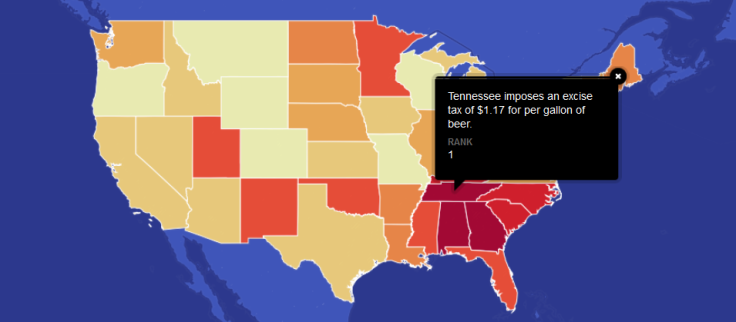

Beer Tax: The Bible Belt, Alaska And Hawaii Impose Highest Taxes On Beer [MAP]

Tennessee, home state of some of America’s most iconic whiskeys, imposes a tax of $1.17 per gallon on beer, more than any other U.S. state, according to data from the Tax Foundation. The lowest state excise tax on beer is in Wyoming -- just 2 cents per gallon.

There isn’t much consistency in the way states and local governments tax beer, according to the Tax Foundation. Rates can include fixed-rate per volume taxes, like the state excise tax, distributor taxes, taxes on beer sold wholesale, retail taxes and so on.

Taxes are also the single most expensive ingredient in beer prices, costing more than labor and raw materials combined, according to the Beer Institute. All taxes combined can amount to as much as 40 percent of the final retail price of beer. As a result, the price consumers pay at their point of purchase can vary greatly.

As for state excise taxes on beer -- they’re the highest in states in the region known as the Bible Belt, and in Alaska and Hawaii.

Here are all the state excise taxes for 2014, mapped. Click on any state to see how much tax the states impose on beer. Drag the map to see the numbers for Alaska and Hawaii.

© Copyright IBTimes 2025. All rights reserved.