Chesapeake Energy Terminates CEO's Well Ownership Program

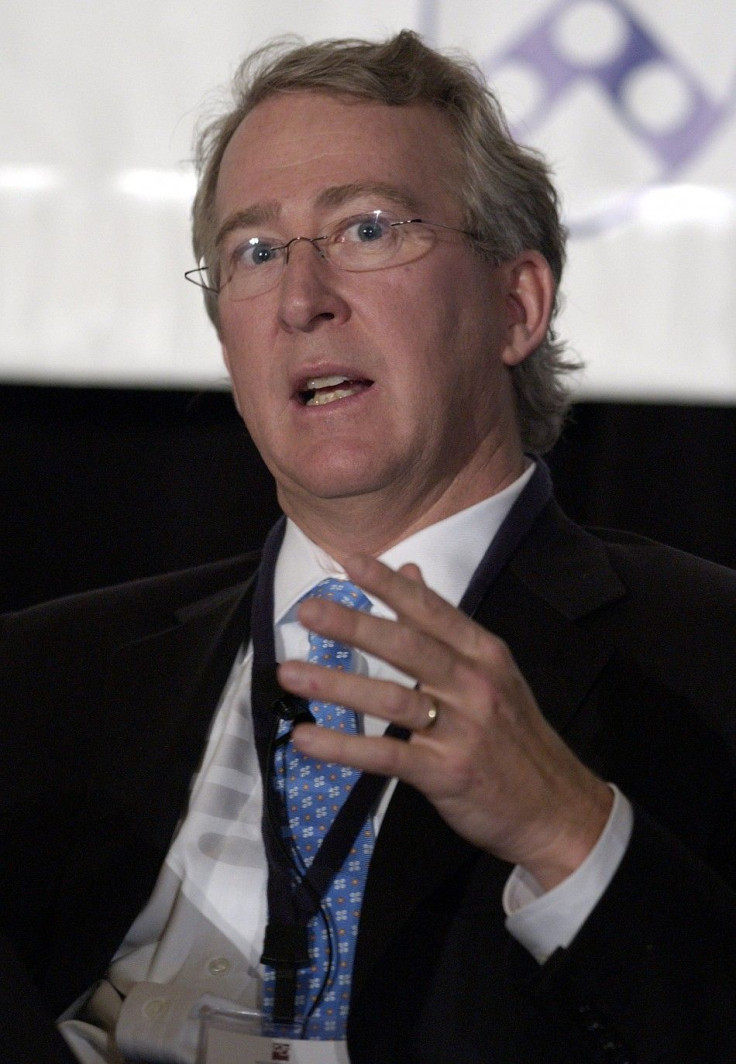

Chesapeake Energy (NYSE: CHK), the second-largest producer of natural gas in the United States after Exxon Mobil (NYSE:XOM), announced on Thursday that it was stopping a controversial program that gave its chief executive officer a stake in the company's wells.

Under the Founder Well Participation Program, Chesapeake CEO Aubrey McClendon could gain a 2.5 percent working interest in any well dug by the company within a calendar year, assuming his partial ownership does not reduce the company's stake to less than 12.5 percent per natural gas well.

But now, that agreement will end as of Dec. 31, 2015, the company said in a statement, after it was revealed that McClendon borrowed more than a billion dollars in loans not disclosed to shareholders.

McClendon has borrowed as much as $1.1 billion against his stake in the wells, but the company's board of directors said it did not review McClendon's transactions, Reuters reported.

The Board of Directors did not review, approve or have knowledge of the specific transactions engaged in by Mr. McClendon or the terms of those transactions, the company said.

McClendon will now disclose information relating to the interests he accrued through the well program, as well as information relating to his financial arrangements with entities through which he participates in the FWPP, as well as any third party that either has or had a relationship with the company, Chesapeake said.

The announcement comes as Chesapeake is scaling back natural gas production due to low natural gas market prices. Earlier in April, it sold billions in assets to cover mounting costs and debt.

The company has been aggressive in acquiring roughly 2.5 million acres through leasing for oil and natural gas drilling over the years and amassing huge debt to do so.

The Board of Directors and Mr. McClendon have committed to negotiate the early termination of the FWPP and the amendment to Mr. McClendon's employment agreement necessary to effectuate the early termination, Chesapeake said.

Shares of Chesapeake rose in New York on Thursday by 11 cents to $18.23.

© Copyright IBTimes 2024. All rights reserved.