Dow Jones Industrial Average, S&P 500 Sink As Viacom Inc (VIAB), Walt Disney Co (DIS) And CBS Corporation (CBS) Sink

U.S. stocks traded sharply lower Thursday, with the Dow Jones Industrial Average dropping more than 100 points, as media stocks sank on mixed corporate earnings. Market professionals also analyzed the number Americans filing new claims for unemployment benefits ahead of Friday's jobs report, which could provide more clues as to the timing of the Federal Reserve's inevitable hike in interest rates.

The Dow Jones Industrial Average (INDEXDJX:.DJI) dropped 109.28 points, or 0.62 percent, to 17,431.19. The S&P 500 index (INDEXSP:.INX) fell 15.81 points, or 0.76 percent, to 2,083.94. And the Nasdaq composite (INDEXNASDAQ:.IXIC) lost 77.55 points, or 1.53 percent, to 5,060.69.

Nine of the 10 S&P 500 sectors traded lower, led by a more than 1 percent decline in consumer discretionary due to a drop in media stocks. The financial sector was the only gainer, up just 0.8 percent.

Dow component Walt Disney Co. (NYSE:DIS) continued to decline Thursday, dropping 4 percent after the company missed revenue estimates and cut its outlook for profits in the cable business this week. Energy giants Exxon Mobil Corporation (NYSE:XOM) and Chevron Corporation (NYSE:CVX) were the biggest gainers in the index, up 1 percent and 0.5 percent, respectively.

Meanwhile, shares of Viacom Inc. (NASDAQ:VIAB), which operates popular TV properties including MTV and Comedy Central, tumbled 19 percent to a 52-week low of $41.80 after the company missed Wall Street revenue forecasts.

CBS Corporation (NYSE:CBS) also saw its stock drop, down 3 percent, after the company saw its advertising sales tumble drop 3 percent from a year ago.

Shares of Planet Fitness Inc. (NYSE:PLNT) dropped as much as 14 percent after the company made its market debut on the New York Stock Exchange, valuing the fitness club operator at more than $1 billion. Shares were priced at $16, the top end of the expected range of $14-$16, but fell as a low as $13.75 in morning trading.

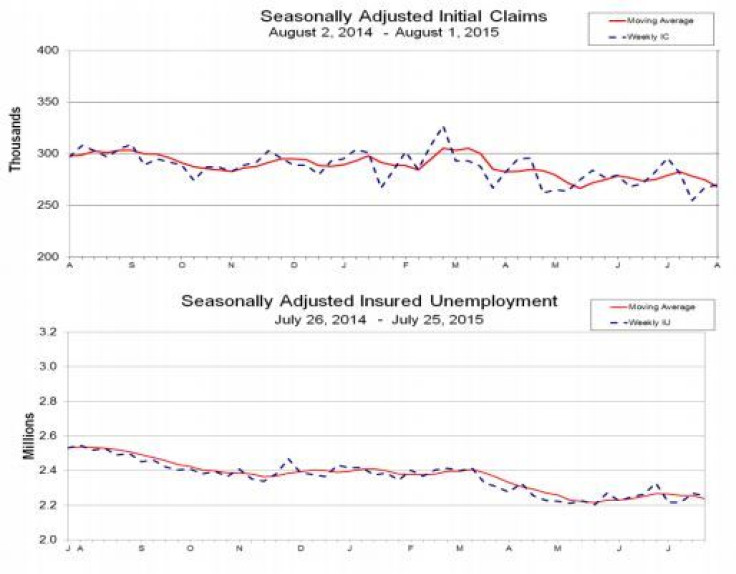

The number of Americans filing new claims for unemployment rose less than expected last week as U.S. jobless claims increased 3,000 to a seasonally adjusted 270,000 for the week ended August 1, the Labor Department said Thursday. Economists had forecast jobless claims would rise last week by 6,000 to 273,000, according to analysts polled by Thomson Reuters.

Initial claims for unemployment insurance have been below 300,000 for 22 straight weeks, the longest such stretch since 1973. Claims below the 300,000 threshold is considered to be a mark of a strengthening labor market.

The data comes ahead of Friday’s highly-anticipated employment report for July. PNC is forecasting net job growth of 210,000 for July (205,000 in the private sector) and expects that the unemployment rate held steady at 5.3 percent.

Job growth has averaged 208,000 per month in the first half of 2015, down somewhat from an average of 246,000 in all of 2014. However, economists say the pace is more than enough to keep up with underlying growth in the labor force. “The job market continues to absorb the slack remaining from the Great Recession,” Gus Faucher, senior macroeconomist at PNC, said in a research note Thursday.

© Copyright IBTimes 2024. All rights reserved.