosting services around the world, and that’s not the business they’re known for. It’s not the consumer brand," said Jonathan Opdyke, CEO of HookLogic, a performance marketing company for brands that works with many of the leading retail companies. "I think they'll find ways to monetize that more this year."

Amazon Prime has grown to cater not only to e-commerce but also to media services. Amazon’s investment in original content, which is mostly only available to Prime subscribers, seems to be paying off, at least in brand attention. Its series “Mozart in the Jungle” won two Golden Globes while Netflix went home empty-handed in 2016.

"We're very pleased with the critical acclaim to Amazon Studios content," Brian Olsavsky, Amazon's senior vice president and chief financial officer, said to investors.

In addition to success in its original series, Amazon is seeing video consumption grow on its site. In international markets, the time spent doubled year-over-year.

Amazon does not disclose how many subscribers there are, but a recent report from Consumer Intelligence Research Partners estimates there were 54 million Prime subscribers in the U.S. at the end of 2015. That number would imply a growth of 35 percent in the quarter, year-over-year. “Their Amazon Prime is genius,” Barry Diller, founder of IAC/InterActive Corp., said on Bloomberg TV this week.

Prime members, who for the most part pay $99 per year, spend $1,100 each year compared with $600 for nonsubscribers, Consumer Intelligence Research Partners estimated. “Prime is driving a flywheel which appears nearly impossible to stop (or even slow down),” Deutsche Bank wrote in a research note.

The question is what will be the next services for Prime. Amazon’s same-day delivery service, called Prime Now, is now available in 25 cities in the United States. Executives admitted to investors on Thursday that it comes as a high cost for the company but that follows the Amazon way of high spending in order to ensure customer satisfaction.

While in prior years Wall Street has issued concern over the company’s commitment to spending, some analysts do admire the company’s successful expansion. “It’s hard not to continue liking Amazon’s setup,” Mark Mahaney, an analyst at RBC Capital Market wrote in a research note on Monday.

Amazon continues to expand on how it will serve each part of the e-commerce experience for a consumer. Amazon’s drones drew attention this year, as the company began testing the technology and revealed details about how it works. Called Prime Air, the drones fly under 400 feet and is designed to deliver packages of up to 5 pounds in 30 minutes, or less.

But, for Amazon, it isn’t just about this final step in the delivery process. Amazon registered with the Federal Maritime Commission to be an ocean freight operator in the United States earlier this month. The company is also in talks to lease at least 20 cargo planes, Seattle Times reported. "We need to add more of our own logistics," Olsavsky said Thursday.

Olsavsky noted that one of the reasons why estimations were not met this quarter was because they did not have enough resources to effectively manage the volume of sales.

“They’re making more bold moves in terms of owning the supply chain,” said Amit Sharma, CEO of Narvar, which focuses on software to improve customer experiences and works with 200 e-commerce companies. “The next step is how do they use their identity to have much more control on the package movement.”

These efforts allow Amazon to not better control and improve the efficiency of the supply side, but also meet more customer demand. In the growing economy of on-demand service like Uber and Airbnb, customers are familiar with such commitment and transparency.

“In the last decade, the supply chain has been focused on free and fast delivery. 2016 will be focused on free and personalized experiences and providing transparency on every part. That’s what Amazon is stepping towards,” said Sharma, who has worked in supply chain management at Williams-Sonoma, Walmart and Apple.

Next steps for Amazon includes looking to more markets. India has been at the top of investor’s minds, as they point to the success of Indian e-commerce giant Flipkart. Amazon is also working to improve its mobile products. One example is its Prime Now app.

© Copyright IBTimes 2025. All rights reserved.