Banks Should Defer Bonuses 10 Years, Tap Them For Fines: Fed Official

(Reuters) - Banks should defer bonus payments for 10 years and tap the bonus pool to pay any regulatory fines, a top Federal Reserve official said on Monday, taking aim at continued lapses across the industry even after the 2007-9 financial crisis.

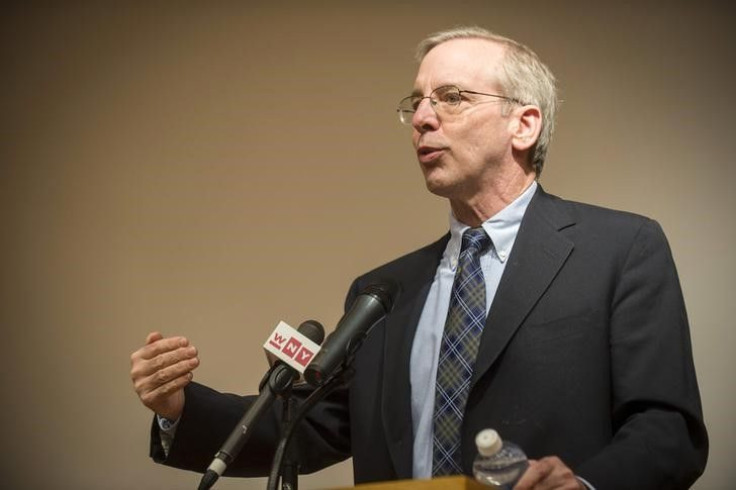

New York Federal Reserve Bank President William Dudley said banks should move toward paying employees in debt securities for their annual incentive pay, rather than in equity.

Dudley's sharp comments came at the end of a one-day conference held by the New York Fed, titled, "Workshop on Reforming Culture and Behavior in the Financial Services Industry."

"How will a firm know if it is making real progress?" Dudley asked in prepared remarks. "Not having to plead guilty to felony charges or being assessed large fines is a good start."

Fed Governor Daniel Tarullo, the Fed's top official overseeing bank supervision and regulation, also gave his view on bank compensation at the closed-door event.

Bankers who increase revenues should not be the only ones rewarded by incentive programs, but those who avoid losses and identify risks should also benefit, Tarullo said in prepared remarks, adding that much more must be done to give bankers proper pay incentives.

"It is important that compensation arrangements, including clawback and forfeiture provisions, cover risks associated with market conduct and consumer protection, as well as credit and market risks," Tarullo said.

Tarullo noted that while U.S. bank regulators do not have the power to criminally prosecute, they can remove bank employees from their companies, positions and even the industry.

CENTRAL REGISTRY

Dudley said that since 2008, fines imposed on the largest banks have far exceeded $100 billion, adding that the industry had largely lost the public trust.

Dudley, who was a partner and managing director at Goldman Sachs before joining the New York Fed in 2007, said the industry's legal woes were not the result of a few bad apples.

"I reject the narrative that the current state of affairs is simply the result of the actions of isolated rogue traders or a few bad actors within these firms," he said.

Dudley said banks should offer longer deferred pay in debt, rather than equity, and added that the bonus pot should be tapped to pay any bank fines so employees would be hit before shareholders.

"Assume instead that a sizeable portion of the fine is now paid for out of the firm’s deferred debt compensation, with only the remaining balance paid for by shareholders," Dudley said. In the event of a fine, "senior management and the material risk-takers would forfeit their performance bond," he said.

Dudley also suggested that there should be a central registry that tracks the hiring and firing of traders and other financial professionals across the industry, which would help prevent constant rule breakers from jumping from firm to firm.

© Copyright Thomson Reuters 2024. All rights reserved.