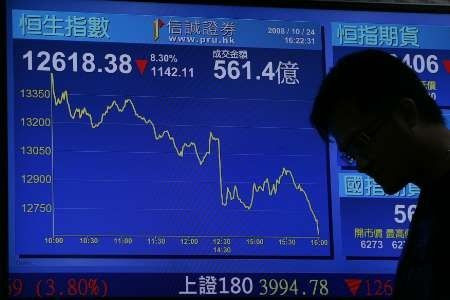

Asian Stocks Fall Ahead Of German Ruling, Fed Meeting

Asian stock markets declined Tuesday as investors opted for caution ahead of key events, including the German court ruling on ESM constitutionality and the U.S. Federal Reserve policy meeting later this week.

Japanese benchmark Nikkei declined 0.70 percent or 61.99 points to 8807.38, Chinese Shanghai Composite fell 0.67 percent or 14.34 points to 2120.55 and South Korean KOSPI Composite declined 0.24 percent or 4.70 points to 1920.00, while Hong Kong's Hang Seng gained 0.15 percent and India's BSE Sensex gained 0.22 percent

The German Constitutional Court will decide on Wednesday whether the country can legally participate in euro zone's permanent bailout fund known as the European Stability Mechanism, which gives loans to member states and may buy their bonds.

Renewed Greek fears also weighed on the sentiment. The debt-ridden country has not yet reached an agreement on how to generate the spending cuts of 11.5 billion euros ($14 billion) that the troika originally demanded by June. Another worrying factor is that Greece does not currently meet the ECB's criteria that countries needing aid should meet the fiscal conditions given in the bailout packages.

Meanwhile, investors also await the U.S. Federal Reserve's Federal Open Market Committee interest rate decision on Thursday. At the Economic Policy Symposium at Jackson Hole, Wyo., on Aug. 31, U.S. Federal Reserve Chairman Ben Bernanke said the central bank would take additional measures if necessary, which was taken as an indication of a stronger push for QE3.

Following last week’s disappointing U.S. jobs data, investors are hoping that policymakers will announce further monetary easing measures to strengthen recovery. The U.S. economy needs employment growth of 100,000 just to maintain "stability" in the job market. But this is the fourth time in the past five months that it has added fewer than 100,000 jobs, which is disappointing by any measure.

“Germany’s ruling is an uncertain factor surrounding Europe’s debt crisis for now, limiting risk appetite for investors. But sentiment is not so weak and Asia is still seeing some fund inflows, providing a floor for regional currencies. Investors are also waiting for the result of the Fed’s meeting,” Hideki Hayashi, a researcher at the Japan Center for Economic Research in Tokyo, told Bloomberg.

Japanese stocks ended lower, led by declines from exporter companies’ shares as the yen strengthened against the euro. Mazda Motor Corp. declined 2.08 percent and Sony Corp. fell 0.33 percent while Panasonic Corp. plunged 1.66 percent after its credit rating was cut by Moody’s, citing weak earnings and higher debt.

In Hong Kong, Angang Steel Co. Ltd. plunged 2.66 percent and China Coal Energy Co. declined 0.74 percent while Cnooc Ltd. advanced 2.51 percent.

In Seoul, Hana Financial Group Inc. declined 1.57 percent and Shinhan Financial Group slipped 1.67 percent while Samsung Electronics advanced 0.48 percent.

© Copyright IBTimes 2024. All rights reserved.