Euro Area Unemployment Falls To 3-Year Low; Markets Extend Losses After Weak China Data

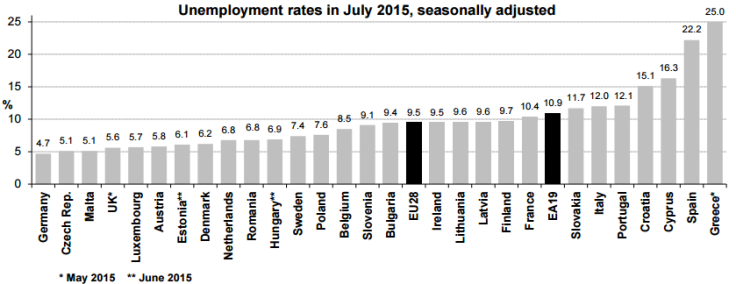

Unemployment in the eurozone fell to its lowest level in over three years, even as the region’s stock markets continued to reflect the global turmoil caused by economic troubles in China. According to data released Tuesday by Eurostat -- the European Union’s statistics office in Luxembourg -- the seasonally adjusted unemployment rate for the 19-nation bloc was 10.9 percent in July, falling below 11 percent for the first time since February 2012.

However, within the eurozone, huge disparities continue to exist -- with Germany having a record low rate of 4.7 percent and Greece -- which narrowly avoided the much dreaded “Grexit” in July --reporting a 25 percent unemployment rate.

Also released on Tuesday, the U.K. manufacturing purchasing managers’ index (PMI) for the month of August showed a decline of 0.4 points -- to 51.5 from 51.9 in July -- meaning British factories slowed down in the month.

“Export order volumes continue to disappoint, with the sterling exchange rate, weak sales growth to the eurozone and the slowdown in China all having an impact,” Rob Dobson from the survey compiler Markit said, in a statement.

Following the announcement, the pound slipped by half a cent against the U.S. dollar to $1.5339.

The latest figures come after a month of volatile trade in European bourses and just days before the European Central Bank (ECB) is due to hold a crucial meeting in Frankfurt.

Reports suggest that the ECB might extend its 1.1 trillion-euro ($1.2 trillion) stimulus program, which has been in place for the past six months, in an attempt to boost the bloc’s modest recovery. The program, which entails the ECB and national central banks of the 19 eurozone nations buying 60 billion euros ($67 billion) of government and corporate bonds every month, is currently scheduled to stay in place until September 2016.

During the meeting, ECB policymakers are also expected to discuss the region’s tepid economic growth -- the eurozone grew at a less-than-expected quarterly rate of 0.3 percent in the April-June period -- and the impact of China’s economic slowdown on European markets, which on Tuesday, continued to extend losses after the Asian nation’s weak PMI figures.

The pan-European STOXX 600 traded 2.2 percent lower in mid-morning trade Tuesday after tumbling nearly 3 percent at the open. London’s FTSE 100 was down 2.1 percent, Germany’s DAX was 2.3 percent in the red and France’s CAC 40 was trading down 2 percent.

U.S. markets are also expected to open in the red Tuesday, with the main stock index futures, including the Dow Jones and S&P 500, down by about 2 percent at 7.15 a.m. EDT.

© Copyright IBTimes 2025. All rights reserved.