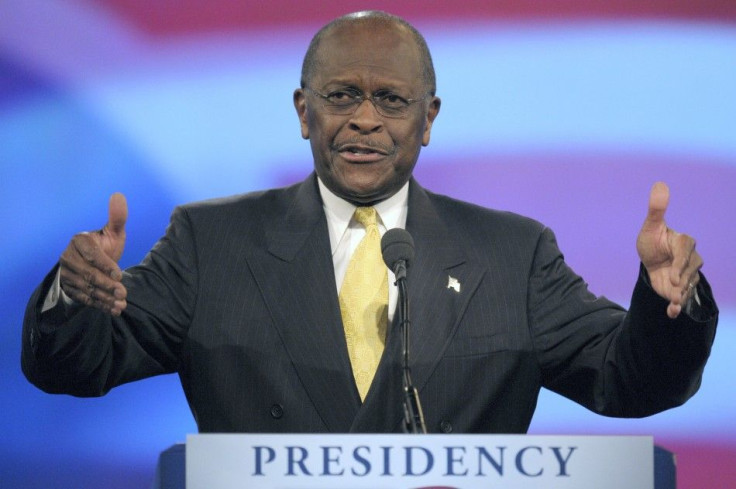

Herman Cain's '9-9-9' Plan Would Tax Poor People's Food, Clothing

Herman Cain's 9-9-9 plan, which the former Godfathers Pizza CEO and current Republican presidential front runner claims will slash taxes and consequently boost the economy, includes some tax increases that may not go over well with many struggling Americans: specifically, sales taxes on both food and clothing.

During an interview with CNN's Candy Crowley on Sunday, Cain said food and clothing would not be exempt from the 9 percent national sales tax he would attempt to enact if elected in 2012. Crowley, who seemed surprised by a potential tax on those basic necessities, pushed Cain to expand on his reasoning.

So a poor person is paying the same amount of taxes on groceries as I am? Does that sound fair to you, just in a vacuum? she asked.

Cain responded that Yes, it does sound fair, claiming the tax would even out since under his policy, those same low-income individuals would not pay taxes if they need to buy a car or a home or some hard goods that are used.

Cain argues that because the 9-9-9 plan -- which would implement a 9 percent flat-tax on personal income and corporate income, in addition to the national sales tax -- would lower income taxes for many Americans, they will have more money to spend and will be able to afford higher taxes on food and clothing.

CAPD: Cain's Tax Plan Would Increase Taxes Paid by Lower-Income Americans

However, Michael Linden, the Center for American Progress' Director of Tax and Budget Policy, told Think Progress that because the bottom quintile of earners currently only pay about 2 percent of their income in federal taxes, under Cain's plan they would be paying considerably more. Specifically, he said with the 9 percent tax on every dollar they make, as well as every dollar spent, the poorest Americans would pay a whopping 18 percent of their income in taxes.

Comparatively, Linden said middle-class earners would see their taxes rise from 14 percent to about 18 percent, while the richest one percent of Americans would see their tax rate fall from about 28 percent to 11 percent under the 9-9-9 plan.

It would be the biggest tax shift from the wealthy to the middle-class in the history of taxation, ever, anywhere, and it would bankrupt the country, Michael Ettlinger, the vice president for economic policy at the Center for American Progress, told The Wall Street Journal.

While Cain has touted his plan as the solution to the nation's economic struggles, Linden's analysis found that, based on 2007 tax data, it would actually result in the largest budget deficits since World War II. If applied that year, the 9-9-9 plan would have yielded just under $1.3 trillion in total federal tax revenue -- 9.2 percent of the GDP -- compared to 18.5 percent of GDP in tax revenue that was actually collected that year.

Cain's plan to tax food is so surprising that even the Tea Party group FreedomWorks assumed certain vital goods, such as food and medicine, would be exempt from the 9 percent national sales tax.

If you're one of the minority of people -- the top 10% of the population -- who pay 70% of the income tax revenues, you might see the change as a good deal.But if you're lower down the income scale, and especially if you're one of the 50% of Americans who don't pay any income taxes, then you might not see it as such a good trade, FreedomWorks' Web site states in an Oct 6. blog post titled Herman Cain's 999 Plan: The Good, the Bad and the Ugly.

Thirty-one states as well as Washington, D.C. exempt most groceries from the state sales tax, according to the Center on Budget and Policy Priorities. In addition, seven states tax groceries at lower rates than other goods and five states tax food, but offer credits or rebates on some of those taxes for low-income earners. Only two states - Alabama and Mississippi -- currently apply their states full sales tax on grocery items.

© Copyright IBTimes 2025. All rights reserved.