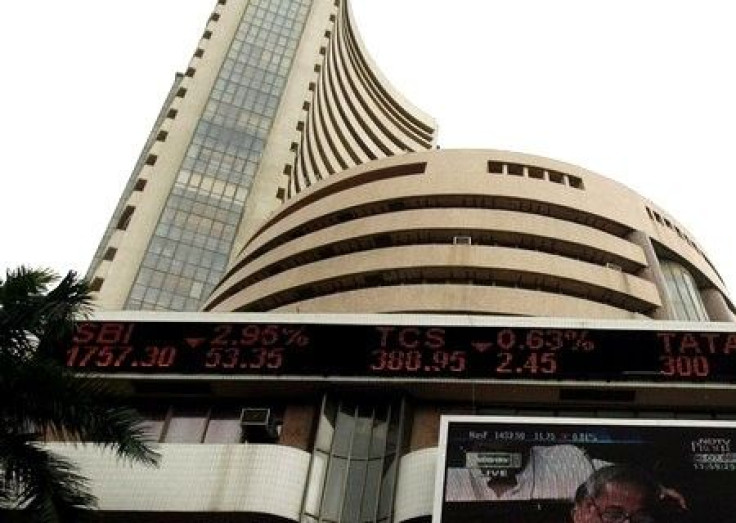

BSE Sensex Falls 0.4 pct, Maruti Slips

The BSE Sensex fell 0.4 percent on Monday as investors turned cautious after four straight sessions of gains, amid weak sentiment in Asian markets, with automakers among the key losers after Maruti Suzuki posted a sharp fall in quarterly profit.

Maruti Suzuki, India's top carmaker, led the decline in shares of automakers, while energy majors Reliance Industries and ONGC, which have risen sharply in the past few sessions, also traded lower.

By 11:20 a.m. (0550 GMT), the main 30-share BSE index was down 0.39 percent to 17,740 points, after opening lower. Twenty-two of its components were trading lower.

The sharp rise we saw last week meant we would get into consolidation mode at some point, said Gajendra Nagpal, chief executive at Unicon Financial Intermediaries.

There is an overall lack of buying in the market. There is no immediate trigger, so we expect the sluggishness to stay, he said.

The index had logged its biggest weekly gain in nearly two months last week, up 6.1 percent, bolstered by hopes of an end to the monetary policy tightening cycle in Asia's third-largest economy.

On Monday, Maruti Suzuki, 54.2-percent owned by Japan's Suzuki Motor Corp, fell as much as 5.9 percent after it reported a more than halving of its quarterly net profit, wider than industry estimates, hit by labour unrest at its key plants and rising interest rates.

Shares in other automakers including Tata Motors, Mahindra and Mahindra and Bajaj Auto also slipped between 1 to 3 percent on worries about growth. The sectoral index was down 1.3 percent.

Reliance Industries, which has the maximum weightage in the main index, fell 1.2 percent. The stock, which has been dogged by concerns over slowing gas output for more than a year, had risen almost 10 percent in October, but is still down 16 percent so far in 2011.

State-run Oil and Natural Gas Corp, which gained nearly 5 percent last week, was also down 2.6 percent.

Software stocks were trading higher after Wipro Ltd, India's No. 3 software services exporter, beat street estimates with a 1 percent increase in quarterly profit and forecast better-than-expected IT services revenue growth.

Wipro shares were trading 2.4 percent higher, while larger rivals Infosys and TCS were up nearly 1 percent each. The sector index was up 0.8 percent.

Shares in India's No 2 lender lender ICICI Bank were trading up 0.1 percent ahead of quarterly earnings later on Monday. The lender is expected to post a 15.8 percent rise in quarterly profit, according to a Reuters poll of brokerages.

The 50-share NSE index was down 0.6 percent at 5,327.10 points.

In the broader market, 695 gainers were slightly ahead of 643 losers on total volume of about 186 million shares.

TOP THREE BY VOLUME

* Lanco Infratech on 13.4 million shares

* Unitech on 7 million shares

* Suzlon Energy on 6.8 million shares

STOCKS ON THE MOVE

* Tata Global Beverages rose 2.5 percent to 91.95 rupees after the world's second-largest tea group posted a 49 percent jump in September-quarter net profit on better performance in overseas markets and price increases from earlier this year.

* Redington (India) rose 2.1 percent to 95 rupees after the technology products distributor said July-September net jumped nearly a quarter to 612.7 million rupees.

© Copyright Thomson Reuters 2024. All rights reserved.