Coffee Saw Investor Interest Return, In Record 2013 ETP Inflows

Inflows into coffee investment funds known as exchange-traded products (ETPs) hit a new record in 2013, as $203 million flowed into such funds, according to an ETF Securities report on Tuesday.

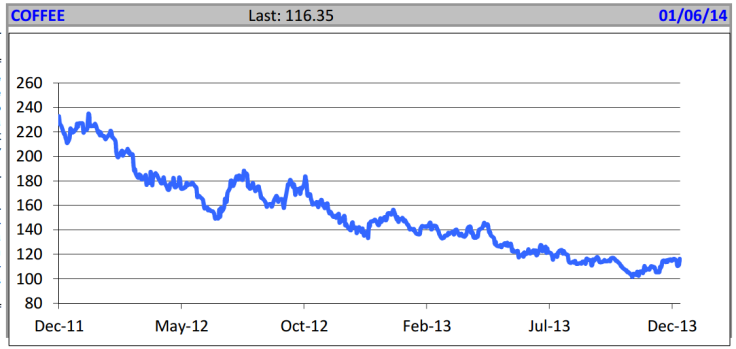

With inflows almost doubling the 2012 level, investors may have positioned themselves for a rebound from historically low coffee bean prices, which reached seven-year lows for Arabica beans in 2013.

The surprise finding tracks data that goes back several years, as commodity ETPs first started gaining popularity in 2003. Exchange-traded products allow investors to track the price of an asset without obtaining the asset itself, a benefit for physically burdensome products like agricultural commodities and gold.

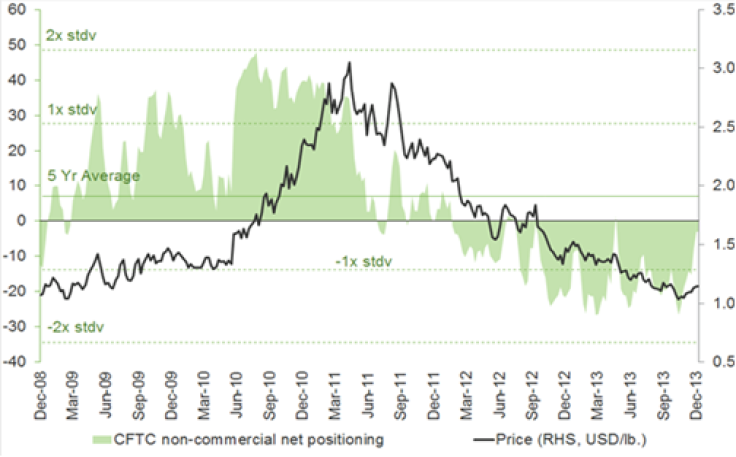

Many traders started betting that coffee prices would continue to fall, as they reached severe lows in 2013, said ETF Securities investment strategist Nick Brooks to IBTimes. They built extreme positions in the coffee futures market, globally worth more than $15 billion.

“Very large short positions were built in coffee futures,” said Brooks. “For many investors with slightly longer time horizons, anywhere from 3 months to 12 months, this has been looked at as a good opportunity for accumulation.”

Any negative news for crop supplies could mean that those betting against coffee, by shorting the product, could be forced to cover their bets, resulting in a short-term rally.

“Gauging the timing of a rally is always difficult, but I think many investors view the Arabica coffee price at these levels as very cheap and view the positioning as extreme,” continued Brooks.

Coffee for March delivery on New York’s NYMEX exchange opened at $1.21 per pound on Tuesday. Coffee should trade from $1.09 to $1.25 per pound in January, after modest gains in December, according to commodities analyst Edward Meir of INTL FCStone.

But Arabica coffee beans, which are largely produced in Brazil, fell 23 percent in price in 2013. Robusta, a somewhat less popular coffee bean from Vietnam, among other places, fell 14 percent on a record Vietnamese crop of 28.5 million bags.

“As prices approach – and likely break – the $1 mark, there will be a much-needed rethink on the part of governments and farmers as to whether the economics of planting even more coffee is worth it,” Meir wrote in a report on Monday.

Other commodities traders have seen low coffee prices in 2014 as a buying opportunity, given strong global demand.

Market bears, however, point to expected bumper harvests in Brazil and Colombia as boosting supply and lowering prices. Brazil could produce 51 million to 60 million bags in the 2014-2015 crop, with harvest season starting in July, according to Bloomberg.

Coffee in 2013 capped off three straight years of price declines, in the longest continuous fall since 1993, reported Bloomberg earlier.

Some 144.6 million bags of coffee beans were produced in 2012 to 2013, according to the International Coffee Organization, more than in the prior two years. A bag of coffee weighs 132 pounds. 150.5 million bags could be produced globally for 2013-2014, meaning that production outpaces consumption, according to a December USDA report.

Lower coffee bean prices rarely translate to cheaper lattes at Starbucks Corporation (NASDAQ:SBUX) or in supermarkets, however. Coffee companies tend to keep consumer prices steady while passing themselves savings from commodity price fluctuations. Starbucks told IBTimes in October 2013 that it forecast $100 million of savings in lower commodity costs for fiscal 2013.

ssets managed by coffee ETPs were at $111 million in 2012, and stood at $234 million in 2013, so investor interest in such products more than doubled, according to ETF Securities data. Popular products in the field include the Dow Jones-UBS Coffee ETN and the Pure Beta Coffee ETN.

© Copyright IBTimes 2024. All rights reserved.