Fake ATM Card Readers And Keypads Help Thieves Steal Info

Your next trip to the ATM could be a score for thieves, and you won’t even know it.

At 10 p.m. on Tuesday night, police arrested two men at a Chase bank ATM in New York's Brooklyn borough on charges of burglary, criminal possession of a forgery device and criminal possession of a skimmer device.

The duo had been hitting ATMs around the city, stealing card data and PINs. Their victims had no idea.

Skimming devices have been found in large banks and bodega ATMs. All it takes is a quick setup, and thieves wait for data to come in.

“To the untrained eye, they’re very difficult to spot, especially in low-lit area,” said Detective Robert Cimino of the police’s financial crimes task force to The New York Times.

Usually they’re installed for just a few hours and removed quickly. The criminals then put the stolen information onto blank cards which they can use to make withdrawals.

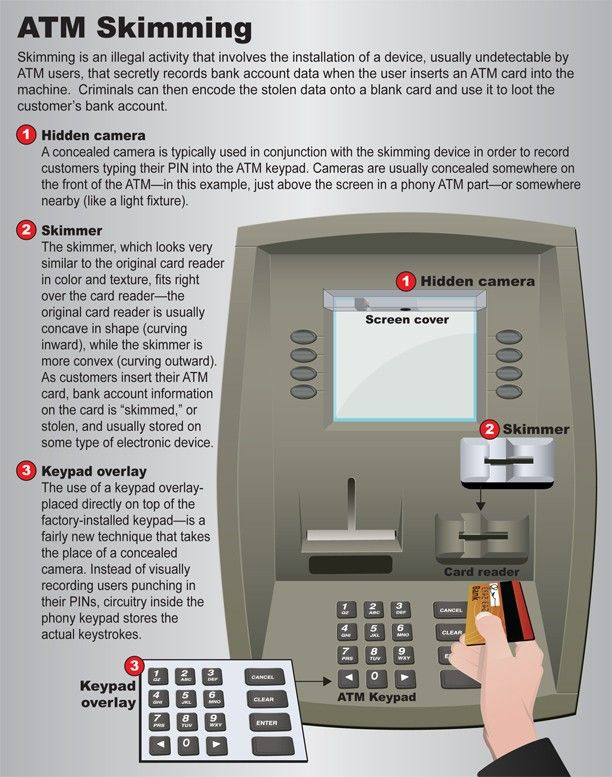

Skimmers are placed over the real card slot in an ATM. When a customer slides their card in, the device scans and stores all the information from the magnetic strip.

Then, hidden cameras placed above the number pad record customers’ personal identification number (PIN.) Sometimes, covers are placed over keypads that can record which numbers are pressed.

It’s a relatively simple method, which makes it popular.

In February, two organizers for a group of skimmers were sentenced to several years in prison after stealing more than $300,000 from 300 checking accounts, according to The Wall Street Journal.

In 2011, a Bulgarian citizen was sentenced in Manhattan to 21 months in prison after stealing $1.8 million from at least 1,400 bank accounts between December 2007 and June 2009, according to the FBI.

Customers should keep an eye open for anything crooked or damaged before using an ATM, and be especially aware of ATMs in tourist areas, which are popular targets.

It can happen with any ATM, even at bigger banks. But machines that are indoors are less-likely to be hit, as the scammers would have more difficulty moving in and out.

© Copyright IBTimes 2024. All rights reserved.