Fed Minutes Suggest Further Easing More Likely

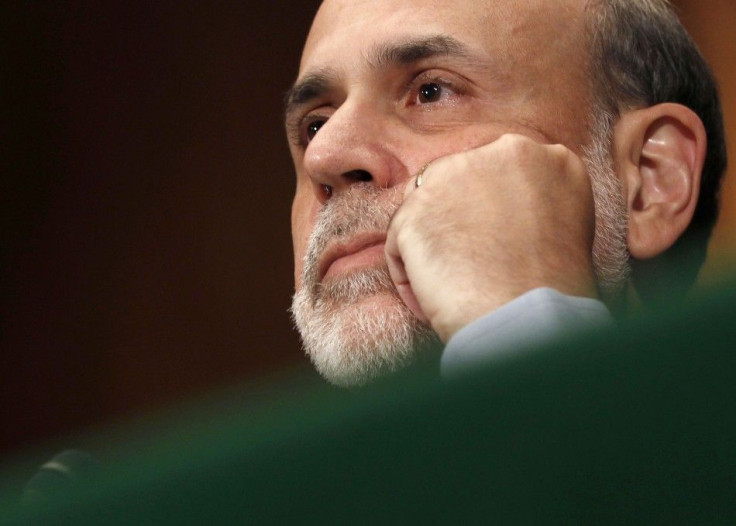

Federal Reserve policymakers seemed more likely Wednesday to recommend further monetary easing than just a month ago, as minutes of a Fed rate-setting panel detailed shaky faith in recent indicators of economic recovery.

Several members indicated that additional monetary policy accommodation could be necessary if the economic recovery lost momentum or the downside risks to the forecast became great enough, the minutes from the April 24-25 meeting of the Fed's Open Market Committee read. A month ago, only a couple of members indicated a willingness for further easing.

While the Fed minutes did not deviate much from previous pronouncements, one surprising tidbit was the assertion that Fed officials feared patterns of economic recovery will follow the trajectory seen in 2010 and, particularly, in 2011, when robust economic figures seen at the beginning of the year began flagging once summer set in.

Some members recalled that gains in employment strengthened in early 2010 and again in early 2011, only to diminish as those years progressed, the minutes said. Moreover, the uncertain effects of the unusually mild winter weather were cited as making it harder to discern the underlying trend in the economic data.

The U.S. central bank leaders reiterated their intention of holding benchmark interest rates near zero at least through late 2014. As before, Richmond Fed President Jeffrey Lacker was the only member to dissent on the issue.

U.S. equity markets seesawed after the release of the minutes, then continued to pursue the daylong pattern of small losses. A few minutes before markets closed for the day, the benchmark S&P 500 Index of U.S. equities was at 1,326.53, off 30 basis points. On the other hand, U.S. Treasuries rallied after the release of the minutes. The benchmark T-note recently offered a yield of 1.759.

© Copyright IBTimes 2024. All rights reserved.