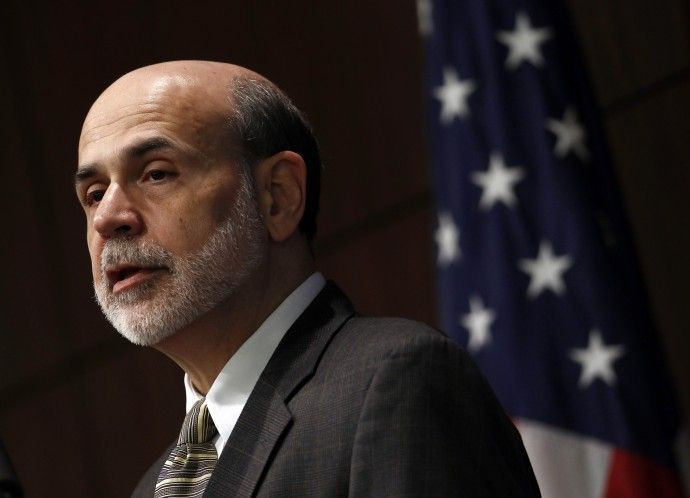

Fed could launch QE3: Bernanke

CBS will air an interview with Federal Reserve Chairman Ben Bernanke on the 60 Minutes show.

During the interview, Bernanke will explain the Fed's decision to launch a second round of quantitative easing (QE2) and defend the program against criticisms from inflation hawks.

Perhaps more importantly, CBS reported that Bernanke did not rule out the possibility of more asset purchases, meaning a third round of quantitative easing (QE3) is possible.

The interview was taped on November 30 and will air Sunday, December 5.

Bernanke is not the only Fed official to strike a dovish tone recently.

When asked about the possibility of spending less than $600 billion for QE2, New York Fed chief William Dudley said it is a little bit premature to be so confident because of slow economic growth and the high unemployment rate.

Boston Fed president Eric Rosengren said he fully anticipate[s] the Fed completing the $600 billion in purchases and if the economy were to weaken substantially and further disinflation were to occur, the Fed could take more action.

Fed Vice Chairwoman Janet Yellen said the Fed is open to further action if it turns out the economy remains sufficiently weak or if [Fed officials are] sufficiently worried about further disinflation in the medium-term.

The airing of Bernanke's CBS interview comes two days after the Bureau of Labor Statistic released a highly disappointing jobs data for November. Total non-farm payrolls gains was 39,000 versus economists' expectation of 150,000.

The economy needs to create at least 100,000 jobs to keep the unemployment rate steady, according to the San Francisco Federal Reserve.

Monthly gains of 39,000 will obviously not be enough to lower the unemployment rate and if the jobs market continues to be this poor, it just might push the Fed to launch QE3.

The high unemployment rate prompted the Federal Reserve to launch QE2 in the first place.

The unemployment rate is elevated… relative to levels that the [Federal Reserve] judges to be consistent...with its dual mandate to foster maximum employment and price stability, the Federal Reserve said in a statement on November 3. The same statement was used to announce the details of QE2.

Email Hao Li at hao.li@ibtimes.com

Click here to follow the IBTIMES Global Markets page on Facebook.

Click here to read recent articles by Hao Li.

© Copyright IBTimes 2025. All rights reserved.