China’s Shadow Banking: Regulators Unveil New Controls On Banks’ Wealth Management Products

SHANGHAI -- China's getting tough on shadow banks. Its banking regulator on Wednesday unveiled a series of new controls on wealth-management products to increase transparency and reduce risk.

Shadow banking can take many forms, including loan sharks, investment companies known as trusts, and off-balance-sheet lending by regular banks. The most important of the latter are “wealth-management products,” which are considered potentially dangerous. The new regulations target wealth-management products: short-term investments generally distributed by banks but that mostly don’t sit on their balance sheets.

In a notice dated March 25, but publicly unveiled Wednesday, the China Banking Regulatory Commission said banks must clearly link wealth-management products with the assets that proceeds are invested in.

For already-issued products with assets that don't meet the new standards, banks should take provisions for losses by the end of this year, the regulatory commission said. Banks are now prohibited from investing more than 35 percent of the total proceeds from the sale of wealth-management products, or no more than four percent of their total assets, whichever is lower, in products such as trust loans.

“This is so far the harshest and most concrete tightening measures regarding [wealth-management products],” Societe Generale's Wei Yao said in a note to clients. “The purpose of this set of policy from the [China Banking Regulatory Commission] is not to devastate banks, but to cap future risk.”

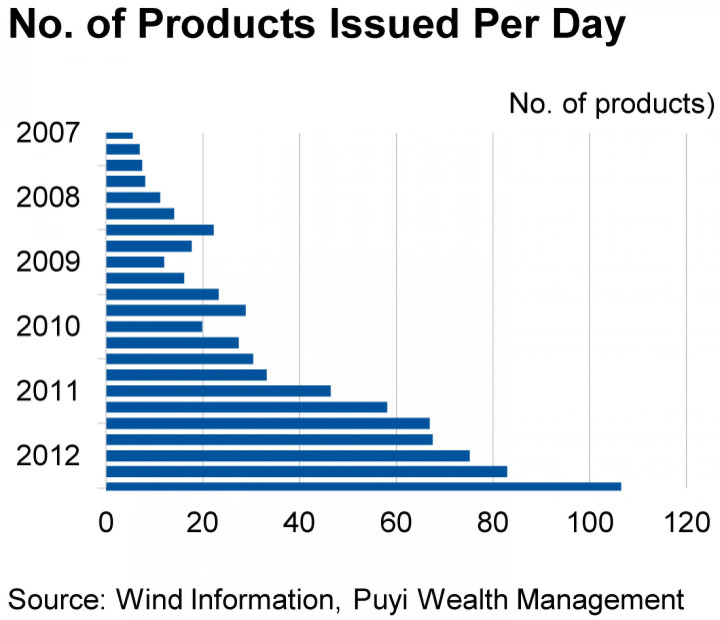

According to the regulator, the total of outstanding wealth-management products reached 7.6 trillion yuan ($1.21 trillion) at the end of 2012, up 66 percent from a year ago and from less than one trillion in 2009. Yao estimates that no less than 30 percent of wealth-management products are put into nonexchange traded instruments, or broadly speaking, shadow-banking financing.

“Implementation of the new rules is likely to kill two birds with one stone, capping growth of risky [wealth-management products] as well as limiting future funding to the shadow-banking system,” Yao said.

Xiao Gang, chairman of Bank of China (SHA:601988), one of the top four state-owned banks, said in an October op-ed published in the English-language China Daily that the shadow-banking sector was a potential source of systemic financial risk over the next few years.

The quality and transparency of wealth-management products was “worrisome,” he said, adding many assets underlying the products were dependent on real estate or long-term infrastructure projects that might find it impossible to generate sufficient cash flow to meet repayment obligations.

"To some extent, this is fundamentally a Ponzi scheme,” Xiao added.

It has attracted headlines after the default of a wealth-management product offered by Hua Xia Bank, an incident that is under investigation by police and regulators. Local media reported proceeds from the product, which offered a yield of 11 percent, were invested in a pawn shop that closed down.

More than 100 wealth-management-related products are debuting on a daily basis, rolled out by Chinese banks, according to Fitch Ratings. Banks under pressure to post strong deposit growth are counting a growing share of these investment funds as savings deposits, something that wasn’t previously done, Fitch said.

© Copyright IBTimes 2024. All rights reserved.