Dark Pool Trading: What You Don't Know Can Hurt You

Their names sound cool and traders love them, but authorities are cracking down on dark pool trading stock trading venues to protect unwitting clients.

Brokers have been severing ties to Barclays LX, a dark pool run by U.K. bank Barclays PLC (LN:BARC), after the New York Attorney General Eric Schneiderman accused the bank of fraudulently portraying the business as safe, when really they were subject to “predatory” and “toxic” trades.

“The lawsuit filed today charges that Barclays grew its dark pool into one of the largest in the United States by telling investors they were diving into safe waters,” Schneiderman told reporters. “In fact, Barclays’ dark pool was full of predators who were there at Barclays’ invitation.”

These mysterious, off-market trading venues can be a blessing and a curse. A lack of transparency helps savvy traders make big deals without affecting the market, but the pools also put unwitting investors at a disadvantage.

In a traditional public exchange like the New York Stock Exchange (NYSE:ICE) or NASDAQ (NADAQ:NDAQ), buyers and sellers make offers on shares that are matched by computers. All participants can see all pending offers and the transaction results are posted immediately.

Dark pools were created to help institutions trade large blocks of stock without the buy and sell offers being visible. That allowed traders to avoid revealing their terms until the deal was finished. For instance, if a broker wanted to sell 20 percent of a company on a traditional exchange, referred to in the trade as “lit markets,” others would see the terms and could act on the information and presumably drive down the share price and cost the seller money. In dark pools, the sale price is posted only after trade happens, which has little influence on the price.

Traditional markets have also become targets of so-called high-frequency traders, who use incredibly fast technology to view the various offers to buy and sell there and are able to trade in milliseconds to their own advantage.

“Big firms are moving their orders away from “lit” markets because they’re concerned about gaming on the exchange by high-speed firms,” wrote Scott Paterson, Wall Street Journal reporter and author of “Dark Pools: High-Speed Traders, A.I Bandits, and the Threat to the Global Financial System” in a Reddit AMA last year.

These days, more than 40 percent of trades happen “off exchange,” up from just 16 percent six years ago, according to Reuters.

That's good for insiders in the trading world but makes it hard for outsiders to get an accurate picture of individual stocks' market demand. Dark pool clients are also ripe for predatory trading practices by high-frequency firms, some of which are given access by pool operators.

As one Wall Street executive told International Business Times in March, “If I’m being screwed, why am I in this pool?”

Soon after the Barclays' news broke major broker-dealers like Deutsche Bank and the Royal Bank of Canada cut their ties to Barclays LX. But Barclays isn’t the only dark pool that’s causing concern.

Even before Michael Lewis published his recent book “Flash Boys,” which highlights the rise of high-speed trading and dark pools, authorities were investigating whether or not these secret trades were affecting the traditional markets like NASDAQ and the NYSE.

In April, Schneiderman unveiled plans to investigate brokerage firms as part of an initiative he dubbed “insider trading 2.0.” And, earlier this month SEC Chair Mary Jo White said she would investigate whether dark pool trading, “risks seriously undermining” the quality of the U.S. market.

“The most important thing she said is, there was evidence that price formation in the lit markets was impacted by the amount of dark trading,” said Robert Greifeld, chief executive of NASDAQ OMX Group Inc., during a Q&A after the speech, according to the Wall Street Journal.

Weeks later the Securities and Exchange Commission fined dark pool operator Liquidnet Holdings $2 million for violating regulations and allowing an independent business unit access to trade data.

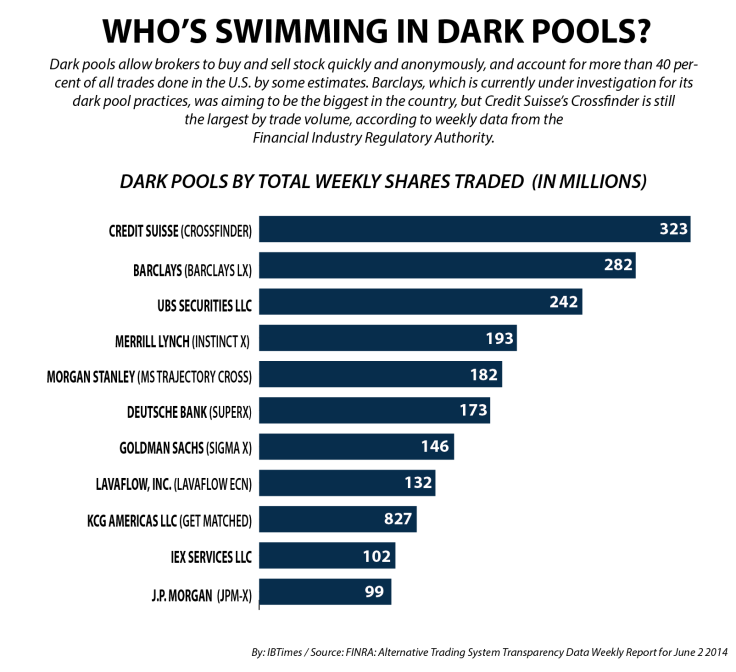

Before brokers started pulling out on Thursday, Barclays had one of the biggest dark pools in the country by volume, with more than 1.7 million trades last week, topped only by Credit Suisse Securities pool, called Crossfinder, which saw 2 million trades, according to the Financial Industry Regulatory Authority, which started publishing this data only a few weeks ago.

Bank of America Corp.'s (NYSE:BAC) Merrill Lynch, Deutsche Bank (NYSE:DB), Goldman Sachs Group (NYSE:GS) and J.P. Morgan Chae & Co. (NYSE:JPM) also operate large dark pools.

© Copyright IBTimes 2025. All rights reserved.