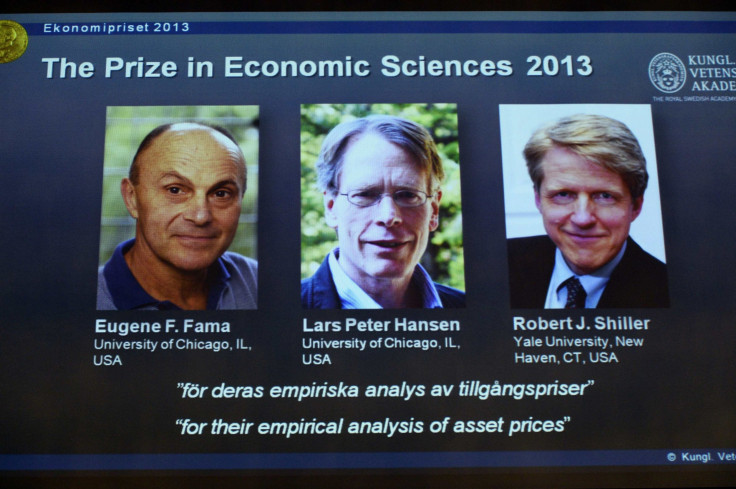

American Economists Eugene Fama, Robert Shiller And Lars Peter Hansen Share Economics Nobel Prize

Three American economists won the Nobel Prize in economics on Monday for groundbreaking research into asset prices that transformed the way economists and investors evaluate financial markets and showed that it is possible to predict the prices of stocks and bonds over long periods of time.

Eugene Fama and Lars Peter Hansen of the University of Chicago and Robert Shiller of Yale University were awarded the top economics prize worth 8 million Swedish kronor ($1.25 million) for their “empirical analysis of asset prices,” the Royal Swedish Academy of Sciences said in a statement.

“Although we do not yet fully understand how asset prices are determined, the research of the Laureates has revealed a number of important regularities that are helping us to arrive at better explanations,” the academy said. “Mispricing of assets may contribute to financial crises and, as the recent global recession illustrates, such crises can damage the overall economy. Today, the field of empirical asset pricing is one of the largest and most active subfields in economics."

Fama, 74, is widely regarded as the father of modern finance after he and his collaborators demonstrated, in the 1960s, that stock prices are extremely difficult to predict in the short term as they absorbed new information very quickly.

Shiller, 67, however, found in the early 1980s that even though it's almost impossible to predict stock prices over days or weeks, their volatility over longer periods could be foreseen and that prices moved because of a range of reasons, including investors’ sentiments. His findings led to the beginning of behavioral economics, which seeks to answer the reasons behind investors' financial decisions.

Meanwhile, Hansen, 60, devised a statistical tool for analyzing changes in asset prices and to test rational theories of asset pricing.

The independent findings of the three economists have implications on macro economy beyond the financial markets, and according to Mark Gertler, a New York University economist who spoke to the Wall Street Journal: “The interesting thing is how the three are connected.”

© Copyright IBTimes 2025. All rights reserved.