Analysis-Easy Russia Sanctions Exhausted, U.S. And Allies Face Economic Bite

As the world's wealthy democratic powers roll out new sanctions against Russia in response to horrifying images of executed Ukrainians in the city of Bucha, it has become clear that the easiest options are now exhausted and stark differences have emerged among allies over next steps.

The European Union proposed a first stab at curbing Russia's energy sector in response to its invasion of Ukraine launched in February, banning imports of Russian coal. But EU countries remain divided even over this move, much less restricting imports of Russian oil and gas that are more important to their economies.

The United States and Group of Seven allies announced new sanctions on Russia's largest lender, Sberbank, more state-owned enterprises and more Russian government officials and their family members, cutting them out of the U.S. dollar-based financial system.

The United States also has banned Americans from new investment in Russia and barred Moscow from paying sovereign debt holders with money in U.S. banks.

Although Russia's heavily restricted rouble rallied to a six-week high on Wednesday, U.S. Treasury officials say the sanctions are starting to turn Russia back into an austere, 1980s Soviet-style closed economy,

But the U.S. sanctions contain carve-outs allowing Russia to continue collecting revenue from energy exports, which can help fuel its Ukraine invasion. U.S. Treasury Secretary Janet Yellen told U.S. lawmakers on Wednesday that stronger curbs on Russian energy are not yet possible for European allies dependent on Russian oil and gas.

Russia supplies around 40% of the European Union's natural gas consumption, which the International Energy Agency values at more than $400 million per day. The EU gets a third of its oil imports from Russia, about $700 million per day.

"We are at the point where we have to take some pain," said Benn Steil, international economics director for the Council on Foreign Relations think tank in New York. "The initial batches of sanctions were crafted as much to not hurt us in the West as much as they were to hurt Russia."

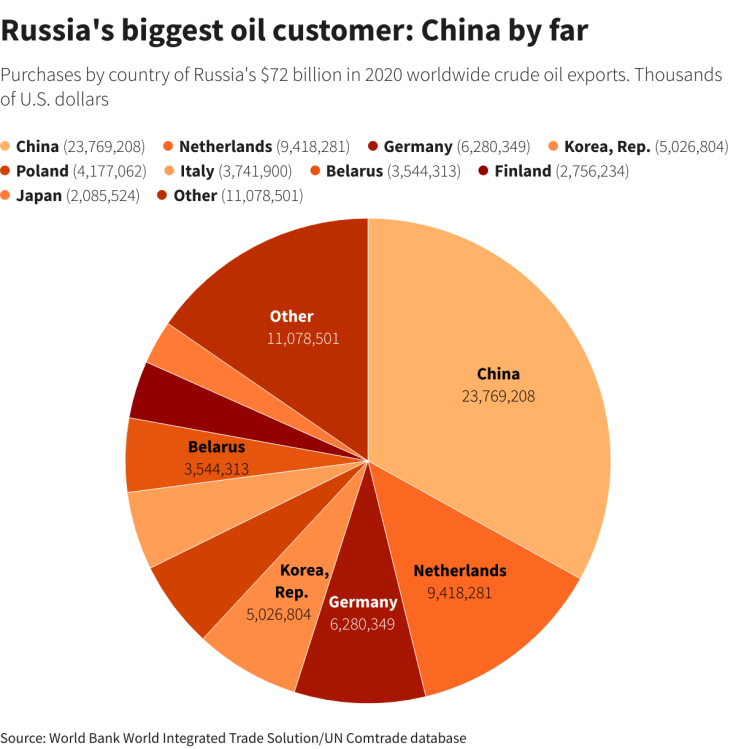

(Graphic: Russia's biggest oil customer: China by far -

)

The divisions in Europe have become more apparent this week. After Lithuania announced on Saturday it would stop importing Russian gas for domestic consumption, Austrian Finance Minister Magnus Brunner voiced opposition to sanctions on Russian oil and gas, telling reporters in Luxembourg that these would hurt Austria more than Russia.

NEXT STEPS

Lack of unity on curbing energy imports means that options are limited to increase pressure further, but the investment ban announced on Wednesday could push more multinational firms to leave Russia, said Daniel Tannebaum, a former compliance officer at the Treasury's Office of Foreign Assets Control.

"You could outright start banning trade in more industries," a move that would cut Russians off from more types of Western products such as pharmaceuticals, similar to a luxury goods ban imposed in the early days of the war, said Tannebaum, who leads consulting firm Oliver Wyman's anti-financial crime practice.

The United States has been pushing European allies to inflict more pain on Russia while trying to make sure that the alliance against President Vladimir Putin does not fray, a balance that only gets tougher.

"You've kind of hit the ceiling - on both sides of the Atlantic - for what can be done easily and what can be done in short order," said Clayton Allen, U.S. director at the Eurasia Group political risk consultancy, referring to the sanctions.

To move to a tougher round of sanctions, U.S. officials will need to provide some assurances to European countries that energy markets and supplies can be stabilized to avoid severe economic hardship, Allen said. An economically weakened EU helps no one, Allen added.

"If Western Europe is plunged into a recession, that's going to drastically limit the amount of support - both moral and material - that they can provide to Ukraine," Allen said.

U.S. Secretary of State Antony Blinken is expected to press the case for more actions in Brussels this week at NATO and G7 meetings of foreign ministers. U.S. Deputy Treasury Secretary Wally Adeyemo held similar meetings last week in London, Brussels, Paris and Berlin.

There also are still loopholes to close, including continued sales by German and French companies into Russia, and the ongoing hunt for luxury yachts and other assets parked by Russian oligarchs, according to one European diplomat involved in sanctions talks.

© Copyright Thomson Reuters 2024. All rights reserved.