Company Linked To Alibaba Investigated By Regulators, Denies Responsibility For China’s Recent Stock Market Crash

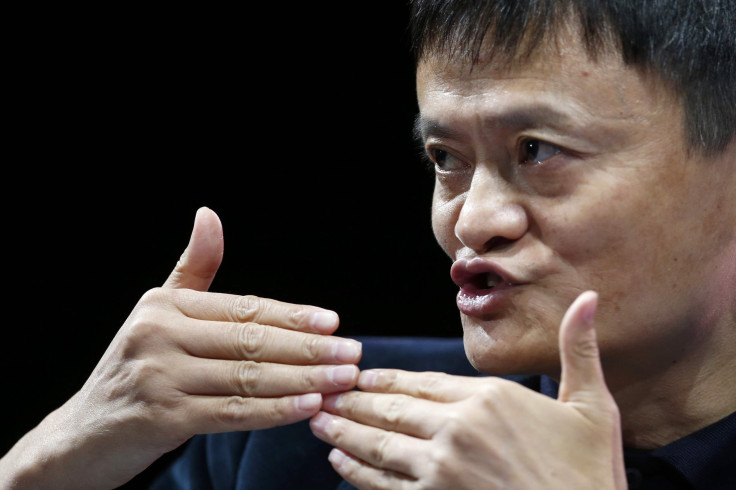

SHANGHAI -- A financial information company part-owned by Chinese Internet giant Alibaba Group’s founder Jack Ma has denied responsibility for the recent crash on the Chinese stock market, after regulators visited its offices as part of investigations into the recent volatility.

Chinese media reports had suggested that a trading platform provided by Hangzhou-based Hundsun Technologies had helped unofficial lending companies to loan significant sums of ‘gray-market’ money to investors, who then put these funds into the stock market.

Such unregulated margin financing -- as this type of borrowing is known -- has been blamed in some quarters for the spectacular falls on China’s stock markets -- which plummeted more than 30 percent between mid-June and early July. Analysts say one of the reasons for the rapid decline was the fact that investors who had borrowed large sums found themselves having to sell off shares to repay loans, leading to downward pressure on the value of stocks.

However a statement from Hundsun on Monday said it was “unfair and irrational” to blame its cloud-based HOMS platform, originally designed for private equity funds, for the market turmoil. The company said that only 0.1 percent of total stock market transactions on China’s stock market over the previous four weeks were accounted for by such ‘forced selling’ using the HOMS platform, state media reported.

Alibaba's Ma, who along with a colleague spent over half a billion dollars to buy a stake of “more than 20 percent” in Hundsun last year, also wrote on his personal blog on Monday that he was “astonished to hear that… Jack Ma crashed China’s stock market,” according to a report by Bloomberg News.

China’s stock market regulator has previously acknowledged that HOMS transactions only accounted for a small percentage of the total -- but some Chinese media commentators have blamed the system for causing the crash.

And as the inquest begins into a fall that wiped some $3 trillion off share values in less than a month, some Chinese citizens have been quick to point fingers. Last week online rumors circulated blaming manipulation of share prices by foreign speculators, while China’s police ministry said at the weekend that it was investigating suspicious transactions by domestic securities houses.

However many analysts, both in China and abroad, have said a correction at some point was inevitable, after the market rose more than 150 percent in the year to mid-June. Yet with ordinary retail investors accounting for more than 80 percent of transactions on the market, the Chinese government has clearly felt it cannot afford a complete collapse in the value of shares, and has intervened heavily to prop up the market.

Following tens of billions of dollars of government-sanctioned share purchases, and pledges by brokerages, state firms and other large investors not to sell their holdings in the immediate future, the value of China’s main index rebounded by more than 12 percent between last Thursday and the close of trading on Monday. On Tuesday it closed slightly down, by 1.16 percent, as some investors sought to capitalize on rebounding values. China’s secondary board and high-tech board in Shenzhen continued to rise, however, closing up almost 1.4 percent, and 1.6 percent, respectively. Hong Kong’s Hang Seng Index was down 0.72 percent after rising for the previous three trading days.

Some observers have however predicted more volatility later this week, with settlement of Chinese A share index futures due on Friday, according to the South China Morning Post. And trading in hundreds of Chinese listed companies remains suspended, after they asked for it to be halted last week, in an attempt to avoid the market volatility. This has led to some concerns that further falls in the value of these companies' shares, once trading in them resumes, could add to market instability.

© Copyright IBTimes 2024. All rights reserved.