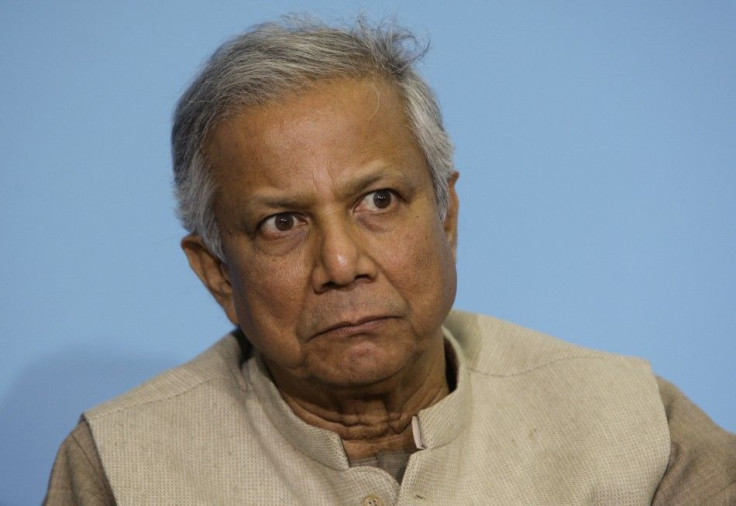

Bangladesh Nobel Laureate Yunus fired as head of Grameen Bank

Bangladesh’s central bank has removed Muhammad Yunus as head of the Grameen Bank, which became world famous as a micro-lender, a provider of loans to poor people.

Dhaka bank regulators said Yunus’ appointment as chief had not been authorized, citing that Grameen’s board failed to obtain permission from authorities when it reappointed Yunus as managing director in 2000.

Bangladesh Bank has relieved Yunus of his duties as managing director of the Grameen Bank, said Muzammel Huq, the government-appointed chairman of Grameen Bank.

The authorities also said Yunus is well past the mandatory retirement age of 60 (Yunus is 70).

KM Abdul Wadud, Bangladesh Bank's general manager, said another managing director for Grameen Bank will be appointed by Grameen's board with prior approval from Bangladesh Bank.

However, Yunus said he will fight the sacking and remain as its head. The matter is likely headed for the courts.

Grameen and Yunus won a Nobel Peace Prize in 2006 on behalf of their efforts in pioneering micro-loans.

Under microfinancing, banks provide small loans to poor people at rates that are slightly higher than those available at other banks.

The program has been credited with lifting millions of poor Bangladeshis, especially women, out of poverty,

But Yunus has come under fire as well, especially from his own government.

In February, Finance Minister Abul Maal Abdul Muhith said said Yunus should resign for being 'too old.'

Grameen, which is 25-percent controlled by the government, faced criticism last November after a documentary produced in Norway claimed that Yunus’ bank had $100 million of aid money to another enterprise without properly observing procedures established by the donors, which included the Norwegian government.

That led to an investigation by the Bangladeshi government set which is expected to be complete by April.

Bangladesh’s Prime Minister Skeikh Hasina has accused Yunus of using “tricks” to avoid taxes and of “sucking blood from the poor” with his bank's loans. Yunus fell out of favor with Hasina in 2007 when he tried to establish a rival political party.

Yunus defended himself saying he had received no under-the-table benefits from Grameen nor was there any wrongdoing at the bank.

© Copyright IBTimes 2025. All rights reserved.