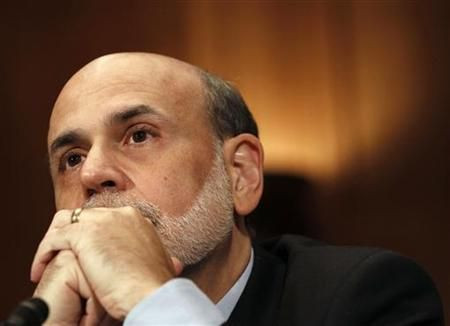

Bernanke Defends Fed From Claims It Is Being Selfish And Hurting Emerging Economies

Federal Reserve Chairman Ben Bernanke on Sunday tried to refute arguments that the U.S. central bank’s aggressive monetary easing has sparked a global “currency war” that risks destabilizing emerging market economies.

Brazil has said U.S. monetary easing to keep interest rates low and weaken the dollar has hurt emerging economies.

“I have been arguing that ‘currency wars’ will only compound the world’s economic difficulties,” Brazilian Finance Minister Guido Mantega said in a statement delivered at the IMF’s annual meeting in Tokyo. “Trying to grasp larger shares of global demand through artificial means has many side effects.”

“It is a selfish policy that weakens the efforts for concerted action,” Mantega added.

Philippine central bank Governor Amando Tetangco told Bloomberg in an interview in Tokyo last week that he is “watchful” of the challenges to monetary policy in emerging markets presented by the Fed’s actions. China also expressed concern at the possible side effects of quantitative easing.

But Bernanke doesn’t think so.

“It is not at all clear that accommodative policies in advanced economies impose net costs on emerging market economies,” Bernanke said Sunday in prepared remarks for a seminar in Tokyo on the last day of International Monetary Fund annual meetings.

The Fed reduced official interest rates to a range of zero to 0.25 percent in December 2008, and last month said that such low levels are “likely to be warranted at least through mid-2015.”

The Fed also initiated a third phase of so-called quantitative easing (QE3) on Sept. 13, purchasing $40 billion of mortgage-backed securities per month, and said this will be continued until there is substantial improvement in labor market conditions.

The Fed has pumped about $2.3 trillion into the U.S. economy to bolster growth. There have also been huge stimulus measures in Europe and Japan.

Opponents contend that such moves has triggered volatile capital inflows into emerging markets, leading to an appreciation of their exchange rates, weighing on trade, and creating threats to financial stability.

On Friday, Mantega warned that Brazil would take "whatever measures it deems necessary" to fight the problem.

"Emerging markets can't passively endure large and volatile capital flows and currency fluctuations caused by rich countries' policies," he said in Tokyo.

“Advanced countries cannot count on exporting their way out of the crisis at the expense of emerging-market economies," Mantega said. "Currency wars will only compound the world's economic difficulties."

Brazil reduced its benchmark rate to a record-low 7.25 percent this month, imposed barriers on capital inflows and purchased dollars in the spot and futures markets to weaken the real and help manufacturers.

In response, Bernanke said that "the linkage between advanced-economy monetary policies and international capital flows is looser than is sometimes asserted."

The Fed's measures not only strengthened the U.S. recovery, Bernanke said, "but by boosting U.S. spending and growth, it has the effect of helping to support the global economy as well."

Bernanke’s comments contrasted with those of IMF Managing Director Christine Lagarde, who told the same audience that such easing is likely to cause large and volatile flows that risk leading to “overheating, asset-price bubbles and the build-up of financial imbalances” in emerging economies.

© Copyright IBTimes 2025. All rights reserved.