Danaher To Buy Nobel Biocare Holding For $2.2B Including Debt

(Reuters) - U.S. healthcare conglomerate Danaher Corp said it will buy Nobel Biocare Holding AG NOBN.S in an all-cash deal valued at about $2.2 billion, including debt, to widen its market presence in the global dental industry.

Danaher said it will offer 17.10 Swiss francs per Nobel Biocare share, representing a 7 percent premium to the current 60 day volume weighted average (VWAP) share price and a 28 percent VWAP premium before July 29, when Nobel Biocare said it was in early stage talks over a potential sale.

Shares in Nobel Biocare closed up at 18.10 francs on Friday.

The deal, which has been recommended by Nobel Biocare's board of directors, is expected to be completed in late 2014 or early 2015.

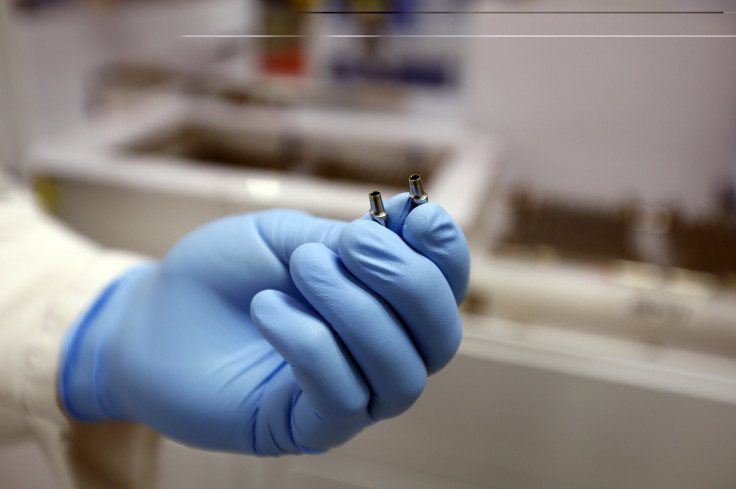

The Nobel Biocare deal brings Danaher a premium range of dental implants to add to its orthodontics, digital imaging systems, impression and bonding materials.

Danaher said the acquisition of the world's second-biggest dental implant maker would make it the largest consumable and equipment player in the dental industry with sales approaching $3 billion.

It said Nobel Biocare would continue to operate as a standalone company and maintain its own brand and identity.

Mergers among medical supplies makers have picked up this year, with Medtronic Inc snapping up Covidien, while Zimmer Holdings Inc agreed to acquire Biomet Inc in April for more than $13 billion.

Analysts had cited other dental implant players such as Henry Schein and Dentsply as possible acquirers of Nobel Biocare, while the company had reportedly also attracted interest from buyout group EQT Partners.

Nobel Biocare was advised by Goldman Sachs.

© Copyright IBTimes 2025. All rights reserved.