ExxonMobil Earnings Preview: Profits To Continue Rising in Q4

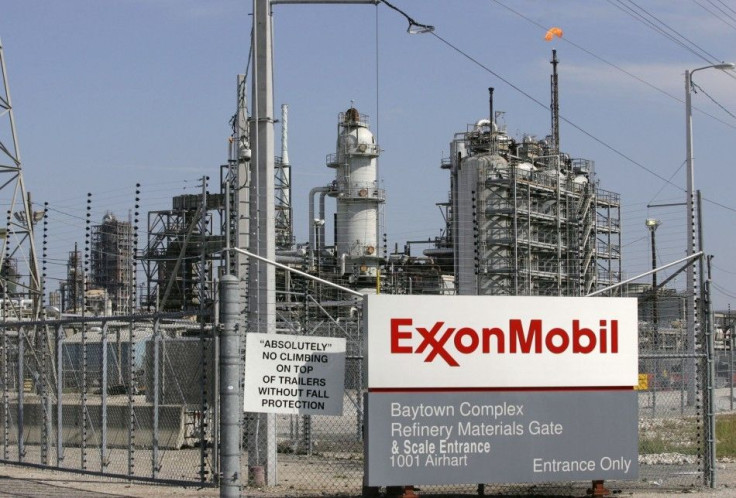

ExxonMobil, the world's largest integrated oil and natural gas company, is expected to report an increase in fourth-quarter profit as higher crude oil prices offset weaker refining margins and record-low U.S. natural gas prices.

Analysts polled by Reuters expect the Irving, Texas-based company to report $9.9 billion in profit, a 5.9 percent increase over the fourth quarter of 2010, with earnings per share of $2.01, an 8.7 percent increase. Revenue is anticipated at $119 billion, 14 percent above the year-earlier level.

The company reports Tuesday, 11 a.m. (New York time).

Pavel Molchanov, an analyst with Raymond James, who expects earnings per share of $1.84, said the quarter's higher crude oil prices are particularly helpful to ExxonMobil since most of its revenue comes from production. For the majority of the fourth quarter the price of crude oil was above $100 per 42-gallon barrel.

Molchanov also said record-low natural gas prices in the U.S., caused by an over-supply, weighed on the company's fourth-quarter results.

Even though there is a glut of natural gas in the United States, natural gas prices are strong elsewhere. ExxonMobil's massive liquid natural gas venture in Qatar most likely drove the company's natural gas earnings in the fourth quarter.

ExxonMobil will most likely report losses in its refining and marketing business.

Refining will be a drag on (overall) earnings, Molchanov said.

For the year, ExxonMobil is expected to report $482.7 billion in revenue, almost $100 billion more than in 2010.

Shares rose in after-hours trading 12 cents to $85.95.

© Copyright IBTimes 2025. All rights reserved.