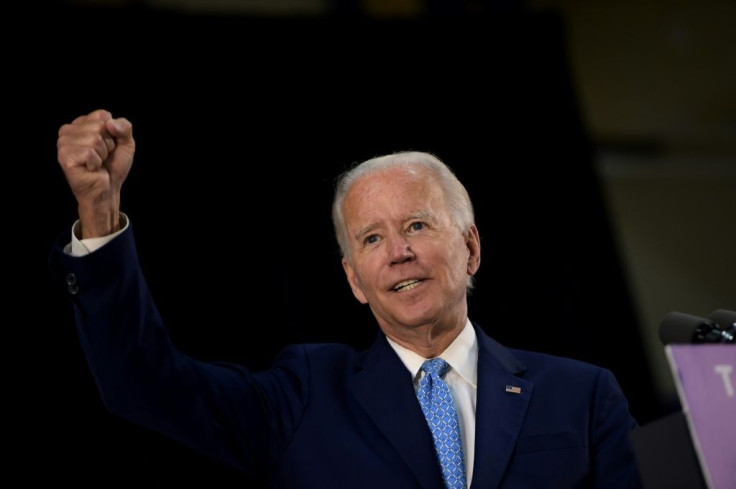

Elections 2020: As Biden's Star Rises, Investors Watch Nervously

KEY POINTS

- Goldman Sachs expects its S&P 500 2021 EPS forecast down from $170 to $150 if Biden wins in November

- 60% in RBC Capital Markets poll feel a Biden win would be bearish or very bearish for equities

- Analysts say Biden's plan to raise taxes behind market discontent

- S&P 500 is down 0.19% year to date

- Real Clear Politics national average of polls shows Biden leading Trump by 8.6 points

The improving prospects of Democratic presidential hopeful Joe Biden in the run-up to the November elections is setting off alarm bells among analysts and investors, who see the former vice-president's plan to raise taxes as damaging to corporate profits and markets.

Biden's chances are looking brighter as a surge in coronavirus infections threatens to push the economy back to the brink and raise discontentment about President Trump's handling of the pandemic fightback. FiveThirtyEight's national polling average shows Trump's disapproval rating at 55.5%, against a 40.5 approval rating. The disapproval number is up from 49.7 just in April and comes as election day comes closer.

Polls now indicate the former vice president is poised to win back the key battleground states Michigan, Wisconsin and Pennsylvania, where Trump had posted surprising wins in 2016. A Real Clear Politics national average of polls shows Biden leading Trump by 8.6 points Monday.

Biden's unpopularity with investors stems mainly from his proposals to raise taxes, analysts say. The Democratic presidential nominee has indicated that he would raise the corporate tax rate from 21% to 28% if elected. That would effectively roll back Trump’s hallmark tax reform that lowered corporate taxes from 35% to 21% and fueled corporate profits amid the trade war the president started with China and a choppy economy.

Goldman Sachs estimated that even a partial reversal of Trump's tax cut would slash about 12% off its total 2021 earnings-per-share estimates for the S&P 500. It estimates its 2021 earnings-per-share forecast for the S&P 500 to slide from $170 to $150 if Biden wins the race for the White House.

The former vice president has proposed a slew of other tax changes, including raising individual income taxes on high-income individuals with income above $400,000. Biden's tax plan would reduce U.S. GDP by 1.5% over the long term, says the Tax Foundation, a Washington, D.C.-based think tank.

Interestingly, the CNBC recently cited a Bank of America study that showed that since 1951, a Democrat win has caused the S&P 500 to underperform over the three months following the election.

Many wealthy investors remain unconvinced about continuing to add risk in stocks considering the rising coronavirus cases and support for Biden, the CNBC reported.

The S&P 500 rose 9.16 points, or 0.28%, Friday (July 17) to close at 3,224.73, up 1.2% for the week.

While a majority of the respondents in an RBC Capital Markets client survey held in the last week of June said a Trump win would be bullish or very bullish for stocks, 60% said a Biden victory would be bearish or very bearish for equities. Interestingly, just 24% held the same opinion in December last year, reported the CNBC. Of those polled, 73% cited the election as being the main cause for worry about their economic future, followed by 68% citing the second wave of COVID-19 cases, and 63% another string of layoffs.

The stock market has accurately predicted the outcome of every U.S. presidential election since 1984, LPL Financial, an independent brokerage, wrote in its blog last month. "When the S&P 500 has been higher the three months before the election, the incumbent party usually won while when the stocks were lower, the incumbent party usually lost," it said.

The S&P 500 index has slipped 0.19% year to date as of the close of trading Friday.

LPL Senior Market Strategist Ryan Detrick was quoted in the company's blog as saying: "Think about it; no one expected Hillary Clinton to lose back in 2016, no one except the stock market that is. The Dow had a 9-day losing streak directly ahead of the election, while copper (more of a President Trump infrastructure play) was up a record 14 days in a row, setting the stage for the change in party leadership in the White House."

© Copyright IBTimes 2024. All rights reserved.