Could “crowd-sourcing” help resource-starved SEC detect fraud?

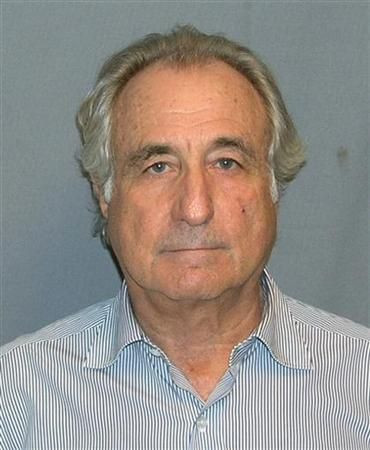

Perhaps the most brazen financial fraud in recent U.S. history was Bernie Madoff's massive $65-billion Ponzi scheme that spanned nearly three decades. A scheme of this magnitude and longevity is, of course, hard to hide and many saw blatant red flags.

As early as 2001, the media had quoted financial professionals who raised questions about Madoff's fund. In 2005, independent fraud investigator Harry Markopolos sent the SEC a memo raising 29 red flags -- he had complained about Madoff to regulatory officials for six years.

Amazingly, despite the sheer scope of the fraud and the abundance of alarm bells and warnings, the SEC did not find enough to convict Madoff until he actually admitted that his fund was just a massive Ponzi scheme. He was forced to do so because when investors wanted to withdraw huge amounts of money during the financial crisis, Madoff could not pay them.

The SEC failed to catch Madoff largely because they are understaffed (a fact the SEC itself has admitted), under-funded, and simply lacked the resources to adequately investigate his activities. Undoubtedly, there were other smaller incidents of fraud that have gone unpunished because of this deficiency.

To solve this egregious issue, NERA Economic Consulting proposed crowdsourcing, the concept behind Wikipedia's existence. Proving financial fraud is essentially an exercise in finding numbers that do not match. Through crowdsouricng, regulators would make financial data publicly available to the masses, who would do the 'grunt work' of sifting through them to find discrepancies.

NERA believes that the investment community (and competitors, reporters, academics, etc.) has the skills, information, resources, and incentive to volunteer for this massive task if the SEC would only disclose the information through a proper channel and method.

As an example of successful crowdsourcing, NERA cited U.K. newspaper The Guardian, which published online 700,000 expense claims by members of the U.K. Parliament. The public combed through the voluminous records and what ensued was national scandal in which politicians were accused of making false claims for outrageous expenses. As a result, criminal charges have been filed and politicians have resigned.

For investment advisors, NERA recommended making information available so that the masses can match the numbers reported to the SEC, the numbers reported to clients, and the numbers disclosed by custodians, or financial institutions that hold the securities for investment advisors.

If the above information is available, then investment advisors would have to fabricate matching phony records for the SEC and investors, and also find a willing custodian accomplice, making fraud rather difficult to perpetrate.

However, in the case of Madoff, this would not have worked; Madoff's firm provided self-custody and could therefore present matching fraudulent numbers to all outside parties.

To combat this, NERA suggested requiring the Depository Trust Company (DTC) to disclose quarterly trading records for all the advisors. The DTC clears and settles the vast majority of investment advisor transactions in the U.S. Through DTC's data, Madoff's discrepancies would have been quickly revealed, said NERA.

Of course, individuals from crowds can make false and erroneous claims. However, the beauty of crowdsourcing is that if a claim is indeed true, a large number of people would repeat and validate it, which would give the claim prominence and credibility. Social news sites like Digg, with their “up-vote” and “down-vote” system, use a similar concept.

NERA acknowledged that it is proposing an “admittedly radical” concept. However, it believes that the benefits and efficacy of crowd-sourcing is immense and would address the public's demand for better policing of the financial markets. In addition, much of the downside risks and costs of implementing this program could probably be mitigated through careful design and planning.

Email Hao Li at hao.li@ibtimes.com

Click here to follow the IBTIMES Global Markets page on Facebook.

Click here to read recent articles by Hao Li.

© Copyright IBTimes 2025. All rights reserved.