Euro Zone PMI Services Index Illustrates A European Divergence: Markit

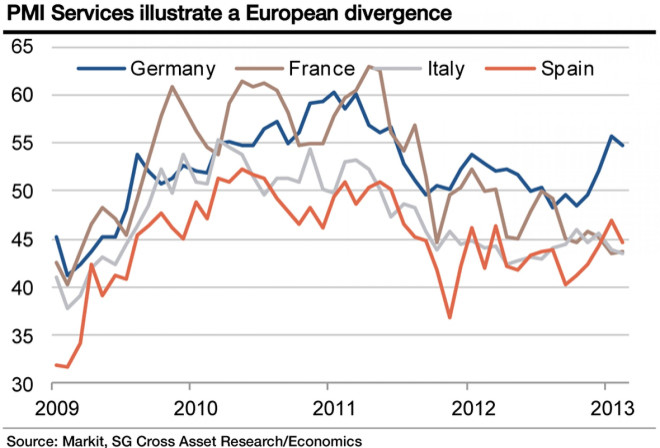

Private business activity in the euro zone in February was not as bad as first feared, but the divergence between France, Spain, Italy and prosperous Germany widened again, a key business survey showed Tuesday.

The Purchasing Managers' Composite Index published by London-based Markit stood at a revised 47.9 in February, up from the initial reading of 47.3 but still well down from 48.6 in January and further away from the break-even mark of 50.

The final release of the euro zone PMI survey for February seemed to confirm that gross domestic product in the single currency bloc is still contracting. At this level, the index appears consistent with quarterly falls in euro zone GDP of about 0.2 percent after fourth-quarter’s 0.6 percent decline, according to Capital Economics economist Jennifer McKeown.

The only growth in the region seems to be coming from Germany, where the PMI was unrevised at 52.7 -- below January’s reading but still above the no change level of 50. But despite a small upward revision, the French index appears consistent with worryingly sharp quarterly falls in GDP of up to 1.0 percent. The first releases for Italy and Spain revealed renewed falls in both PMIs, also pointing to continued recessions.

The divergence between Germany and France so far this year is the widest in the 15-year survey history. Germany is on course to see the strongest quarterly growth since the spring of 2011, but France is contracting at the fastest rate for four years.

“The deteriorating picture in the periphery is also a concern,” said Chris Williamson, chief economist at Markit, in a statement.

Looking at the peripheral countries, rates of decline picked up in Italy and Spain, with further weakness likely in Italy especially in the coming months due to the uncertainty caused by the elections.

The Italian Services PMI fell slightly from 43.9 to 43.6 and remains well below the 50 threshold.

“It should be noted that the survey was conducted during the first half of February and, therefore, does not reflect the recent political uncertainty generated by the parliamentary elections,” Anatoli Annenkov, an economist with Societe Generale Global Economics in London, said.

In Spain, the service sector contracted on the back of a substantial fall in new orders in February.

While further signs that the downturn in the euro zone is slowing come as a relief, McKeown believes that with activity remaining very weak, particularly outside Germany, the European Central Bank will remain under pressure to implement further support policies this week and beyond.

© Copyright IBTimes 2025. All rights reserved.