Chevron Corporation's (NYSE: CVX) Annual Analyst Meeting In 6 Charts

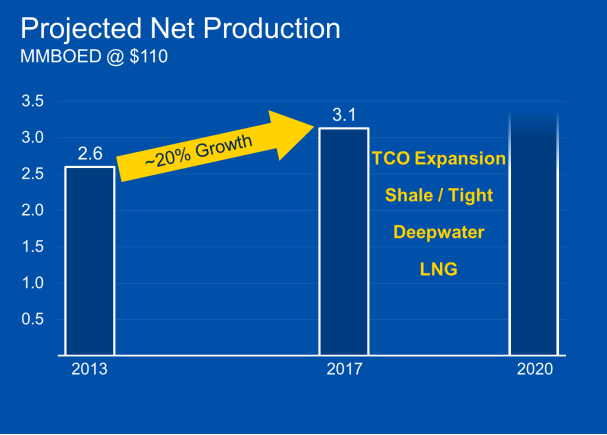

Chevron Corp.'s (NYSE: CVX) Chairman and CEO John Watson unveiled the company's plans to sell $10 billion in assets in the next three years and said it will boost production to 3.1 billion barrels a day in 2017, up from its current rate of 2.6 million barrels a day.

That's a bigger increase than Chevron's closest competitor, ExxonMobil Corp. (NYSE: XOM), is planning, Watson told investors.

"We're selling more assets than originally planned, about $10 billion over the next three years ... mostly upstream," Watson said at the meeting in New York.

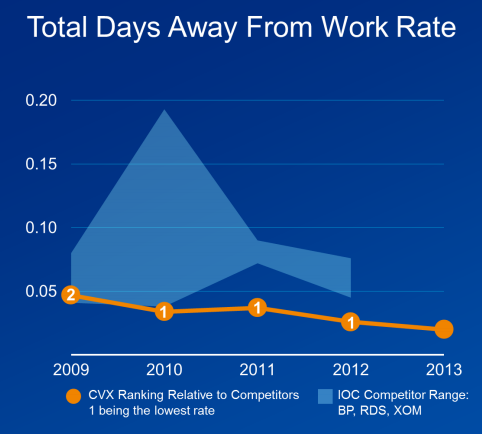

At the beginning of the annual meeting, Watson bragged about Chevron's safety record, which has been the best in the industry for a few years. "We lead the industry in safety," Watson said.

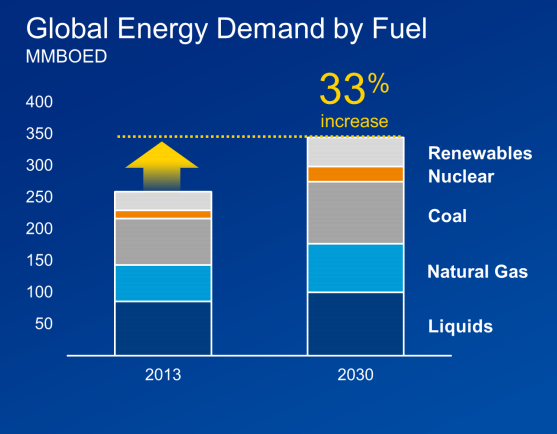

Then Watson moved on to global energy outlook. "By 2030, global energy demand is expected to grow by about a third," he said.

Rising population and incomes are driving the growth. Chevron forecasts that global demand will increase by more than 15 percent for liquids and by about 35 percent for gas.

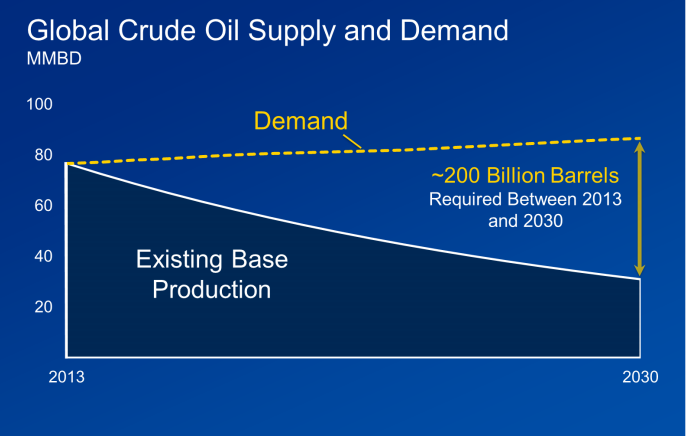

The outlook for oil is not as optimistic. Demand will persist, but "it will require enormous investment in people and capital to meet demand ... about $7 trillion over this period," Watson said. That number could rise to $10 trillion, according to Chevron's estimates.

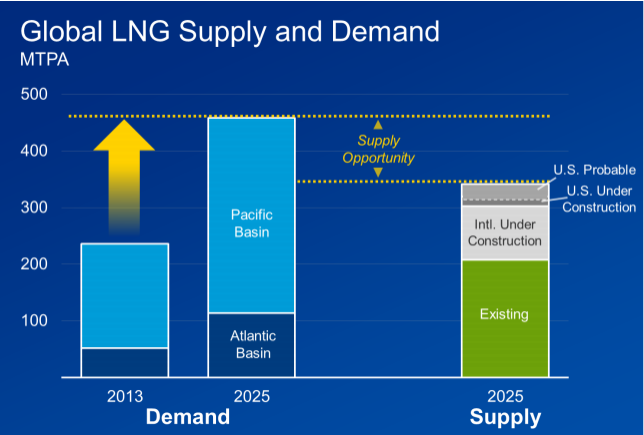

Oil and natural gas is expected to make up nearly half of energy demand going into 2030. Global demand for liquid natural gas (LNG) is expected to nearly double by 2025, requiring more than 100 million tonnes per annum (mtpa).

And finally, Watson discussed the company's earnings. In 2013, Chevron brought in $21.4 billion in earnings, with an 11 percent dividend increase and 12.1 percent year-end debt ratio.

Chevron plans to increase production by 20 percent through 2017 from increased LNG, deepwater and shale or tight oil production, along with an expansion of the Tengizchevroil consortium (TCO), a project near the Caspian Sea with ExxonMobil, the Kazakhstan government and its oil company and Lukoil.

© Copyright IBTimes 2025. All rights reserved.